In brief

- Kraken has conducted a survey among its VIP clients.

- Roughly half of the respondents predict Bitcoin's will reach over $22,000 in 2020.

- Traders hope the SEC will approve Bitcoin exchange-traded funds this year.

Cryptocurrency exchange Kraken published the results of a survey conducted among the platform’s VIP clients in February, on March 27.

Despite the economic woes exacerbated by the worldwide coronavirus outbreak, the average 2020 price target indicated by the exchange’s VIP clients was surprisingly high.

They estimated end of year prices of $22,866 for Bitcoin and $810 for Ethereum. Although it’s worth noting that Kraken’s survey took place before the mid-March global market collapse.

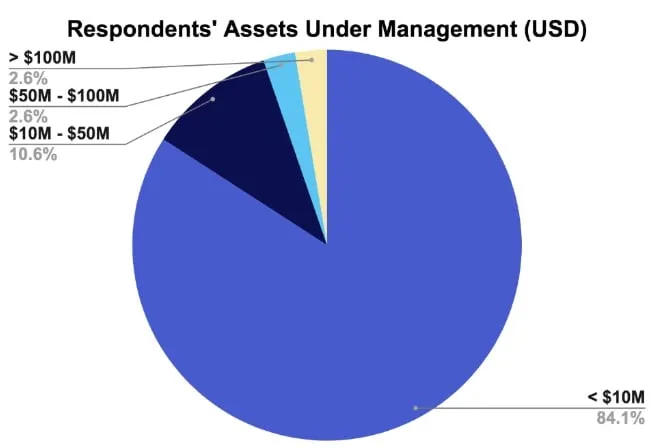

Among the survey respondents, 41% identified themselves as investors, 40% as traders and 15% as representatives of an institution. The last 5% comprised payment processors, crypto exchanges and miners.

“While 44% of respondents believe that we’re in a bull market, 34% are unsure and 22% think we’re in a bear market,” showed the survey.

The crypto industry might see further investments throughout this year. While only 36% of the survey takers had raised capital in 2019, 49% of them expect to do so this year.

Besides Bitcoin, the five most popular altcoins among Kraken’s respondents were Ethereum, Monero, XRP, Litecoin and Tezos. 54% of the survey takers were also confident that 2020 will signify another “alt season.” This is where altcoins rise in price against Bitcoin.

“Tether (USDT) was the overwhelming favorite (60.4%) among stablecoin users,” the post added, although 44.4% of respondents don’t use stablecoins at all.

Roughly half of the respondents are also confident that the US Securities and Exchange Commission will finally approve the launch of the first Bitcoin exchange-traded funds this year. So far, every Bitcoin ETF application has been delayed or withdrawn.

Companies such as Bitwise, VanEck and SolidX have all withdrawn their corresponding Bitcoin ETF proposals after facing long delays. The SEC was not convinced a "real" Bitcoin market exists, due to inflated market data.

But with Binance set to acquire CoinMarketCap, could more transparency be on the way? It seems unlikely.