At Money20/20 earlier this month, David Schwed, COO of Halborn, sent a message back to his team from the floor of the fintech conference in Amsterdam.

“I’m happy,” he wrote. “I feel like there are adults here.”

After attending crypto-centric conferences in Texas, Miami, and Barcelona over the past few weeks, he said seeing booths that belonged to JP Morgan, Citibank, and Goldman Sachs was a welcome change of scenery from fist bumps and late-night festivities.

Schwed joined Halborn, a blockchain security firm, last July. In his previous role, he served as global head of digital assets technology for BNY Mellon, one of America’s oldest lenders and the world’s largest custodian bank.

That’s part of the reason why he sees a “huge, huge market” for big banks to enter the crypto industry, he told Decrypt. And he’s not the only one.

Institutions from the traditional world of finance dipped their toes in crypto long before FTX hit rock bottom last November. But now, as the SEC circles the largest two centralized exchanges left standing, traditional finance (or TradFi, as it's been nicknamed in the industry) appears poised to gain ground—and possibly market share. Some experts say all financial roads in the U.S., no matter how nascent, eventually lead to Wall Street.

“The banks and the financial institutions with capital are always years behind by design because they're risk averse,” Schwed said. “And then once there is any sort of clarity, whether it's coming from the SEC or court systems, they're just gonna jump on that opportunity and create.”

Even if Wall Street wants in, Schwed believes crypto will always have its anti-establishment actors, who skew libertarian. Their rallying cry: screw financial intermediaries. But he said that faction will likely shrink or pivot toward privacy coins as regulators turn up the heat, leading to more robust regulations along the way.

“The companies that we see today, [...] they're going to look and feel much different” in the future, he said. “The ones that are smart, the ones that are gaining capital, are going to be building around what's coming out of these lawsuits from the SEC.”

“Shark Tank” star Kevin O’Leary is among the seasoned investors who believe a changing of the guard is afoot. As America’s financial watchdog tries to bring crypto to heel, he told Decrypt that three years from now, the industry’s leading firms will be comprised of an entirely different crew.

“We have to thank them for their service and their entrepreneurship, but they have to go,” he said of today’s top exchanges. “They don't understand the concept of integrating [with] the global financial system in a way that allows institutions to participate.”

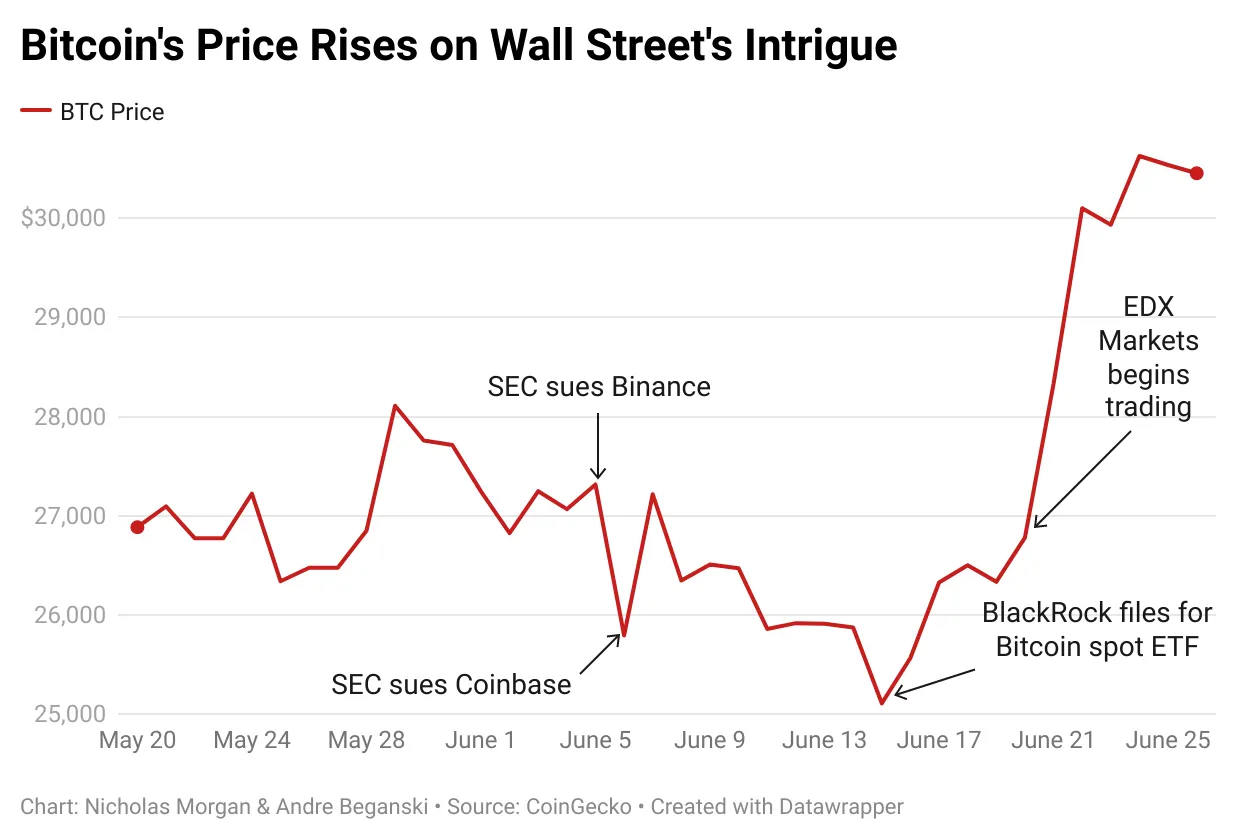

Amid the bitter vibes on Crypto Twitter after the SEC’s recent regulatory blitz, a glimmer of hope for crypto adoption flickered when BlackRock announced its bid to establish America’s first spot-based Bitcoin ETF. Not long after, Wall Street titans Fidelity, Charles Schwab, and Citadel Securities announced that their crypto exchange EDX Markets began trading operations.

Days later, Bitcoin’s price was flirting with $30,000, up by roughly 20% since BlackRock filed its application.

If BlackRock’s Bitcoin ETF gets approved it would be a game-changer. To date, the SEC has blocked every application, time after time, since the Winklevoss twins first filed for a Bitcoin ETF in 2013.

It didn’t take long for the phone of CF Benchmarks CEO Sui Chung to “ring hot” with calls from clients following the ETF announcement, he told Decrypt. In particular, it was clients from large traditional firms looking to gauge BlackRock’s odds of success.

This was a palpable shift in their attitude toward Bitcoin, he said, believing if BlackRock was willing to experiment with the creation of new financial products, so should they, "because, clearly, it can be done.”

BlackRock keeping Coinbase as the custodian for its Bitcoin ETF, even after the SEC charged the San Francisco-based company with operating an unregistered exchange in a lawsuit, is a tacit vote of confidence. The two announced their first big partnership last August, inking a deal that allows BlackRock’s institutional Aladdin platform users access to digital assets through Coinbase’s brokerage service.

By targeting Coinbase, the SEC sparked some TradFi sympathy. Shortly after it was sued, the Committee on Capital Markets Regulation, which describes itself as a nonpartisan research group, released a brief that criticized the agency’s lawsuit and accused the SEC of making it unduly difficult for crypto firms to register with the watchdog.

Leo Mizuhara, CEO of the digital asset management platform Hashnote, said BlackRock’s choice to wade deeper will incentivize more institutions to take crypto seriously as an emerging asset class.

"To a large extent, [BlackRock] legitimizes the entire space as an investable asset class," Mizuhara told Decrypt. "The fact that they did this right after the SEC sued Coinbase, I think really illustrates how little people think the SEC has legs to stand on."

However, the glow that accompanies more involvement from big institutions isn’t a welcome step for some of crypto’s true believers. FUD flowed on Crypto Twitter about a TradFi takeover after BlackRock’s filing, labeling the SEC’s regulatory double-tap as part of a pernicious plot.

"These big companies are used to controlling financial markets, and crypto makes them feel threatened," Miles Deutscher, a self-described DeFi addict said on Twitter. The goal, he claimed, is to kill “crypto businesses via aggressive regulation, so that big TradFi can step in and control US trading.”

The hidden agenda behind the recent SEC crypto crackdown:

Big TradFi funds sat back in 2017 and 2021 and watched crypto exhibit 1000%+ returns, whilst they were sidelined watching their equities grind up 10% per year.

This made them extremely envious of new crypto startups…

— Miles Deutscher (@milesdeutscher) June 16, 2023

But among those working with these institutions, Wall Street’s involvement should be welcomed as a necessary evil.

"I've always been of the opinion that crypto and Bitcoin are not going anywhere if they're only there for hardliners and anarchists," said Mizuhara from Hashnote. "In order for it to make its mark in the world, it really does have to go mainstream. We're on step two of 10 at this point, but it's coming."

Editor's Note: This story has been updated to correct CB Benchmarks Sui Chung's title.