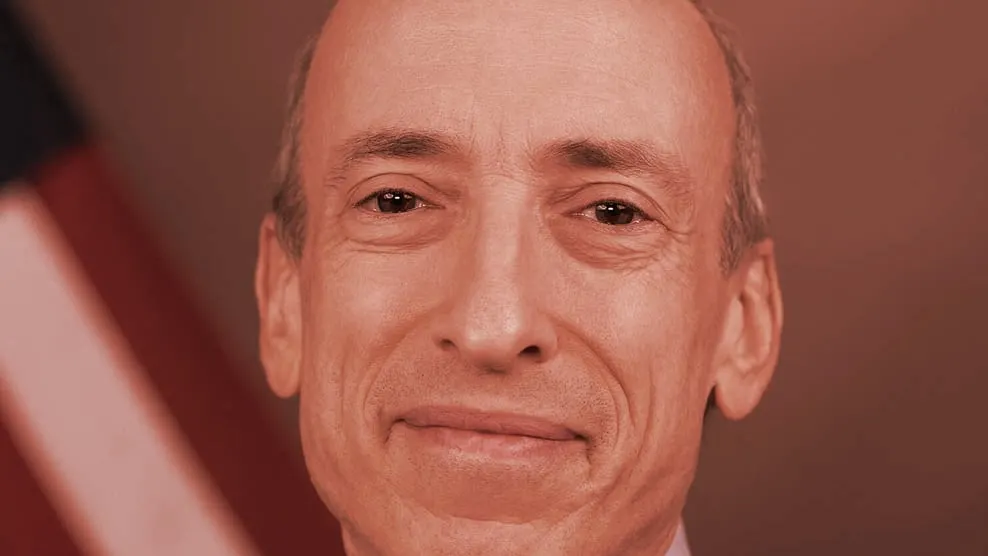

How hard is it to spot a crypto scam? According to SEC Chair Gary Gensler, it’s not nearly as difficult as it might sound.

Speaking to the U.S. Army during a Twitter Spaces earlier this month, Gensler and SEC Commissioner Caroline Crenshaw discussed what they consider the dangers of investing in crypto and how to tell if a project is a scam.

“If something looks too good to be true, sometimes they really are,” Gensler said. “There are certain red flags that you can look for beyond it being too good to be true.”

In general, Gensler laid out three telltale signs that something may be a scam: (1) the crypto project can’t provide clear documentation regarding how it works or how it plans to delivers on its goals; (2) the project can’t demonstrate that it's in regulatory compliance; and (3) the project can’t easily explain what it is at all.

Gensler also said that offers of high returns are a red flag and warned against projects that are overly complicated or that rush the investor to make a decision, praying on “FOMO,” or the fear of missing out.

What are the risks for investing in crypto?

Listen to my discussion with Commissioner Caroline Crenshaw and @USArmy ⬇️ pic.twitter.com/df90CkxwjN

— Gary Gensler (@GaryGensler) January 27, 2023

The SEC chairman also once again reiterated his belief that many cryptocurrencies may be unregistered securities.

“Most [cryptocurrencies] are not complying with the securities laws, but they should be,” he said. “It’s the Wild West, I’d say you have to really wonder if there is a ‘there’ there.”

Presenting a grim outlook on the future of the crypto industry, Gensler told the audience that the majority of cryptocurrencies, upwards of 15,000 tokens currently in the market, will ultimately fail.

“It’s important to understand that crypto is novel; it’s speculative,” Commissioner Crenshaw said. “There are really, really reduced investor protections because most of them have not chosen to come under the SEC remit.”

Pointing out the history of scams in crypto, Crenshaw said there needs to be more transparency in the industry.

“They’re noted for their scams, and they claim to be transparent,” Crenshaw said. “What’s on the blockchain is transparent, but the rest of what’s there is not transparent.”

Though Crenshaw did not call out FTX by name, the specter of Sam Bankman-Fried’s collapsed crypto exchange continues to haunt the crypto market. FTX, once a dominant player in the crypto industry, imploded in November following a bank run on the exchange. The liquidity crisis forced the company to admit it did not hold one-to-one reserves of customer assets and eventually file for bankruptcy.

Bankman-Fried has since been arrested and charged with eight financial crimes, including wire fraud and conspiracy to commit money laundering, in connection with the collapse of the exchange. At the moment, there are still billions in customer assets that are unaccounted for, and millions of customers still don’t know if they’ll ever see those funds again.

“The bottom line is there’s increased risk when you invest in these novel, speculative, volatile investments that really lack basic protections and regulations,” Commissioner Crenshaw said during the Twitter Spaces. “So if you’re considering investing in crypto, consider how much of your portfolio you devote to it, and certainly no more than you can afford to lose.”