The Winklevoss twins are taking legal steps to help their exchange and stablecoin compete in a crowded market.

The US Patent and Trademark Office granted six patents to Winklevoss IP, LLC between August 6, 2019, and January 21, 2020, for generating a stablecoin on a blockchain, modifying its supply, and paying dividends. The patents should allow the twins' Gemini Trust Company to sell new types of blockchain-based financial instruments.

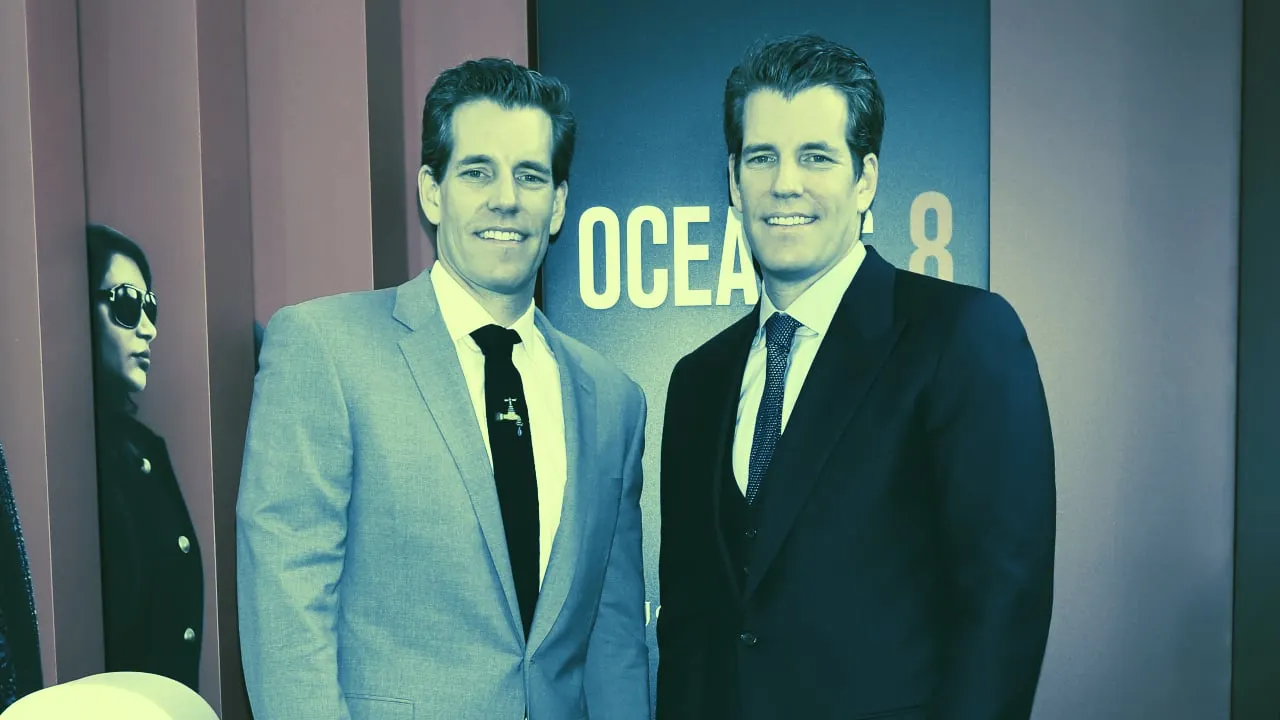

It's easy to see why the Winklevoss twins would be patenting stablecoin systems. Tyler and Cameron Winklevoss are the CEO and president, respectively, of Gemini Trust Company, a digital asset exchange and home of the eponymous Gemini dollar (GUSD).

Gemini advertises GUSD as an ERC20 standard token that's pegged 1:1 to the U.S. dollar: "The Gemini dollar is a stable value coin that combines the creditworthiness and price stability of the U.S. dollar with the technological advantages of a cryptocurrency and the oversight of U.S. regulators."

Taken together, the patents sketch out a system by which a "trusted entity" such as a bank or, ahem, digital asset exchange like Gemini can manage a stablecoin so that it is collateralized by a fiat currency. Moreover, they outline a novel system for modifying supply, which commonly takes place through "printing" new tokens or "burning" others. That’s important because it plays to what might be Gemini's real aspirations here: creating new blockchain-based financial products.

It's no secret that #regulation is core to our DNA🧬

So what are some of the steps we're taking to get to a safe and regulated #crypto infrastructure?

✅Got a NY trust license

✅Regulated by the NYDFS

✅Joined @VCAdotorgLearn more in #crypto20in2020: https://t.co/7xagzEAUwm pic.twitter.com/bObUzCxnKE

— Gemini (@Gemini) February 3, 2020

Indeed, the claim for patent #10,438,290 opens by bemoaning the fact that "current blockchain technology, as implemented, does not have adequate technological solutions to paying dividends or other forms of payouts (like interest) on such investments in a stable value token which is tied to a blockchain technology."

It's worth noting that rival exchange Coinbase already offers rewards to users who hold its stablecoin, USDC. However, while Decrypt wrote in October that the rewards are "essentially interest," it doesn't appear to be an overly complicated process—Coinbase just moves money from other accounts into users' accounts.

Gemini seemingly has more complex financial instruments in mind. For example, the patent filing states that a digital certificate of deposit (CD) could generate interest that would result in a corresponding amount of USD being deposited into the exchange. Those dollars would then be converted to a stablecoin and ultimately distributed when the digital CD hits maturity.

Just because Winklevoss LP says it has the technology to do it, don't expect to see these or other instruments any time soon. Since its inception, Gemini has cultivated a reputation for playing nice with regulators. It was among the first cryptocurrency companies to get a BitLicense from the New York Department of Financial Services, even as other exchanges balked.

Even so, it's a relatively small exchange, all things considered, falling outside of CoinMarketCap's top 100 for adjusted volume as of today; it did $401 million over the past 30 days, compared to $4.13 billion for Bitfinex. That exchange's stablecoin, Tether, has a market cap of $4.6 billion, which dwarfs the $4.5 million for Gemini Dollar.

Gemini, it appears, is hoping its conservative playbook of accumulating patents and getting regulatory approval pays dividends.