In brief:

- Craig Wright had threatened to strangle the Bitcoin blockchain during the block reward halving.

- Wright claimed he would sell a "large volume" of BTC, while simultaneously opening a 10x leveraged short.

- But the halving has come and gone—and there was no attack.

Craig Wright’s nefarious plot to crash Bitcoin during its block reward halving failed to materialize. His plan, set out more than six months ago, threatened to bring the network to its knees. But, if anything, the halving was too uneventful.

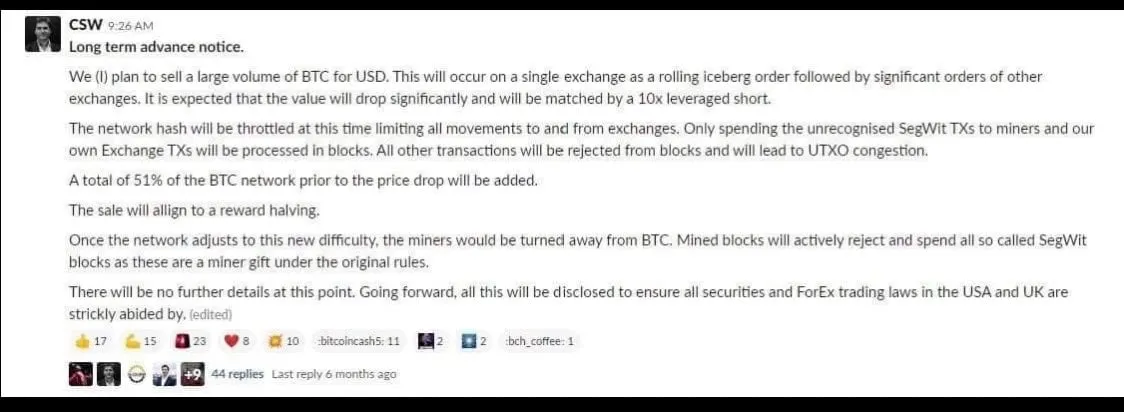

The self-proclaimed Satoshi Nakamoto had laid out a multi-step plan to attack Bitcoin during the halving, which involved selling a “large volume of BTC for USD,” and matching the sale with a 10x leveraged short.

Wright wrote on a Bitcoin SV (BSV) focused Slack channel, “We (I) plan to sell a large volume of BTC for USD. This will occur on a single exchange as a rolling iceberg order followed by significant orders of (sic) other exchanges,” adding, “It is expected that the value will drop significantly and will be matched by a 10x leveraged short.”

Wright professed his intention to simultaneously launch a 51% attack on the Bitcoin network. This is where a mining farm has so much mining power that it takes control over the network, and is able to censor transactions and temporarily reverse them. Such an attack is exceedingly difficult and very expensive to do—Messari estimates it would cost $425,000 an hour.

Wright’s plan involved only mining blocks containing his own transactions—as well as SegWit transactions. SegWit is a proffered solution to the Bitcoin scaling problem, where transaction capacity is effectively increased from 1MB to 4MB by splitting transaction data into two parts. SegWit was implemented on Bitcoin in 2017, but it wasn’t embraced as the Bitcoin scaling solution by everyone.

By taking advantage of a SegWit compatibility quirk, Wright sought to redirect those transactions away from their intended recipients, and into the hands of his miners.

Wright wrote, “The network hash will be throttled at this time limiting all movements to and from exchanges. Only spending the unrecognized SegWit TXs to miners and our own Exchange TXs will be processed in blocks.”

SegWit transactions are not backwards compatible with earlier versions of Bitcoin. In fact, under the original rules, the transactions would end up in the hands of Bitcoin miners. And Wright, if he had control of the network, would be able to revert back to the original rules. In doing so, he would be able to take the Bitcoin from any SegWit transactions made.

And at the same time, the network would be effectively stopped. Nobody—except Wright and friends—would be able to make a Bitcoin transaction. Chaos would ensue.

Except it didn’t.

While the price fell somewhat, it was nothing out of the usual for the volatile Bitcoin price. But as for the health of the network, and its network security, everything proceeded without a hitch.

Did Wright forget to strangle the Bitcoin network? Was he distracted by his multiple lawsuits? Or was it all just to rouse his BSV supporters?

Turns out he simply changed his mind.

Wright's spokesperson Ed Pownall told Decrypt, "He has much more recently said he doesn’t plan to do that & the thing the media are using is AGES old."

In the meantime, Bitcoin will keep whirring.

Updated with a comment from Craig Wright's spokesperson.