I stopped by @PBDsPodcast this morning to discuss currencies, crypto, politics, #bitcoin, banking, macro, money, and the media with @patrickbetdavid. https://t.co/IctlB4l7gN pic.twitter.com/e6ljbGM124

— Michael Saylor⚡️ (@saylor) May 9, 2023

$62,849.00

-4.97%$1,815.21

-5.55%$1.33

-4.84%$582.21

-4.56%$0.999927

-0.01%$76.55

-5.06%$0.280695

-1.42%$1.031

1.50%$0.090804

-6.34%$47.35

-4.34%$0.999917

0.00%$480.09

-10.53%$0.256214

-5.91%$7.96

-1.78%$26.51

-2.04%$0.999303

0.08%$0.160197

-0.32%$321.35

1.37%$8.10

-4.70%$0.14873

-4.31%$0.999675

0.26%$0.00940554

-2.75%$0.999872

0.04%$0.093561

-3.36%$50.64

-3.90%$233.12

-5.76%$8.25

-5.12%$0.00000592

-4.19%$0.85136

-5.95%$1.32

-4.19%$0.073872

-1.88%$0.10706

-4.00%$5,108.97

-0.37%$1.41

-0.54%$5,144.67

-0.38%$3.29

-4.63%$1.23

-5.19%$1.00

0.00%$0.579741

-1.13%$0.997391

0.00%$112.70

-5.07%$0.687212

-1.33%$0.00000392

-4.92%$0.999615

-0.02%$1.12

0.00%$165.14

-4.21%$1.00

0.02%$2.19

-2.81%$72.92

-3.77%$0.00000164

-1.65%$0.161694

-0.04%$0.062439

-1.93%$0.999458

0.01%$8.11

-4.10%$0.966696

-3.85%$0.24314

-4.98%$11.00

0.01%$2.06

-0.91%$6.64

-4.70%$0.105562

-4.28%$8.20

-2.70%$0.373779

-4.19%$0.00175691

-8.90%$2.03

-6.72%$0.01693034

-2.82%$0.056032

-6.30%$62.97

-1.69%$0.999466

0.01%$0.805002

-6.12%$1.23

-0.20%$0.096046

-5.02%$0.02933708

-3.03%$0.765646

7.12%$3.28

-2.76%$0.00893584

-4.24%$0.0833

-3.46%$114.39

0.02%$0.999685

-0.02%$1.027

0.00%$1.11

-0.70%$1.34

-4.56%$0.0334979

-0.24%$0.871524

-3.20%$0.807918

-5.03%$0.00712519

-4.78%$0.080022

-0.17%$1.095

0.03%$0.997146

0.17%$1.56

-5.52%$0.090725

-4.07%$0.999778

-0.00%$0.02855864

-0.12%$0.01300781

1.60%$0.00000578

-4.76%$0.998803

-0.02%$27.70

7.54%$1.085

0.02%$0.999717

-0.01%$1.18

-0.22%$0.142038

-4.64%$0.244952

0.85%$0.065163

-4.37%$0.232365

-3.22%$31.92

-4.65%$0.04545356

0.24%$0.00630521

-4.11%$166.05

0.47%$0.366039

-1.69%$1.18

-6.96%$0.99952

0.04%$0.582826

-5.39%$1.001

-3.52%$0.03410254

-1.51%$0.151856

-3.90%$1.37

-4.62%$1.02

-0.03%$0.452203

-2.97%$0.999832

-0.00%$0.07676

-5.76%$0.00000033

-0.27%$0.21853

-4.35%$0.00000033

-3.33%$3.16

-9.21%$0.01641858

-1.50%$118.19

-2.01%$0.052226

-5.49%$3.13

-1.06%$1.47

-6.38%$14.87

-4.39%$0.997837

0.09%$0.314

2.46%$0.04971539

-3.15%$0.065339

-2.57%$0.00557301

-5.39%$0.02557587

-3.64%$0.992527

0.27%$0.00002775

-4.36%$1.63

1.49%$16.88

-3.01%$0.283088

-1.73%$0.294864

-3.85%$1.37

-1.07%$0.139181

-12.76%$0.295058

-2.42%$0.04780087

-4.37%$0.115602

-5.97%$0.00246768

-0.89%$0.00247762

-5.48%$0.06667

-2.99%$0.998246

-0.11%$0.196829

-7.79%$5.91

-5.03%$0.306888

10.10%$0.02056892

6.23%$0.04065951

-3.88%$0.999997

0.01%$0.988316

-0.02%$1.075

0.03%$0.999726

-0.02%$1.69

1.47%$22.79

-0.31%$0.077726

-3.41%$0.098713

-1.85%$1.21

-2.85%$0.491151

-2.00%$0.00000095

-0.09%$0.00202631

-0.60%$1.18

-3.70%$0.194635

-7.19%$1.00

0.00%$0.00003464

-0.22%$5,012.35

-6.69%$0.051955

-1.26%$2.63

-1.48%$0.085262

-2.26%$0.18789

-2.87%$0.183528

-3.26%$0.078051

-0.37%$1.00

0.00%$0.01885348

-7.76%$0.00467536

-4.39%$0.0897

-4.46%$0.114806

-3.76%$0.759317

-0.46%$0.999182

-0.14%$17.42

-1.67%$8.56

8.02%$0.02301859

2.64%$1.79

-0.34%$0.01998658

0.23%$0.00344414

-4.80%$2.02

-2.91%$47.99

-0.02%$1.73

-4.57%$0.994616

-0.12%$1.26

-0.12%$3.33

17.61%$0.57404

-5.26%$0.04923286

-5.28%$0.998018

-0.05%$0.151082

0.19%$0.999718

0.26%$1.91

-6.82%$1.013

-0.02%$0.0393643

-1.95%$0.00000736

-3.98%$3.31

-15.33%$0.146861

-8.06%$0.02500933

38.24%$0.1427

-8.39%$0.3141

-2.06%$0.303556

-1.66%$0.382421

-3.04%$8.76

3.97%$0.618462

-3.30%$11.83

-8.75%$1,097.52

0.05%$0.153267

-4.83%$0.600986

5.88%$0.319739

-0.37%$0.073454

-2.55%$0.12703

-3.80%$0.994457

-0.07%$0.249167

-2.82%$0.076632

-5.56%$0.124492

-4.00%$0.130573

0.89%$4.20

-4.25%$0.122708

-5.01%$0.00143977

-2.51%$0.216027

-0.96%$0.085969

-4.59%$0.274409

-3.73%$1.001

0.00%$1.83

-4.50%$0.346225

-12.97%$0.999635

-0.12%$0.999809

-0.02%$0.00386815

-0.08%$0.239924

-6.23%$0.071595

-4.39%$1.47

13.42%$0.33018

-2.74%$11.74

4.99%$1.062

0.00%$0.999553

-0.04%$0.999772

0.01%$2.21

-1.64%

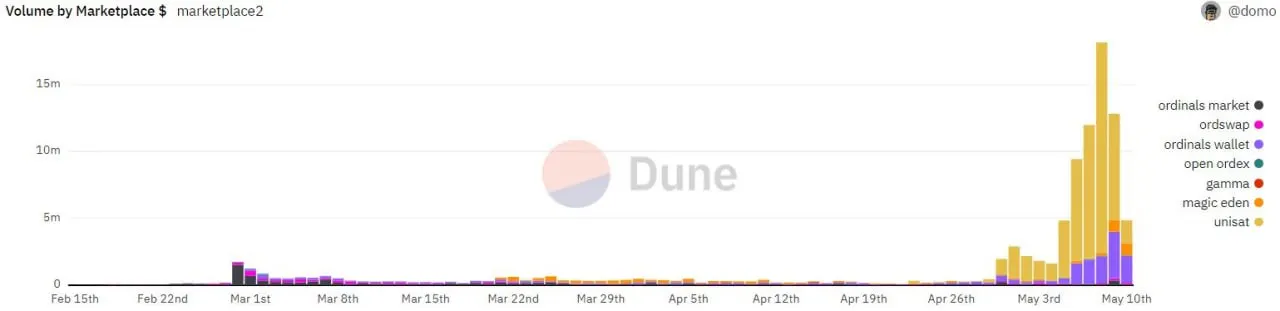

Bitcoin bull and Microstrategy co-founder Michael Saylor said the latest Ordinals craze has been a catalyst for Bitcoin adoption

“Every time someone builds an application that’s cool on Bitcoin, like all the Ordinals and inscriptions and whatever that are driving up transaction fees, its a catalyst,” said Saylor on the PBD Podcast.

He roped in bank failures, hyperinflation, regulators calling the asset a commodity, and whenever “a company like Microstrategy buys another $100 million worth of Bitcoin” as similar catalysts for adoption.

I stopped by @PBDsPodcast this morning to discuss currencies, crypto, politics, #bitcoin, banking, macro, money, and the media with @patrickbetdavid. https://t.co/IctlB4l7gN pic.twitter.com/e6ljbGM124

— Michael Saylor⚡️ (@saylor) May 9, 2023

Ordinals, unlike the other catalysts mentioned, is a newer development on the leading blockchain.

They offer a way to store media on the network by inscribing their data on the smallest unit of Bitcoin, satoshi. It was developed in early 2023, essentially ushering in non-fungible tokens (NFTs) on the largest network in the industry.

The development hasn’t stopped there either.

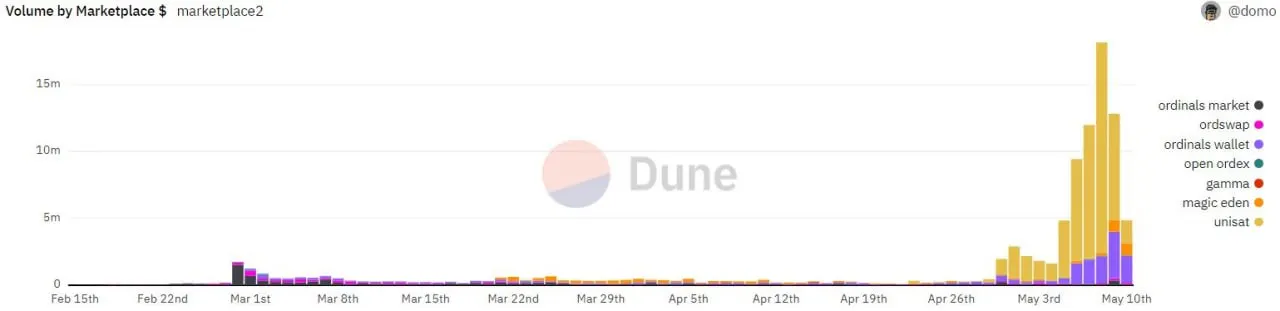

In March, another programmer created a fungible token creation standard, BRC-20 (a hat tip to Ethereum’s ERC-20 token standard) atop Ordinals, sparking a flurry of meme coins on the market. Yesterday, the market capitalization of BRC-20 tokens hit $1 billion.

Ordinals continue to gain traction too as the world’s leading exchange Binance moved to list Bitcoin NFTs on its platform.

While the surge in the network’s demand has increased miner revenues, the high fees have made BTC transfers very expensive.

Bitcoin Ordinals have caused a surge in network fees of around $20 per transaction from less than $2 before May 2023.