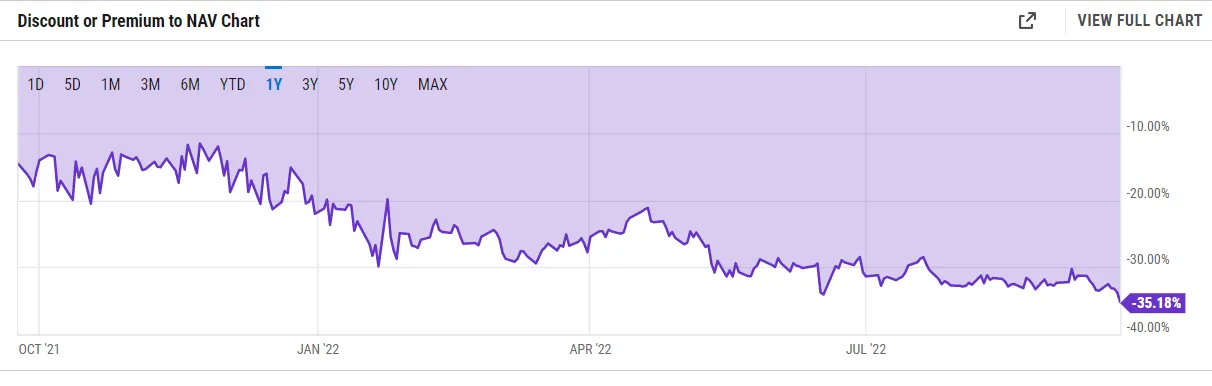

There seems to be no bottom for the Grayscale Bitcoin Trust (GBTC), as shares of the industry’s largest Bitcoin fund hit a record discount of 35.18% last Friday.

GBTC shares allow investors to trade shares in trusts that hold pools of Bitcoin, with each share tracking the price of Bitcoin. The purpose is to give traditional investors exposure to the leading cryptocurrency without the need to actually buy and hold the asset itself.

Since its inception in September 2013, GBTC had historically traded at a lofty premium to spot Bitcoin prices. For years, this used to be a rather attractive option for investors even in spite of a hefty 2% annual management fee.

However, the trust flipped negative and began trading at a discount to spot Bitcoin prices at the end of February last year, following the launch of several Bitcoin ETFs in Canada.

A discount to the net asset value (NAV) may seem like a bargain as it enables investors to buy “shares” in Bitcoin below the actual market value. Still, it comes with a catch: There is no redemption mechanism for GBTC.

This means that the arbitrage trade of buying the discounted shares, redeeming them for the underlying asset (much like how an ETF would operate), and then selling the underlying for a profit is closed. Any GBTC holders are simply stuck with a decaying asset or forced to sell at a loss (depending on when they picked up their shares).

According to Grayscale’s website, GBTC currently holds $11.9 billion in assets under management.

Bitcoin ETF: Mission impossible?

Grayscale has been long arguing that the best way to resolve the issue is to convert its GBTC product into a Bitcoin ETF—an exchange-traded fund backed by physical Bitcoin, as it would help bring its product back to the value of the underlying.

Standing in the firm’s way, however, is the U.S. Securities and Exchange Commission (SEC), which is yet to greenlight any spot Bitcoin ETF for American investors—although it has approved several Bitcoin futures ETFs.

The SEC rejected Grayscale’s application to convert GBTC into a Bitcoin ETF in June, saying that it did not do enough to protect investors from "fraudulent and manipulative acts and practices."

The decision prompted Grayscale to sue the regulator, with CEO Michael Sonnenshein stating that the investment firm will continue to leverage all of its resources to advocate for its investors and the "equitable regulatory treatment of Bitcoin investment vehicles.”