Another alleged crypto fraudster that profited heavily from the 2017 ICO bull mania is now facing the music, a whole 41 months after he was charged by the Commodity Futures Trading Commission (CFTC) on February 11, 2020.

Previous CFTC cases against financial fraudsters in crypto, such as CabbageTech, Mirror Trading International, or Empowercoin have taken far less time to resolve.

The CFTC today announced the judgment from the U.S. District Court for the Southern District of New York for a permanent injunction against former New York Stock Exchange (NYSE) broker Michael Ackerman, who operated Q3 Holdings.

The Ohio man is being banned from trading or registering in any CFTC-regulated markets. In addition, he is to pay $27 million in restitution to victims he defrauded, in addition to another $27 million as a civil monetary penalty for running a fraudulent digital asset trading scheme.

The 54-year-old first pleaded guilty to wire fraud in September 2021. As part of his plea agreement, Ackerman agreed to restitution of $30.6 million and forfeitures of his assets amounting at least $36 million.

Authorities say that between August 2017 to December 2019, Ackerman duped investors through his company Q3 Holdings with promises of 15% monthly returns. Q3 promised to deliver those returns through its proprietary trading algorithm by trading Bitcoin and other digital assets.

He successfully solicited at least $33 million from more than 150 investors, sourced predominantly from physician Facebook groups, according to the CFTC.

By December 2019, Ackerman claimed that the fund had successfully grown nine-fold to approximately $315 million—a spectacular return given market prices at the end of the 2017 crypto bull market. At the time, total crypto market capitalization had fallen from its 2018 all-time-high of $850 billion to $200 billion.

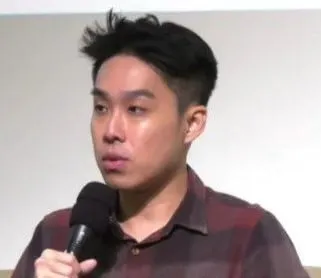

The CFTC says that in order to mislead investors and the fund’s limited partners, Ackerman manufactured screenshots and accounting statements that falsely represented the fund’s portfolio. The falsified information was then passed on by his partners, former Wells Fargo Advisors employee James Seijas and Florida general surgeon Quan Tran.

Yet, Seijas and Tran were also apparently misled by Ackerman himself. Ackerman’s partners claimed to discover only later major discrepancies in the fund’s actual asset values versus what Ackerman had told them.

In reality, less than $10 million of the money raised was actually invested. Instead, Ackerman used the money for personal gain in cars, jewelry, travel and private properties, including a 150-acre Montana plot and a $3 million Florida beach house.

Aggrieved investors collectively formed a legal entity “Q3 Investment Recovery Vehicle” that sought to hold Ackerman along with his partners accountable.