In brief

- Bitcoin is now the best-performing asset in 2020, after racking up 22.4% gains since the start of the year.

- Gold is also performing well, gaining 9.5% YTD—despite suffering severe losses in March.

- Major US stock indices and oil futures are still down this year after a record sell-off in March, despite recovering somewhat in April.

Bitcoin (BTC) has secured the position of most profitable investment of 2020, after eclipsing the performance of gold and oil, as well as major stock indices.

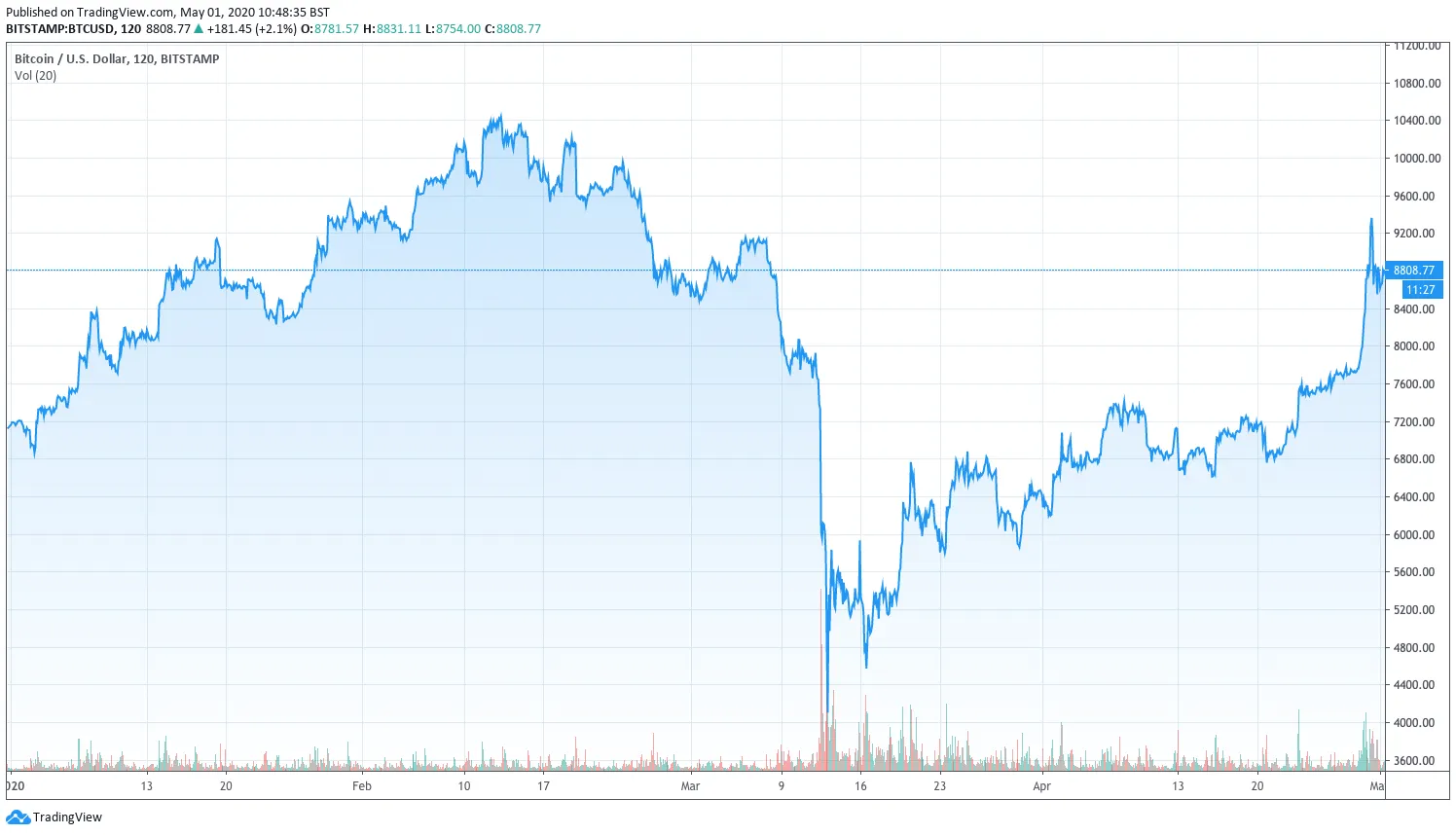

Since the start of the year, Bitcoin has experienced some of its highest-ever volatility, which has seen its price fluctuate between a high of $10,446 on February 13 and a low of $4,111 on March 13. According to TradingView, the cryptocurrency also witnessed one of the most dramatic sell-offs in its decade-long history, crashing from $7,717 to $4,111 in a single day—equivalent to a 47% loss.

Despite this volatility, Bitcoin has now managed to recover most of the value lost during its mid-March crash, and is now up 22.4% since the start of the year.

Gold, on the other hand, has also posted strong results so far in 2020. Starting the year at $1,529/oz, gold spiked to as high as $1,700/oz in early March, before collapsing to as low as $1,491 throughout mid-March. Since then, gold has recovered to its current value of $1,675/oz—equivalent to a gain of 9.5% YTD.

Although both Bitcoin and gold witnessed a dramatic sell-off in mid-March after the World Health Organization (WHO) declared a coronavirus pandemic, both are now trading at close to their pre-crash value. Comparatively, major US stock indices including the Dow Jones Industrial Average (DJI) and S&P 500 are still in the red following the crash, with DJI still down 15.7% YTD, while the S&P 500 is down 10.6% since the start of the year. Nonetheless, the S&P did manage to gain 12.7% in April alone, and appears to be showing strong signs of recovery.

As the world enters into a period of economic slowdown as a result of the movement controls instituted in most countries to tackle the coronavirus, several industries have been hit hard. Among these, few have been hit as hard as the crude oil industry, which saw shattering losses in the first four months of 2020.

Back in April, futures contracts for West Texas Intermediate crude (WTI) were trading at below zero due to a combination of extreme lack of demand and oversupply, forcing traders to pay buyers to take it off their hands. Although things have recovered somewhat since then, WTI oil's futures for June expiry are currently trading hands for just $18.59—compared to more than $60 for the June 2019 contract.

Likewise, stocks in major oil firms like Exxon Mobil and Chevron Corporation have tanked this year, falling to their lowest value in more than a decade.

Banking firms have been hit too by the coronavirus. As Decrypt reported, British bank HSBC reported a 50% fall in profits while Spain’s Santander suffered an 82% decline in quarterly net profit.

Does this mean Anthony Pompliano, partner at Morgan Creek Digital, was right?

Tips

Have a news tip or inside information on a crypto, blockchain, or Web3 project? Email us at: tips@decrypt.co.