Dai Savings Rate is now live paying out 8% at no additional risk compared to holding Dai.

Can be accessed at:https://t.co/dI2nxIS9DP

(Not available for Americans or VPN users)— Rune (@RuneKek) August 6, 2023

$68,574.00

1.29%$1,992.12

1.31%$1.44

1.25%$627.80

0.30%$0.999987

0.01%$86.61

2.10%$0.288475

1.29%$0.099537

-1.27%$1.041

0.95%$565.39

0.44%$51.15

1.09%$0.281238

-0.49%$0.999896

0.00%$8.33

-4.19%$29.96

0.05%$8.97

1.11%$0.999589

0.04%$330.68

-0.48%$0.16085

-1.23%$0.162845

0.42%$0.999222

0.00%$0.00953435

-0.64%$0.10041

0.52%$259.46

1.01%$55.32

0.67%$0.99946

0.02%$9.30

2.04%$0.00000645

1.15%$0.958486

0.00%$0.121728

5.00%$1.34

-1.29%$0.078059

-0.10%$5,112.48

1.16%$5,149.06

1.29%$1.34

-0.42%$3.64

5.40%$1.37

2.23%$0.637513

1.94%$1.00

0.00%$123.69

6.08%$0.727436

1.59%$0.0000042

-0.82%$184.00

2.97%$0.997155

0.02%$79.49

0.04%$2.34

0.08%$1.00

0.01%$1.12

0.00%$0.174417

-0.74%$0.999871

0.02%$0.0000017

0.03%$0.064311

0.98%$9.25

7.22%$1.055

1.44%$0.998995

0.02%$0.270106

1.07%$0.00211479

0.17%$11.00

0.00%$2.23

2.56%$0.112715

8.40%$2.34

-0.06%$7.26

1.45%$8.57

1.48%$0.389952

-0.22%$0.01778087

-5.71%$0.058779

-2.48%$66.46

-0.58%$0.902311

3.25%$0.109106

-1.99%$1.63

7.52%$0.03120964

0.05%$0.999531

0.06%$3.51

-1.58%$0.00956812

-0.11%$0.090415

-0.38%$1.23

-0.02%$1.48

-0.53%$1.00

0.05%$0.97601

2.53%$1.027

0.00%$0.0356205

2.09%$114.37

0.02%$1.11

-0.09%$0.896008

2.52%$0.00776836

-0.67%$0.080444

0.23%$0.099707

3.85%$1.095

0.00%$0.997334

-0.09%$0.00000636

-0.63%$0.999672

0.03%$0.02900379

-2.02%$0.158719

-1.25%$0.01295785

0.13%$0.999489

0.05%$0.481884

-1.32%$0.07122

-0.08%$1.00

0.03%$1.087

-0.11%$1.18

-0.01%$0.256579

-0.26%$1.33

3.18%$0.00695347

1.12%$34.47

2.11%$0.651805

-0.92%$0.392924

0.47%$24.46

2.78%$170.53

4.66%$0.999

0.01%$1.10

-1.38%$0.215177

-23.95%$1.54

4.96%$0.16697

-0.84%$0.0431461

-0.49%$3.78

11.78%$0.03577388

0.00%$0.083829

0.69%$0.243489

-1.17%$1.75

7.84%$0.465506

-1.38%$0.99972

0.01%$0.00000034

-0.20%$0.00000033

-3.02%$0.056139

-0.21%$1.021

0.04%$16.40

2.35%$0.01696089

0.16%$120.40

3.21%$0.054329

0.36%$3.20

2.30%$0.336148

7.14%$0.02846237

5.28%$0.326721

-1.05%$0.069736

-1.43%$0.336443

2.05%$0.162379

-0.76%$0.0000304

-1.01%$0.0059165

2.26%$0.997623

0.13%$1.54

7.01%$0.332202

0.94%$0.053274

2.67%$0.994117

0.23%$0.129036

1.17%$0.236773

4.72%$17.40

-0.05%$1.63

2.21%$0.00276753

0.74%$6.84

3.36%$0.073132

-3.88%$0.02007456

-1.34%$0.04525718

-1.81%$0.002457

-1.67%$1.37

5.42%$0.999294

-0.02%$0.085495

2.23%$0.0209861

-0.24%$0.224667

0.13%$1.075

0.00%$1.00

0.00%$0.988266

0.00%$0.523248

-0.35%$0.9996

-0.02%$5,674.10

-2.80%$0.00217232

2.08%$0.097536

1.87%$22.86

0.00%$0.203611

2.99%$0.00000097

0.61%$1.23

1.13%$0.00003641

-1.08%$1.59

4.66%$1.036

1.42%$2.78

0.38%$0.196777

0.91%$0.099429

1.31%$4.35

-1.49%$0.259138

20.37%$0.052855

-0.97%$0.00509844

-0.45%$1.00

0.00%$0.187201

22.76%$0.080106

1.16%$0.00394287

0.85%$0.186495

0.61%$0.122611

1.14%$1.00

0.00%$2.23

-0.17%$1.94

-2.12%$0.658617

1.15%$18.12

-0.79%$0.999812

0.01%$0.0208397

27.24%$0.75806

-0.86%$0.054255

1.40%$0.167919

-1.00%$2.14

1.91%$0.0441048

0.75%$1.80

0.20%$0.02251973

-2.53%$47.99

0.00%$0.00000802

1.24%$0.992397

-0.31%$8.01

0.04%$1.27

-0.32%$0.34421

2.51%$13.98

0.59%$0.648359

10.87%$0.997985

-0.06%$1.014

0.18%$1.001

0.21%$0.430947

15.54%$0.688082

4.86%$0.413401

-0.52%$0.312975

0.72%$0.169593

2.58%$0.273008

-1.32%$4.62

0.86%$8.91

-0.81%$0.083016

1.62%$0.305153

-5.51%$2.03

-0.01%$0.093889

0.71%$0.325657

-0.78%$0.072172

-2.09%$1,097.12

0.04%$0.130711

3.52%$0.13077

-0.70%$0.080627

-0.61%$0.261049

1.15%$0.0015076

-0.31%$0.995172

0.02%$0.00409928

-0.20%$0.124943

4.16%$0.579822

-3.51%$0.13086

-0.02%$0.999009

1.38%$1.53

-11.48%$0.995734

0.00%$0.00231128

-0.11%$2.37

1.68%$0.209311

2.80%$6.00

49.61%$0.195242

-1.08%$0.340633

-5.37%$1.00

0.03%$0.999716

0.01%$2.42

1.01%

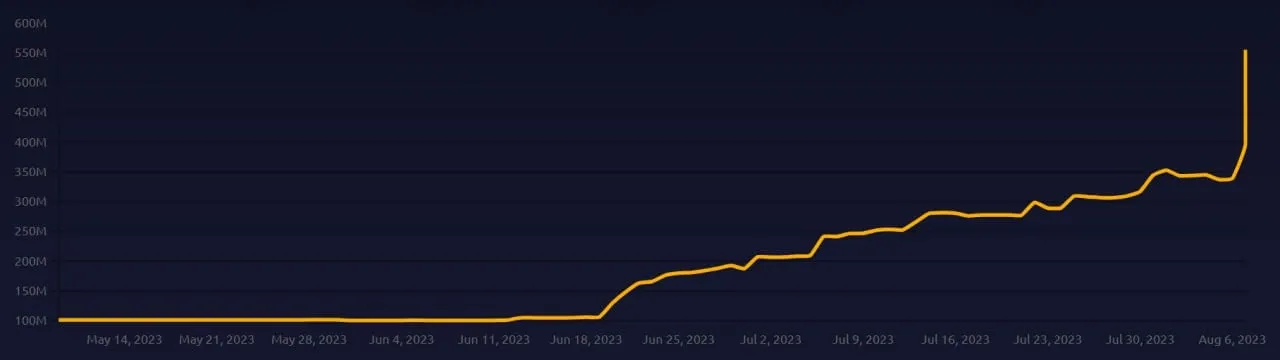

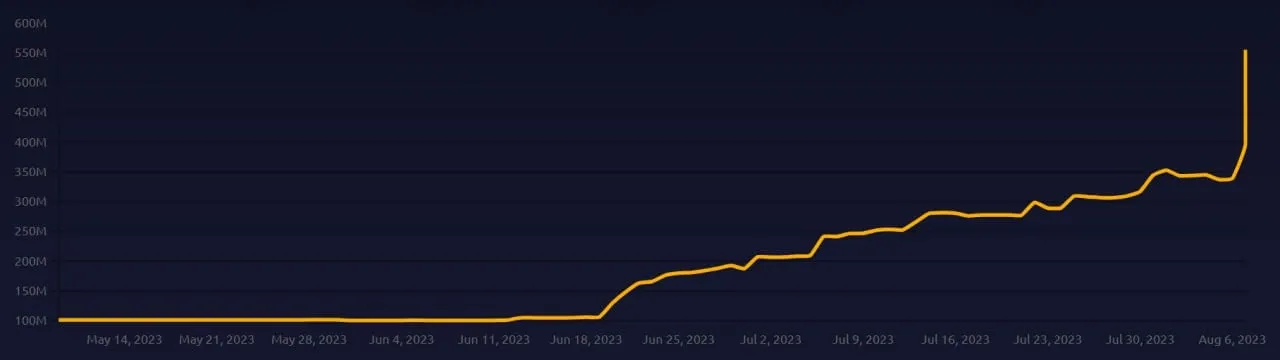

The MakerDAO community has approved and executed a temporary increase in the annual returns for depositing its DAI stablecoin into the protocol.

Folks staking the decentralized stablecoin can now enjoy a whopping 8% yield on their holdings.

The interest rate earnings on DSR are enabled through Spark Protocol which is not available to non-U.S. users or VPN-linked addresses.

The MakerDAO community governs the Maker Protocol which mints the dollar-pegged DAI against over-collateralized deposits of other cryptocurrencies, like Ethereum or Uniswap’s UNI token.

On July 19, MakerDAO’s creator Rune Christensen introduced the Enhanced Dai Savings Rate (EDSR) proposal to temporarily increase the returns on Dai Savings Rate (DSR) to increase its demand.

Maker’s DSR contracts let DAI holders earn from the protocol’s revenue by depositing DAI into it.

The community approved the proposal on August 4, with the code going live this Sunday. Christensen announced the upgrade in a tweet this morning.

Dai Savings Rate is now live paying out 8% at no additional risk compared to holding Dai.

Can be accessed at:https://t.co/dI2nxIS9DP

(Not available for Americans or VPN users)— Rune (@RuneKek) August 6, 2023

The total amount of DAI deposited in the DSR contract jumped by 257 million DAI or 75.7% from 339.4 million to 556 million DAI since the activation of EDSR, according to Makerburn.com data.

The supply of DAI has jumped by 4.88% or $217 million from $4.225 million before the activation of EDSR.

Of the total supply, 11.9% has been deposited in DSR contracts.

In the tweet introducing the EDSR update, Christensen emphasized the temporary nature of the feature, stating, "once more users arrive, the rate will go back down."

He had articulated in the governance proposal that the initiative aims to allocate the "increased stability fees" earned by Maker from its Vault users.

The MakerDAO stability fee is a variable interest rate that is charged to users who borrow DAI. The stability fees and DSR are variable rates set by the MakerDAO governance.

As the percentage of deposits in DSR contracts rises, the savings rate will reduce toward the protocol’s average stability fee of 3.19%.

Since the last quarter of 2022, the protocol’s revenue from stability fees and interest earnings has surged due to increasing exposure in real-world assets (RWA) like U.S. Treasury Bills and corporate debt.

RWA accounts for 52.5% of Maker’s revenue, according to a Dune dashboard.