In brief

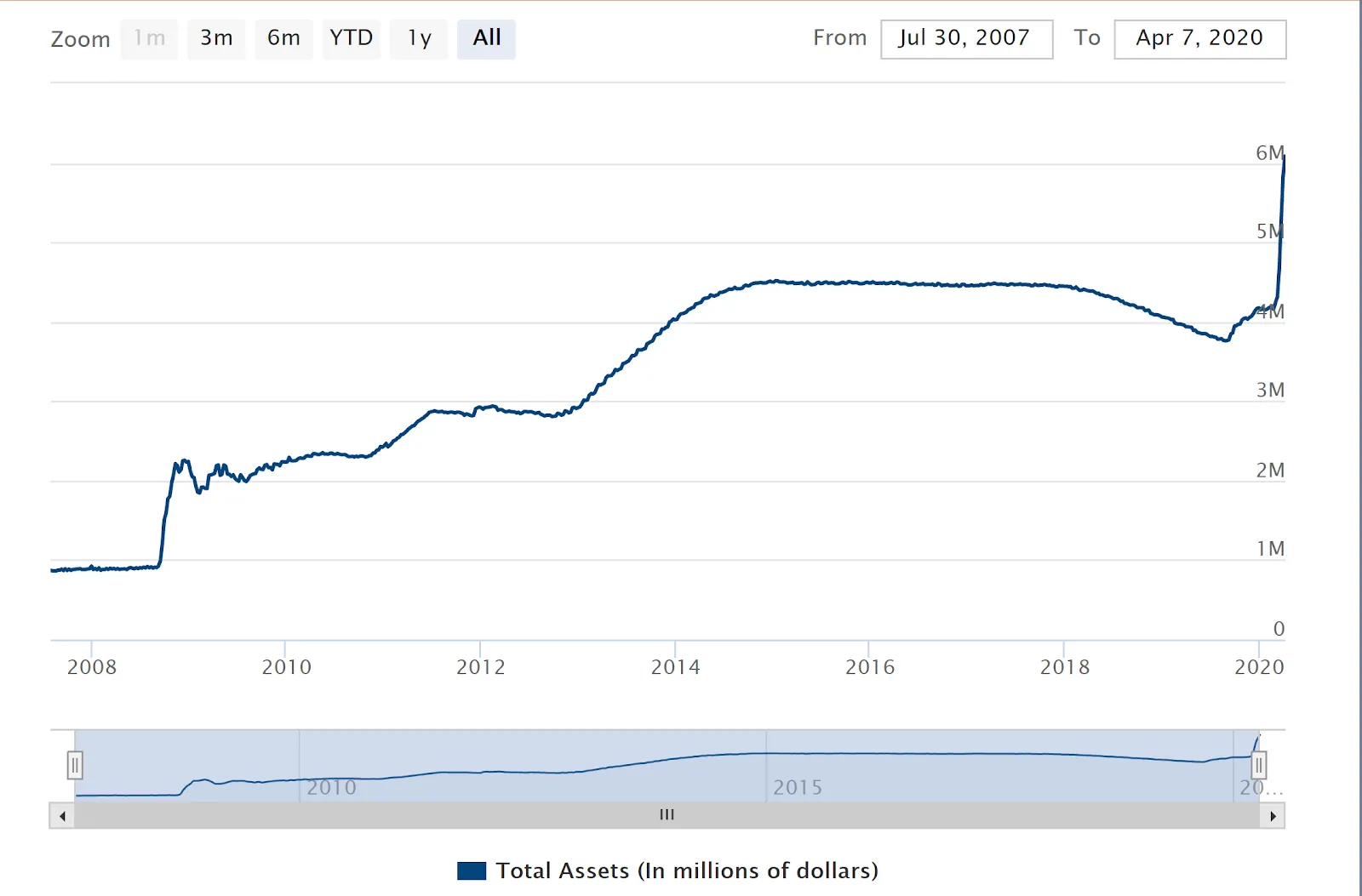

- The Fed's balance sheet has hit $6 trillion.

- The Fed is trying to curb the economic fallout caused by the coronavirus.

- The IMF predicts the worst recession since the Great Depression of the 1930s.

The Federal Reserve balance sheet has broken above $6 trillion, an increase of 50% in the last month, or $2 trillion, since October 2019.

The Fed’s balance sheet represents all of its total assets. As America’s central bank, the Fed tends to buy assets, like government securities, whenever it wants to increase the monetary supply.

The large balance sheet is a sign that the Fed is doing all it can to influence the economy, and shows that it has a lot of power. In comparison, Bitcoin doesn’t have a central bank, so there’s no centralized authority that can dictate the monetary supply.

The Fed has cut interest rates almost entirely, bought hundreds of billions of Treasury and mortgage-backed securities, and fashioned stimulus packages worth trillions. In fact, recently it has been printing money at a rate of $1 million per second.

The huge influx in purchases represents its massive efforts to curb the economic fallout of the coronavirus, which the International Monetary Fund has declared the worst recession since the Great Depression of the 1930s.

The US has been hit hard by the coronavirus. According to Worldometer, the US has more cases than Italy, France and Germany combined. The state of New York has more cases than the whole of Italy, the previous epicenter of the crisis.

The economy has ground to a screeching halt. Regional manufacturing activity in New York fell by nearly 80%, and economists from JP Morgan, one of the largest banks of the US, expect a drop in GDP growth by 40% in the second quarter of the year. Profits of JP Morgan fell by 69% in the first-quarter of this year.

The IMF predicted that global growth in 2020 will fall to minus three percent, a drop of 6.3% since January 2020. Should the crisis resolve itself in the second half of the year, the IMF predicts that global growth will rebound to 5.8% in 2021.

In the meantime, the Fed’s balance sheet will continue to grow.

Tips

Have a news tip or inside information on a crypto, blockchain, or Web3 project? Email us at: tips@decrypt.co.