The deadline to file your tax return in the UK is January 31—and holding cryptocurrency introduces an additional layer of complexity to the process.

If you’re a UK crypto holder, keep your receipts—every single one of them, whether for a novelty cup of coffee bought with Bitcoin, or the tab of acid you bought from the dark web—because otherwise, Her Majesty’s Revenue and Customs is going to come looking.

That’s the advice two of Britain’s crypto tax experts, as well as two co-founders of Recap, a crypto accountancy software company, gave to Decrypt when asked how UK crypto users should file their taxes. Of course, their advice errs on the side of caution. But why take the risk when the fines can be so steep?

We collated their answers to produce this, a rough guide on how to file your crypto taxes in the UK ahead of the 31 January deadline.

Keep records of all of your transactions

Geraint Jones, a partner at London-based accountancy firm Berg Kaprow Lewis LLP, told Decrypt that HMRC's view is that crypto-assets are usually chargeable assets. That means you have to pay capital gains tax when you buy, sell, and exchange them—for every single transaction.

To work out what amount is liable for capital gains tax, you have to take the sterling equivalent at purchase and the sterling equivalent at sale,” he said. In other words, if you bought 1 Bitcoin for £0.01 in 2009, and then sold it today, you’d have to pay capital gains tax on the sterling value of Bitcoin, currently £6,655, less the £0.01 you paid for the Bitcoin.

To work out the value of your crypto, you should take a “reputable exchange’s value” at the time of purchase, said Jones. You could do it by day or by hour; but you’d have to use the same methodology throughout your tax return, he said: “You couldn’t choose to do it in different ways on different exchanges according to what happened to be most convenient for you.”

So, for a capital gains tax calculation concerning a Bitcoin to Ether transaction, you should take the sterling value of Bitcoin when you purchased versus the sterling value of when you sold it for Ether. Then you have an acquisition of an Ether coin, which should be valued at the sterling equivalent at the point of purchase.

Richard Baldwyn, a tax specialist and director at The Friendly Accountants in Poole, who also used to work for HMRC, told Decrypt a tale of woe. Because exchanging cryptocurrencies for other cryptocurrencies potentially realizes a chargeable capital gains tax, those who exchanged currencies at, say, the height of the 2017 boom, might have to pay capital gains tax from these trades, even if they haven’t liquidated the funds from exchanges. Because some of Baldwyn’s clients didn’t—or couldn’t—liquidate funds from exchanges, they were left with paying a hefty tax bill, in some cases without the means to pay it back.

Of course, this is crypto—exchanges, many of dubious quality, run by even more dubious individuals, often shut down and scrub their records clean. It isn’t always possible to download your transactions. Tough luck, said Jones. “The onus is on you to keep good records. The Revenue can fine you quite heavily if your records are inadequate.”

Come clean about your taxes

Where records exist, the HMRC will check, said Jones. “The HMRC are currently going to the exchanges and demanding records of everybody who has been trading through their websites. I would imagine that everyone is going to be caught.” Coinbase, eToro, and CEX.IO have all received letters from HMRC, according to Coindesk. Will HMRC bother to penalize? Definitely, said Jones. “ I would always recommend that people file their tax returns,” he added.

“I think there's a lot of people still out there that are scared to disclose because they're worried that they will be facing tax bills where they don’t physically have the money to pay the tax,” said Baldwyn. But “It’s best to disclose now,” he said. “Come clean now, and don’t drag your feet.”

Baldwyn expects that there might be an initiative from HMRC to try and encourage people to come forward by offering a low flat rate penalty. Better that, than a huge fine.

Consider using software

Jones suggests logging transactions in a spreadsheet, splitting things up according to the crypto assets that you own. Balwyn suggests using software to help extract the relevant data from exchanges. Jones thinks this is a good idea, but if you use it, “HMRC have the right to challenge it, and you need to have the backing documentation to justify the stance you've taken,” he said.

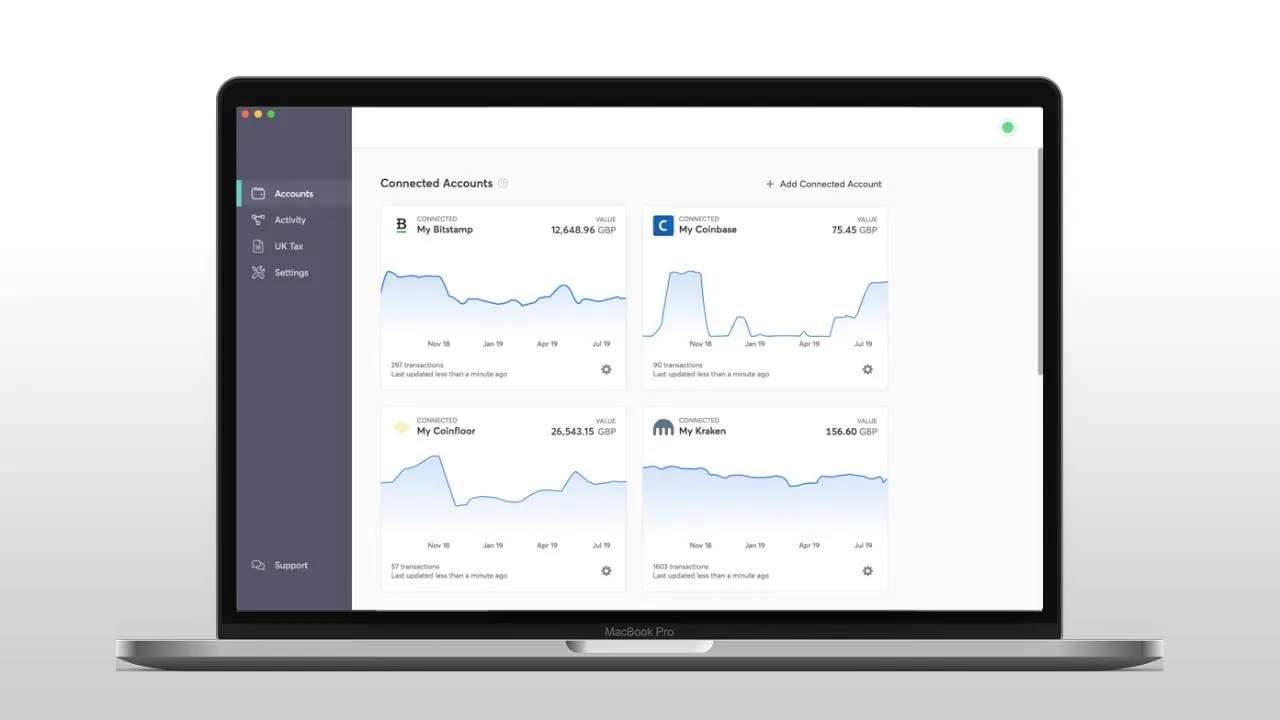

One such piece of software is Recap, which automatically calculates capital gains tax reports for you. It was created by Daniel Howitt, of Lincoln, who spent 38 hours calculating his own crypto tax return back in 2017. Never again, he told Decrypt, and so he set up Recap, along with co-founder Ben Shepheard to save schleps like you pain and strife. Recap launched in August, has around 350 users, and costs between £120 and £400 to get a tax report; the price is based on the number of transactions you’ve made.

“Instead of spending twenty or thirty hours cleaning all of your information and trying to work out what your tax position is on a spreadsheet, you can literally connect all of your cryptocurrency exchange accounts, hit a button, and see your capital gains tax position with a few clicks,” said Howitt.

“We will connect to all of the cryptocurrency exchange accounts where you trade, via API connections, and we pull all your data into one place,” he said. Then Recap runs the calculation, and prints out a tax report.

The HMRC’s guidance around cryptocurrencies is still a work in progress (though the laws are still the same), but Howitt told Decrypt he’ll keep his software up to date. Recap’s also partnered with a local accountancy firm, Wright Vigar, to make sure it is compliant with the law.

Recap also supports airdrops and forks, but doesn’t explicitly support staking, since HMRC hasn’t given guidance on it, said Howitt’s co-founder, Shepheard. Once you’ve got the report from Recap, Shepheard advised that customers still consult accountants to check things over.

Report mining and crypto salaries as income

Both salaries paid in crypto, and the proceeds of crypto mining, are considered to be income by HMRC—including proof-of-stake and proof-of-work mining. Jones said, “If you are paid in crypto, that is a salary, and you should really be converting the cryptos you’re paid in into sterling, even if you don’t actually convert them into sterling. They’re still taxable. And if the company concerned is in the UK with a UK presence, should be applying PAYE.”

Here’s how HMRC looks at forks

Jones said, “The HMRC’s general view is that when the blockchain forks, you take a percentage of the base cost into the new fork.” So, when Bitcoin forked into Bitcoin Cash, you’d take the value of Bitcoin Cash and Bitcoin on the day of the fork, and appiortion the original cost on a pro rata basis.

How airdrops are taxed

Shepheard, of Recap, said airdrops are treated as gifts. Jones concurred, and added that that your base cost would be zero. So if you sold some airdropped Bitcoins for £10, you’d pay capital gains tax on the £10.