In brief

- A new documentary about Bitcoin pioneers in Southern Africa is launching on Amazon Prime.

- The film, "Banking on Africa: The Bitcoin Revolution,” is released with a companion research report.

- The report features comprehensive and up-to-date information about crypto in Africa.

Bitcoin came too late for Alakanani Itireleng’s little boy. He died before she could raise the money to pay for his surgery in South Africa.

But it was through trying to save Paco that Alakanani was first introduced to Bitcoin. What she learned amazed her—and like many other people around the globe, she became an evangelist for the digital currency.

Now known as Botswana’s Bitcoin Lady, Itireleng went on to found the educational non-profit Satoshi Centre, where she teaches others about how to use and profit from it, and transform their lives. She’s one of the many inspiring Africans featured in “Banking on Africa: The Bitcoin Revolution.”

The documentary, shot by Tamarin Gerriety, for award winning South African production house Documinute, launches on Amazon Prime on Friday. It explores how Bitcoin pioneers in Southern Africa are surmounting the widespread challenges on the continent—poor infrastructure, mismanaged economies, high remittance fees, and widespread poverty—with crypto.

A comprehensive report on the African Bitcoin ecosystem, conducted by research agency, Arcane Research, is set to be released alongside the documentary.

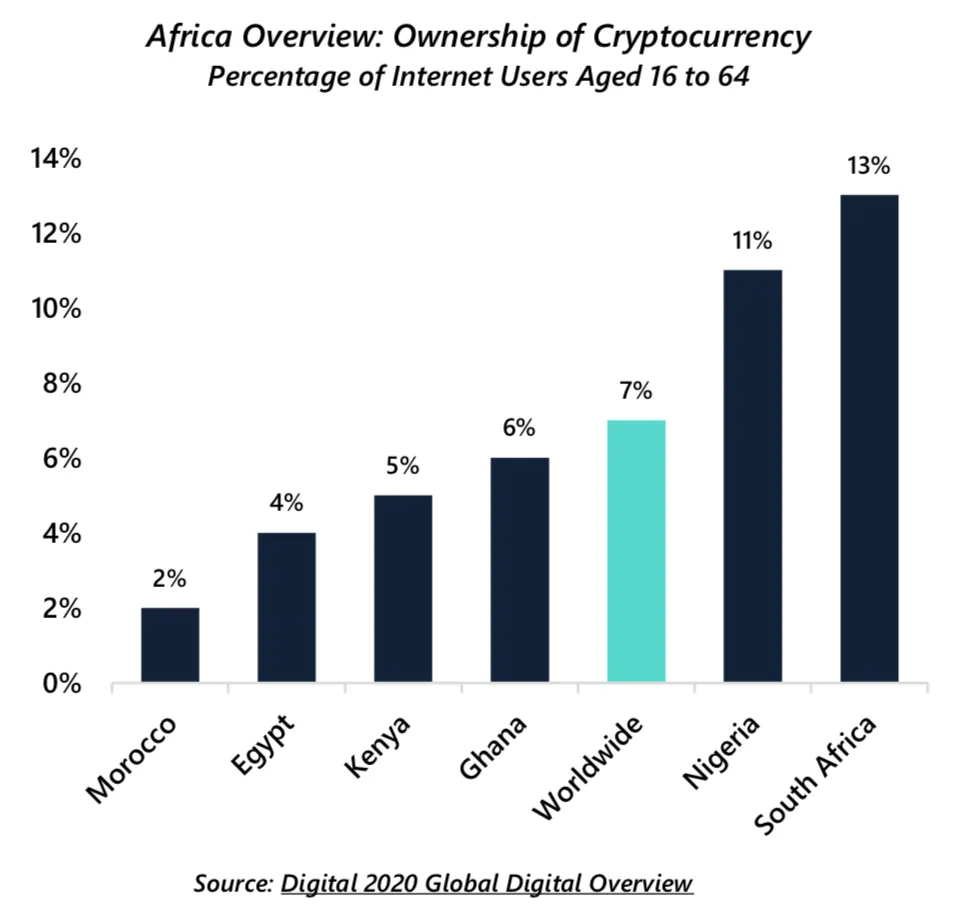

“Africa is one of, if not the most promising regions for the adoption of cryptocurrencies,” the report claims. Most of the continent is underserved by traditional financial services, with 66% having no access to a traditional bank account. But much of Africa still requires significant investment in crypto-specific infrastructure (such as exchanges) as well as its Internet and electricity networks, per the report.

Focus is often placed on investment, speculation, and trading, but Africa, more than any other continent, has a need for the utility of cryptocurrencies, according to the report.

For example, cryptocurrencies could offer lower-cost and faster remittance payments than current systems. Sending a payment of less than $200 to a Sub-Saharan country, costs an average of about 9% compared to the global average of 6.8%, while payments between countries are even more expensive.

Crypto projects have not been slow to recognize the opportunity Africa offers, and the report highlights those most active in Sub Saharan Africa, including Akoin, an ambitious project building a crypto city in Senegal and Sun Exchange, a peer-to-peer solar panel micro-leasing platform, as well as cryptocurrency platforms Bitcoin Cash, Dash, and Electroneum.

What these projects have in common is that their successes in African markets have resulted from in-the-field action, said the report. That spirit also came across from the individuals featured in the documentary.

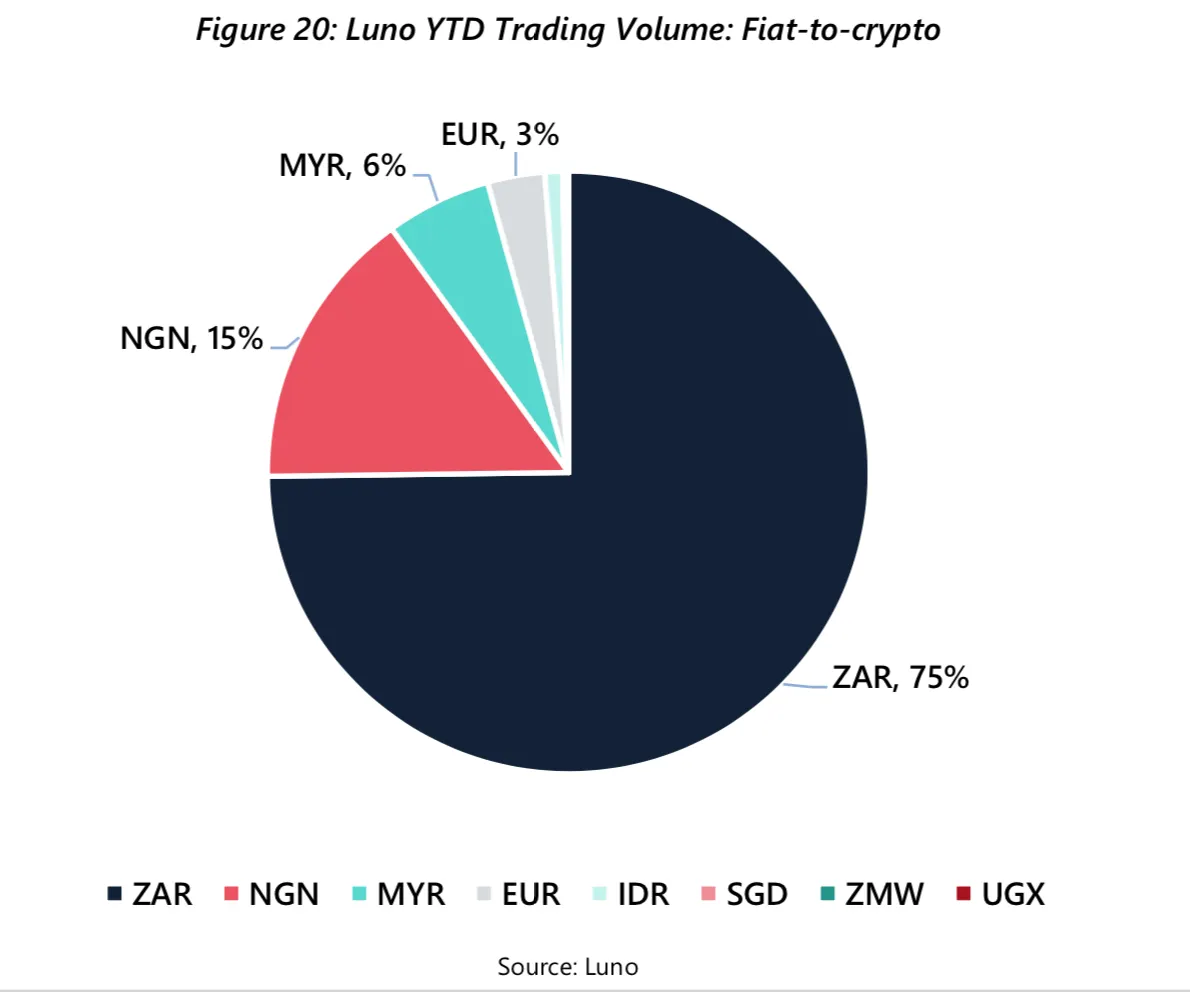

"Bitcoin has already shown how it has been able to usher in a new and improved financial system across a region that has so desperately needed it,” Marius Reitz, Africa Manager at Luno, said. The exchange was established in 2013, and most of its 4 million customers are in Africa.

But as the report highlights, Africa’s lack of infrastructure—an astonishing 57% of the region’s population still lacks access to electricity—is not an easy hurdle for Bitcoin to surmount.

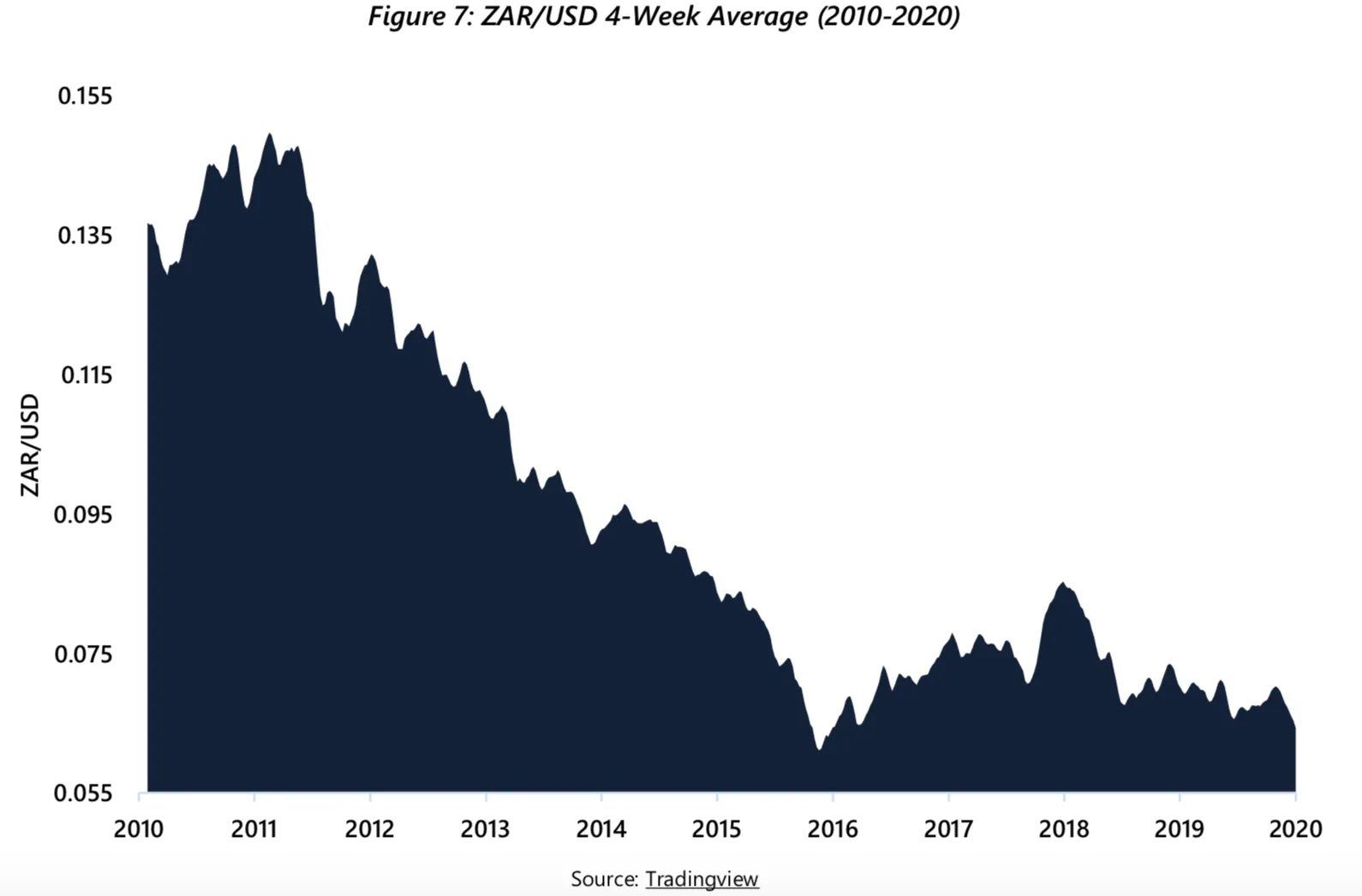

“You’re not going to solve all the problems, certainly,” Monero cryptocurrency contributor, South African Riccardo Spagni said in the documentary. “Even if it just becomes a reserve currency, the local currency becomes less important. People can trivially shift from whatever the local currency is into Bitcoin. Now, your reliance isn’t on the government to keep the economy stable, because you’ve got a fallback, that’s very powerful.”

There are technologies where Africa could still steal a march on the West—the so-called leapfrogging phenomenon, that could see innovations adopted more quickly, as traditional infrastructure is less likely to exist. “We were on 3G before the United States and most of Europe,” Spagni pointed out.

Perhaps the most inspirational story belongs to Lorien Gamaroff, founder of blockchain-based social outreach platform, Uziso.

Gamaroff was filmed in 2015, setting up an energy payments platform to enable donors to pay for electricity for schools in South Africa, where many rural communities are disadvantaged by an expensive and complicated system of paying upfront. The system also relies on third parties to act as middlemen between end users and the power companies—a problem a blockchain-enabled smart meter would solve.

“It’s not just a tech thing. It’s not just a new invention. It’s something that can actually help real people,” he said at the start of the film.”

The documentary shows him setting up the first demo of the system, and builds in excitement as he waits with the school teachers for the funds to be transferred, and the schoolhouse lights to go on. Miraculously, everything worked as planned.

This article has been updated to correct the reference to Riccardo Spagni as Monero's founder. He is, in fact, a Monero contributor.