Bitcoin (BTC) may finally leave crypto winter behind and outshine the market in the coming months, according to a research report by Berenberg.

Such a possibility could be due to “a combination of circumstances, evolution, and timing,” reported the Hamburg-based multinational investment bank.

Notably, analysts write, Bitcoin is practically the only digital asset to be characterized as a commodity rather than a security by the U.S. Securities and Exchange Commission (SEC), the decentralized nature of its blockchain protocol, as well as the upcoming Bitcoin halving that will see the rate at which new coins are produced and released into circulation cut in half, per the report author Mark Palmer.

The halving cuts miner rewards in half. Currently, miners earn a reward of 6.25 Bitcoin; by next Spring, that figure will be 3.125.

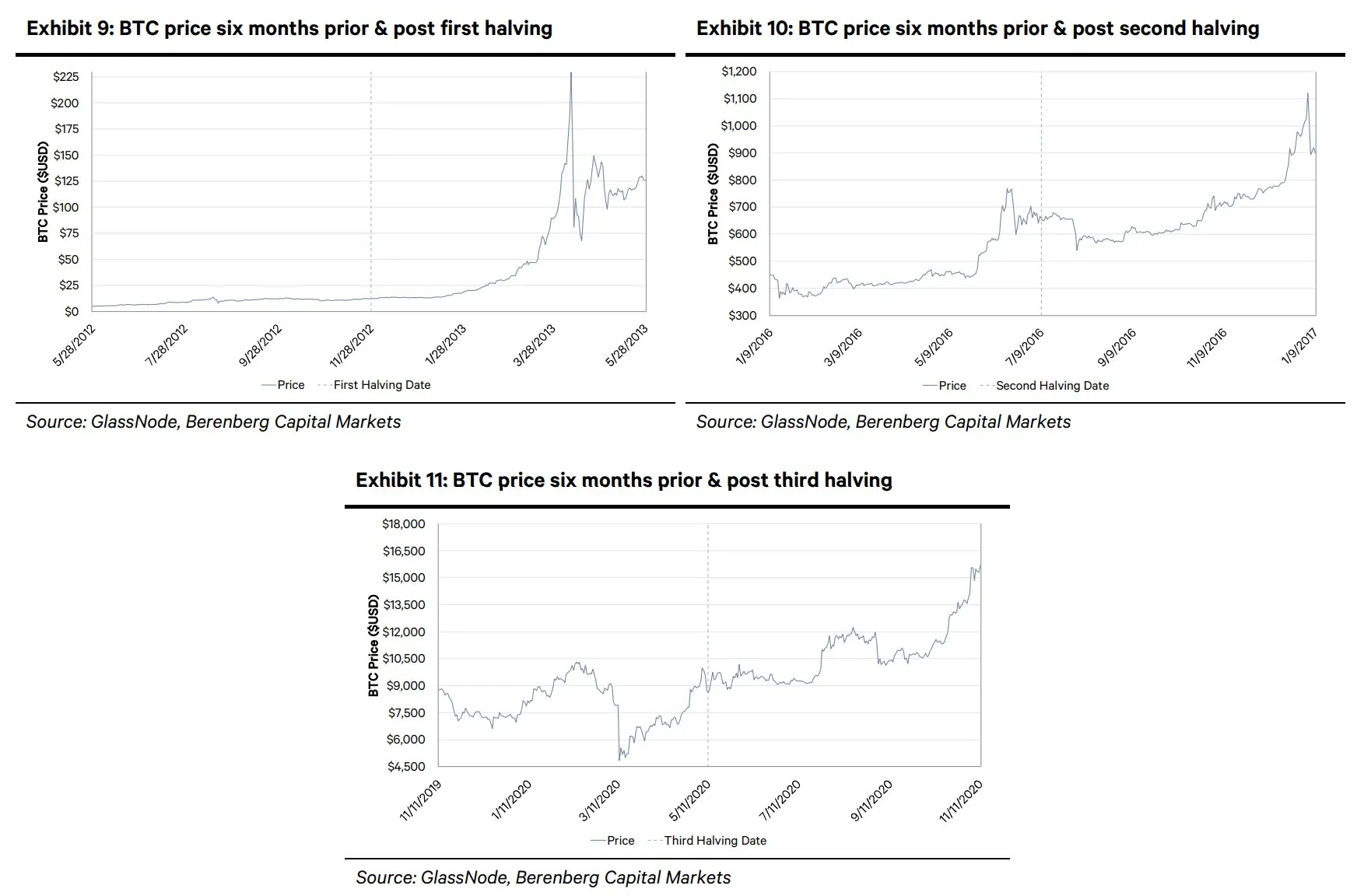

Historically, Bitcoin halving events have been associated with a significant increase in the price of the asset, and Berenberg sees the next one as no different. Moreover, the next halving could also “serve as catalyst… by extension,” for MicroStrategy shares, the largest corporate holder of Bitcoin reserves at about 140,000 BTC.

“If history is any guide, then we believe the price of Bitcoin could rally ahead of and following this much-anticipated halving, with MSTR’s stock offering a leveraged means through which investors can take advantage of that event,” reads the report.

While the price of Bitcoin rallied about 65% since the start of the year, MSTR is up almost 120% over the span.

MicroStrategy stock closed the Thursday trading session at $318.64, with Berenberg covering MSTR with a buy rating and a $430 price target.

What is the Bitcoin halving?

Bitcoin halving is an event that occurs approximately every four years, with the protocol specifying that there will only ever be 21 million Bitcoins in existence. The halving is designed to gradually slow down the creation of new coins until the final one is mined in the year 2140.

The first Bitcoin halving took place in November 2012, when the mining reward was reduced from 50 BTC to 25 BTC per block. The second halving occurred in July 2016, reducing the reward to 12.5 BTC per block, and the third halving took place in May 2020, reducing the reward to 6.25 BTC per block.

The next Bitcoin halving is set to occur at block 840,000, which is estimated to happen approximately in April 2024, with the mining reward to be reduced once again by half.

The halving has important implications for Bitcoin's supply and demand dynamics. Slowing the rate at which new Bitcoins are created, makes the asset slightly more scarce.

On the flip side, the halving makes mining less profitable for miners, as they receive fewer Bitcoins for the same amount of work. This can lead to a decrease in the network's hashrate and increased competition among miners.

What other factors may boost the price of Bitcoin?

Berenberg also argues that Bitcoin’s recent appreciation can be seen “as an indication that more investors are recognizing it as a sensible alternative not only among crypto tokens, but also within a global financial context.”

The banking crisis earlier this year, the report reads, has also had a "lingering impact" on traditional finance, even arguing that investors have lost trust in the Federal Reserve "due to its perceived mishandling of the interest-rate cycle."

The bank said that these macro factors have led to concerns about de-dollarization—the process of reducing or eliminating the use of the U.S. dollar in international trade and financial transactions—and could potentially highlight the value proposition of Bitcoin as an alternative currency.

This is also what MSTR stock could benefit from “if investors increasingly turn to Bitcoin as an alternative currency,” the report reads.

“As such, we believe Bitcoin has emerged as a safe haven relative to other crypto tokens, and this advantaged position could spur demand for it,” reads the report.