$64,074.00

-0.78%$1,853.05

-0.04%$1.35

-0.22%$584.08

-2.05%$1.00

0.02%$79.11

1.74%$0.283253

0.60%$1.034

0.25%$0.091435

-1.25%$48.07

-0.40%$0.99999

0.02%$484.83

-2.03%$0.25868

-1.35%$8.56

6.33%$27.15

3.20%$0.998668

-0.03%$0.160044

-1.67%$321.21

4.41%$8.20

-0.84%$0.149701

-1.06%$1.00

0.11%$0.00929404

-0.13%$1.00

0.04%$0.095105

0.32%$242.87

2.23%$51.14

-0.18%$8.29

-0.77%$0.0000059

-1.71%$0.860395

-2.16%$1.29

-3.64%$0.111895

2.23%$0.074136

-0.36%$5,136.29

-1.49%$1.42

1.17%$5,169.27

-1.63%$3.34

-0.19%$1.24

-2.02%$1.00

0.00%$0.590516

2.61%$0.997638

0.03%$114.51

-0.12%$0.695745

-0.71%$0.00000395

-0.41%$0.999987

0.03%$167.37

-1.45%$1.12

0.00%$0.999763

0.00%$74.05

-0.66%$2.20

-1.85%$0.065995

4.92%$0.00000164

-0.74%$0.162714

1.82%$0.999809

0.08%$8.30

-0.61%$0.967415

-1.16%$0.246473

-0.74%$0.112728

5.73%$11.00

0.03%$2.12

1.50%$6.81

-0.23%$8.33

1.41%$0.376304

0.92%$0.00170244

-5.03%$2.00

-5.66%$0.056582

-2.82%$62.07

-1.07%$0.01598745

-8.32%$1.00

0.08%$0.820841

-0.71%$0.812059

9.78%$0.098093

-0.31%$1.23

-0.16%$3.37

1.72%$0.02914387

-1.69%$0.00913989

0.65%$114.40

0.01%$0.083613

-0.32%$0.999982

0.04%$1.027

0.01%$1.36

-1.71%$1.11

-0.08%$0.03339743

-0.92%$0.880221

-0.98%$0.824573

1.87%$1.74

10.80%$0.00710216

-2.92%$0.080119

-0.22%$1.095

0.01%$0.994482

-0.44%$0.092309

-1.41%$0.02942227

3.05%$0.999995

0.04%$0.00000574

-2.01%$0.999047

0.01%$28.43

7.68%$0.01253853

-3.58%$1.086

-0.08%$0.144951

-0.39%$1.00

0.05%$0.258416

7.17%$1.18

-0.22%$0.065946

-1.08%$0.237209

0.43%$32.43

1.66%$0.00645107

2.18%$0.04593557

0.97%$0.608607

3.01%$1.20

-1.44%$165.23

-1.64%$0.366183

-0.72%$1.00

0.16%$0.498609

9.94%$1.026

0.82%$1.43

3.10%$0.152675

-0.67%$0.03330425

-1.67%$0.078199

-0.48%$1.021

0.07%$0.999765

0.01%$0.224856

1.29%$0.00000033

-0.71%$0.00000033

-1.45%$119.84

1.21%$0.01642981

-0.66%$3.12

-6.06%$0.052944

-0.64%$15.50

2.45%$1.53

2.30%$3.16

0.36%$0.332241

12.05%$0.050285

-0.54%$0.994112

-0.37%$0.065809

-0.64%$0.02570756

-1.31%$0.0055497

-2.45%$0.991592

0.03%$1.45

3.88%$0.00002793

-0.44%$0.287255

5.78%$17.07

1.60%$0.299747

0.11%$1.63

0.67%$0.144167

6.34%$0.299657

0.33%$0.118339

-2.64%$0.04812827

-0.08%$0.00248346

0.25%$0.209947

1.63%$0.329646

13.17%$0.069134

1.89%$0.00251157

-1.49%$0.999384

0.04%$6.00

-0.94%$0.04168115

3.31%$0.999997

0.00%$0.988575

0.47%$0.02004227

-2.31%$1.075

0.01%$0.999885

0.04%$1.26

2.01%$1.69

0.20%$5,561.13

5.90%$0.078111

-0.64%$0.0021269

5.69%$0.498595

0.24%$22.79

0.00%$0.099305

-0.94%$0.00000095

-0.33%$1.19

0.44%$0.194506

-2.95%$0.00003469

-0.31%$1.00

0.00%$0.08718

0.26%$0.190918

3.01%$0.079603

3.13%$0.05158

-0.32%$2.60

-2.21%$0.180454

-3.84%$1.00

0.00%$0.01918827

-3.65%$0.176374

12.05%$0.117337

0.69%$0.00471431

-1.37%$0.772958

1.79%$0.089718

-1.57%$17.79

3.26%$8.71

-0.54%$1.00

0.07%$2.07

-0.63%$0.00349671

-0.31%$0.02284358

-6.47%$1.79

0.03%$0.0198495

-1.25%$48.00

0.03%$0.75857

49.24%$3.64

-3.26%$1.74

-2.19%$0.995818

0.30%$0.588222

3.22%$0.050388

-0.21%$1.25

-1.01%$1.97

-0.18%$3.29

14.08%$0.99853

0.06%$0.02610957

40.19%$0.149933

3.57%$0.00000749

-0.13%$0.999179

-0.01%$1.012

-0.11%$0.03909919

-1.49%$0.147818

-3.39%$0.304153

-1.87%$0.64801

3.54%$0.304605

-3.78%$0.388306

0.74%$0.159166

2.14%$1,097.43

-0.00%$8.60

-3.16%$0.074655

2.59%$0.318584

-0.07%$0.598573

9.23%$0.077971

-0.61%$0.125919

-5.97%$4.28

-0.85%$0.250143

-3.18%$0.125219

-0.37%$0.124688

-2.50%$0.360415

-3.74%$0.249745

2.72%$0.130198

0.18%$0.08756

-0.80%$0.994847

-0.02%$0.279374

0.75%$0.0014398

-0.51%$1.028

1.87%$1.85

-0.35%$11.02

-13.06%$0.00392849

2.22%$1.001

0.00%$0.213304

-3.70%$0.072839

-1.09%$0.999808

0.03%$0.191494

3.68%$0.329514

-2.61%$1.42

0.29%$1.063

0.03%$0.999932

0.03%$2.24

2.04%

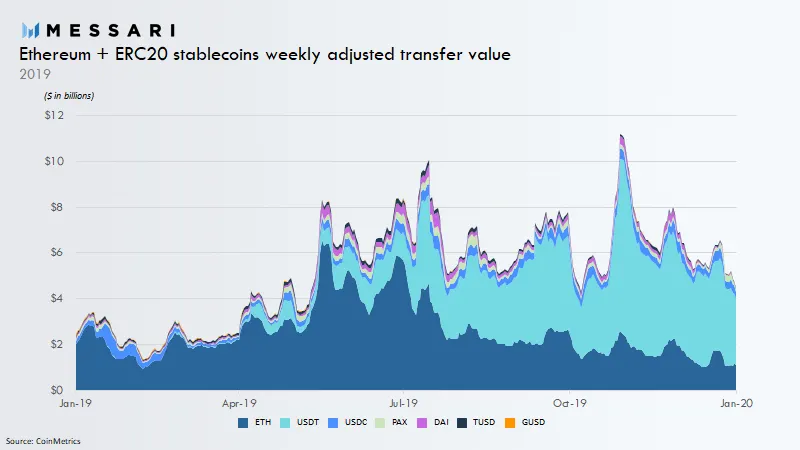

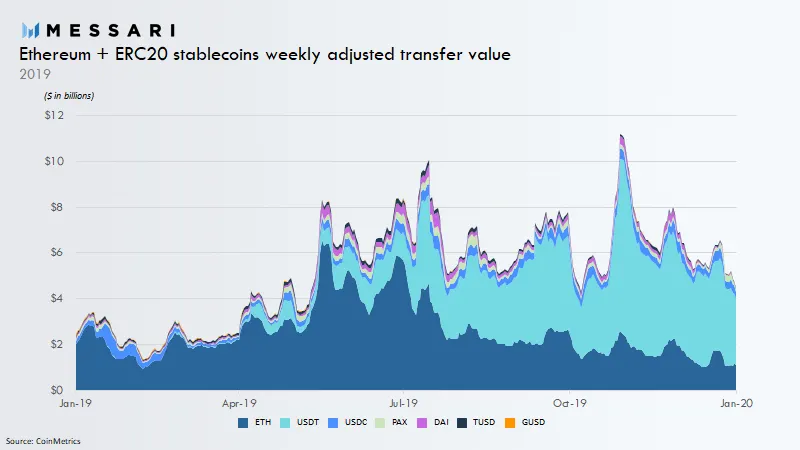

Ether, the native cryptocurrency on the Ethereum blockchain, is no longer the most popular cryptocurrency on the platform: Stablecoins are, according to new analysis by Messari.

Though Ethereum has its own cryptocurrency, there are thousands of tokens that run on the platform. Some of these platforms are stablecoins, assets that are tied to the value of another currency, like the US dollar or gold.

Traditionally, the majority of value being transferred across Ethereum has been in ether. But now stablecoins have taken over. Due to the rise of US dollar stablecoin Tether on the Ethereum blockchain, more value is transferred on Ethereum using stablecoins than its own native cryptocurrency.

“Ethereum’s economy is now dominated by stable value transfer,” tweeted Ryan Watkins, a research analyst at Messari. He said the flip happened in mid-2019, and the gap has widened ever since.

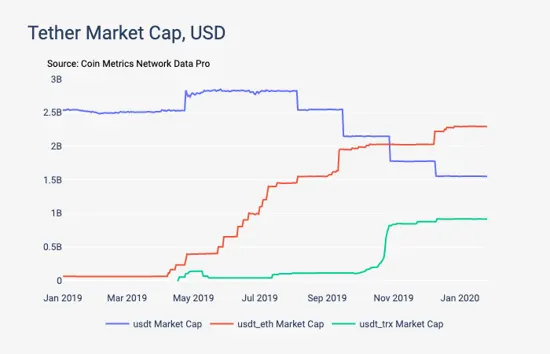

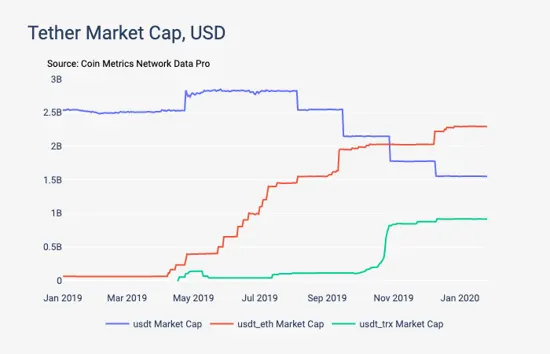

Tether is also on on Bitcoin’s Omni layer, but the eponymous company behind the token began migrating tokens to Ethereum in April 2019. After a few months, the amount of Tether on Bitcoin started declining rapidly. Recently, Tether has started issuing coins on the Tron blockchain, with an influx of USDT in November 2019.

In a tweet in November, data analysts CoinMetrics said that the value of Tether transfers on Ethereum were two or three times that of ether transfers. “By comparison, this ratio never grew above 0.4 on Bitcoin,” it wrote.

Initially the influx of stablecoin activity on Ethereum started clogging up the network. But miners adapted—by slowly increasing block sizes—and the network has managed to cope. However, if Tether continues to print more coins on Ethereum, there could be more to worry about.