Bipartisan legislation to establish a regulatory regime for stablecoins in the U.S. has been pushed back to after the August recess.

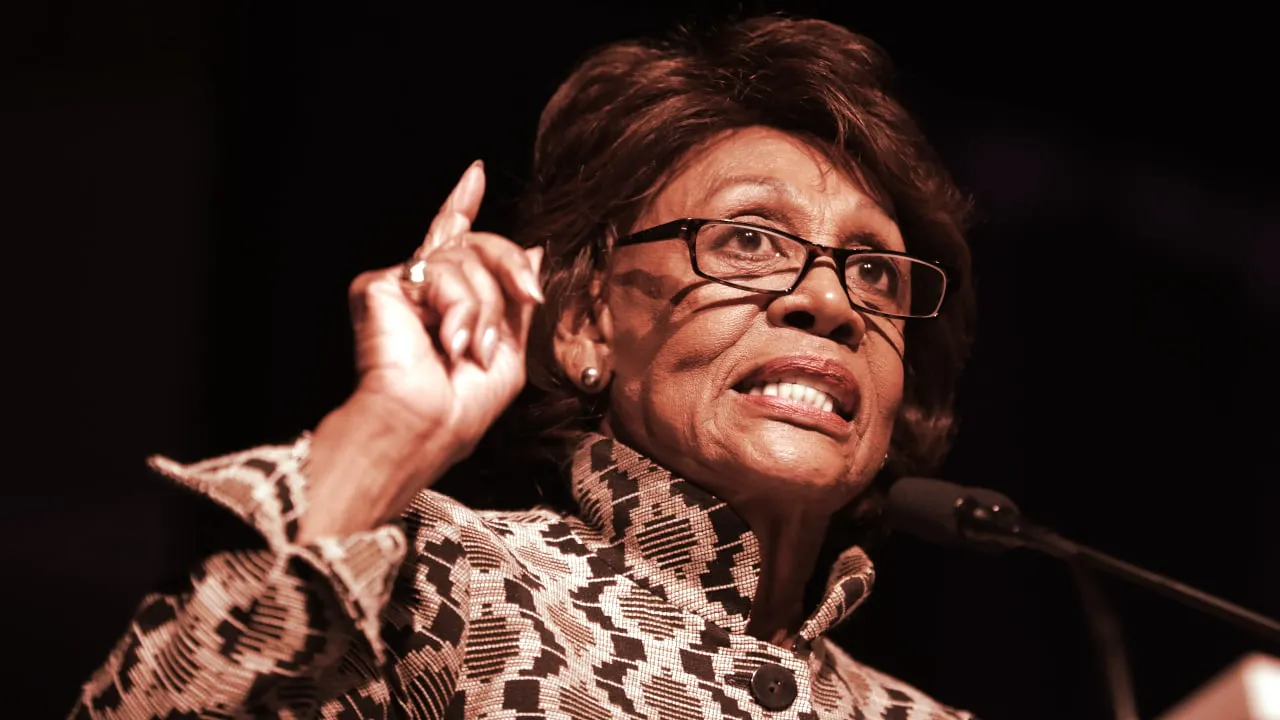

In a statement, Rep. Maxine Waters (D-CA) said, "Although the Ranking Member, Secretary Yellen and I have made considerable progress towards an agreement on the legislation, we are unfortunately not there yet, and will therefore continue our negotiations over the August recess."

She added that, "It’s critical that we continue moving the ball forward on this so we can have a regulatory framework that protects consumers, while allowing for responsible innovation."

The bill was initially expected to move forward yesterday as part of bipartisan work between waters and Rep. Patrick McHenry (R-NC). The piece of legislation reportedly aims at stablecoin issuers, like Tether and Circle, to maintain 1:1 reserves of their stablecoins in circulation and would also limit the types of assets that could back these stablecoins.

The delay follows reports that Treasury Secretary Janet Yellen raised concerns over how the proposed bill addressed questions over the custody of digital assets.

In a February 2022 hearing, Rep. Waters highlighted the risks of stablecoins, noting that, "investigations have shown that many of these so-called stablecoins are not, in fact, backed fully by reserve assets," and that speculative trading and a lack of investor protections "could even threaten U.S. financial stability."

Stablecoins face renewed scrutiny

The proposed regulation around stablecoins has gained renewed urgency in the wake of the collapse of algorithmic stablecoin UST earlier this year.

At the time, Yellen issued an "urgent" call for stablecoins to be regulated this year. She argued that the run on UST "illustrates that this is a rapidly growing product and there are rapidly growing risks," adding that, "digital assets may present risks to the financial system and increased and coordinated regulatory attention is necessary."

However, days later, Yellen conceded that stablecoins have yet to reach a scale "where they're financial stability concerns" in remarks to Congress, noting that the crypto market doesn't yet pose a "systemic risk."