It must be a bear market if Bitcoin mining companies, usually the ultimate HODLers, have started selling their stashes.

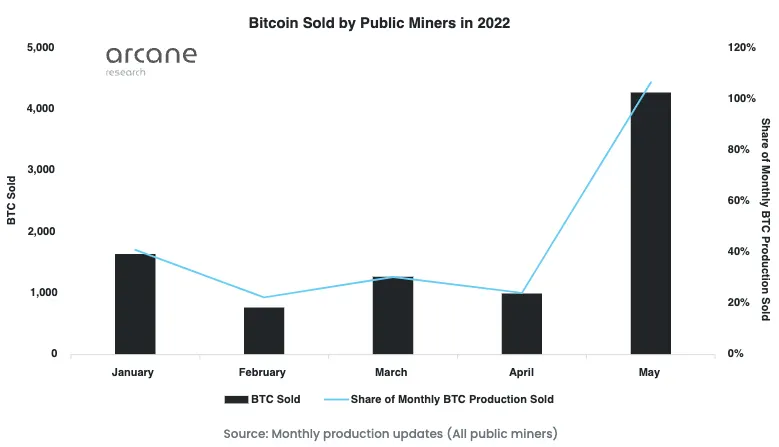

Publicly traded Bitcoin miners, like Marathon Digital and Riot Blockchain, sold more Bitcoin than they produced last month, a big step up from the first four months of the year when they sold only about 30% of what they produced, according to a new report from Arcane Research.

"If they are forced to liquidate a considerable share of these holdings, it could contribute to pushing the Bitcoin price further down," Jaran Mellerud, an Arcane Research Bitcoin mining analyst, wrote in a report.

Yesterday, Toronto-based Bitfarms sold 3,000 Bitcoin—almost half its supply—to reduce debt. The plan going forward will be to no longer HODL all of its daily Bitcoin production, Jeff Lucas, Bitfarms chief financial officer, said in a press release.

"While we remain bullish on long-term BTC price appreciation," he said, "this strategic change enables us to focus on our top priorities of maintaining our world-class mining operations and continuing to grow our business in anticipation of improved mining economics."

As far as public companies go, miners have accumulated a lot of Bitcoin. In fact, seven of the 10 largest Bitcoin treasuries belong to miners, according to Bitcoin Treasuries. They include Core Scientific (CORZ) has 8,497 BTC; Marathon Digital Holdings (MARA) has 8,133 BTC; Hut 8 Mining (HUT) has 7,078 BTC; Riot Blockchain (RIOT) has 6,536 BTC; Hive Blockchain (HIVE) has 4,032 BTC; Bitfarms (BITF) has 3,075 BTC; and Argo Blockchain (ARBK) has 2,317 BTC.

Still, it's worth noting that publicly traded miners account for only 20% of the hash rate on the 206 million Terrahash per second (TH/s) Bitcoin network.

When taken as a whole, Bitcoin miners look to be holding onto their Bitcoin, and their supply has barely chanced since January, Zack Voell, an analyst at Bitcoin mining software company Braiins, said on Twitter.

Bitcoin miners are holding a total balance of 2.59 million BTC right now.

That number has dropped by exactly -0.61% since January 1. (One-hop address data from @coinmetrics.)

💎 🤲🏻

— Zack Voell (@zackvoell) June 20, 2022

The network's hash rate is an aggregate measure of how much computer power is being used to mine Bitcoin. Each single hash represents a computer generating a new number to "guess" a cryptographic string. Whichever miner, or pool of miners, correctly guesses it wins the right to verify a block of transactions and add it to the blockchain.

When that happens, miners earn rewards and transactions fees. But mining has become increasingly less profitable as markets continue to lag.

Miner revenue has struggled to stay above $20 million per block since the start of the month. Per block revenue started the year at about $50 million, had dropped just below $40 million at the start of May, and sunk as low as $16 million last week, according to Blockchain.com, during the panic over distressed hedge fund Three Arrows Capital and crypto lender Celsius.