In brief

- Mobile manufacturers such as Apple have exploded in value over the last year.

- The cryptocurrency sector has outpaced their growth.

- Bitcoin's growth of more than 160% exceeds the performance of the top five publicly traded mobile companies combined.

In the last year, publicly traded smartphone manufacturers like Apple, Google and Samsung have exploded in value, with many reaching their highest market capitalization ever.

However, though impressive, their growth was dwarfed by that of the cryptocurrency sector, as Bitcoin (BTC) and altcoins recovered from a major downturn seen in early 2019.

Bitcoin takes a bite out of Apple

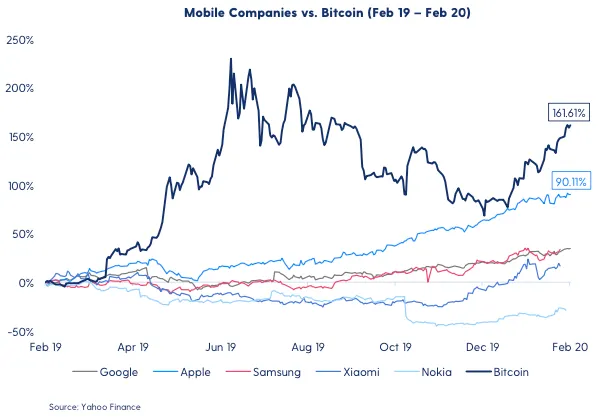

According to data provided by online wallet provider and Ethereum exchange platform Luno, four of the top five publicly traded mobile companies have accrued major gains in the last year.

As it stands, Apple (AAPL) is the best performing publicly traded mobile company, with its stock price increasing by more than 90% between February 2019 and February 2020. Likewise, both Google (GOOGL) and Samsung (SMSN) have also seen impressive gains in the past year as their share prices improved by over 30% during this same period.

That momentum doesn't appear to have been adversely affected by the GSMA's recent decision to cancel this year's Mobile World Congress. The trade show, a major event in the tech industry calendar, was cancelled over concerns surrounding the novel coronavirus outbreak that has infected more than 70,000 people worldwide.

While smartphone manufacturers' growth over the last year is significant, Bitcoin experienced far greater growth over the same period—climbing from around $4,000 to around $10,000. This growth of more than 160% exceeds the performance of the top five publicly traded mobile companies combined.

Altcoins gain momentum

Although the last year has been a bullish period for Bitcoin, several altcoins witnessed even stronger growth during this time, including Bitcoin SV (BSV), Lisk, ICON and Hedera Hashgraph (HBAR), which grew by between 182% and 410%.

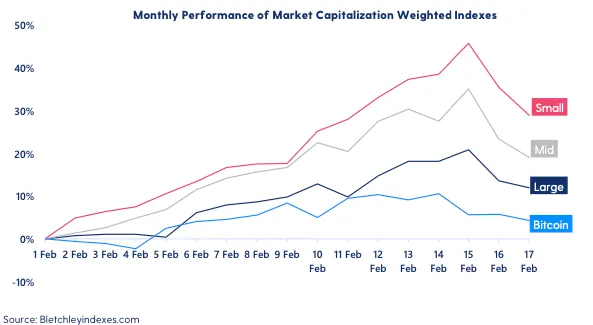

In February alone, small-cap cryptocurrencies with a market capitalization of between $30 million and $500 million have gained an average of 29%. Similarly, both large-cap cryptocurrencies and mid-cap cryptocurrencies also experienced solid growth during February—both eclipsing the 4% gained by Bitcoin so far this month.

Of these cryptocurrencies, Ethereum (ETH) stands out as one of the best performers this month, gaining almost 50% and seeing its market dominance improve significantly again Bitcoin. Concomitantly, Bitcoin saw its market dominance shrink to under 61% this month—a value not seen since July 2019.

This growth is representative of an overall bullish change in market sentiment. Alternative.me's Crypto Fear & Greed Index, a tool used to analyze market sentiment in the crypto space, is currently neutral with a value of 49, but reached as high as 59 yesterday—a value that hasn't been seen in almost a year.

Overall, a strong improvement in investor sentiment appears to behind the recent market growth, but this has suffered as a result of the latest dip.