Babel Finance has become the latest crypto lending platform to suspend redemptions and withdrawals, the Hong Kong-based company said in a blog post Friday.

The firm stated it was “facing unusual liquidity pressures” amid a border crash in cryptocurrency prices, citing a lack of available assets readily on-hand as the basis of its decision to prevent customers from moving money out of their accounts.

“Recently, the crypto market has seen major fluctuations, and some institutions in the industry have experienced conductive risk events,” said Babel Finance, in the announcement posted to its website.

It follows a similar move by crypto lending platform Celsius, which earlier this week announced that it would prevent customers from withdrawing or transferring their funds, as its positions in Lido Staked Ethereum (stETH) came under threat when stETH lost its peg to ETH. The ripple effects from stETH’s depegging continue to spread, with crypto hedge fund Three Arrows Capital (3AC) facing questions over whether it’s insolvent.

Babel Finance stated that it is “in close communication with all related parties” regarding details of the steps it is undertaking to resolve the issue, as it tries to get its finances in more stable shape and “protect [its] customers.”

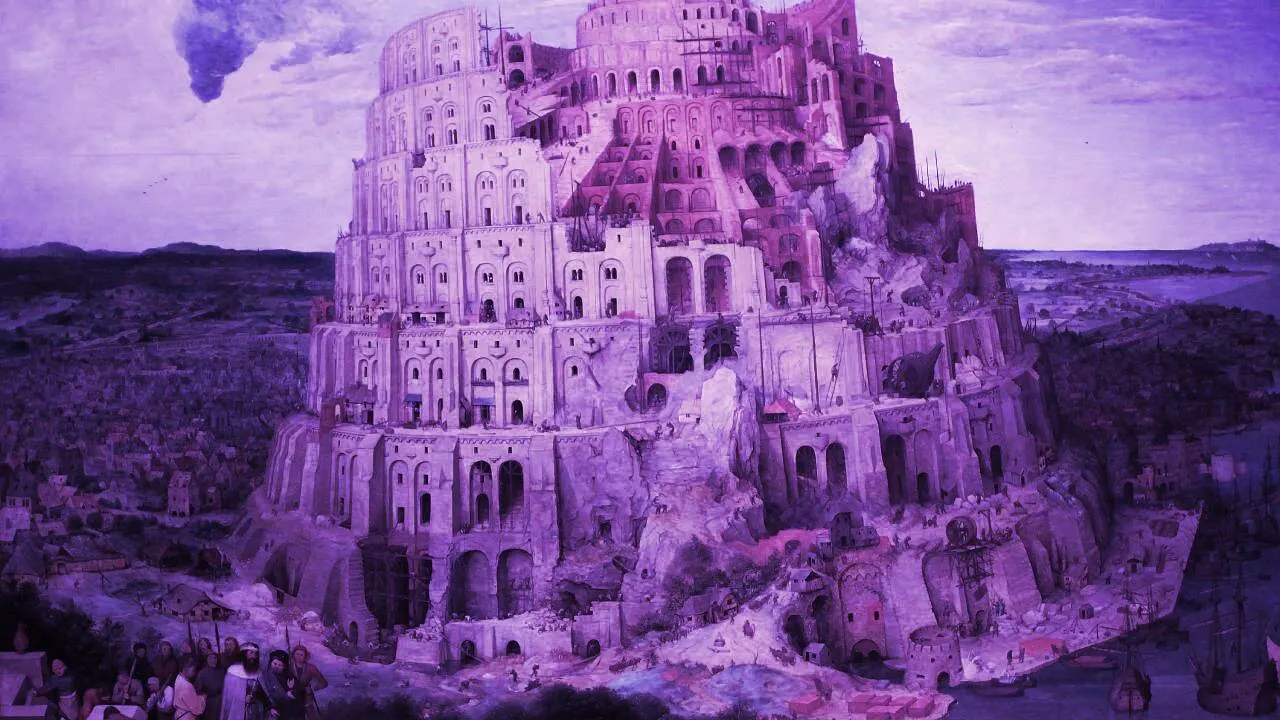

Tower of Babel

Less than a month ago, Babel Finance received a valuation of $2 billion following an $80 million Series B fundraising round. In a statement accompanying the news, the firm billed itself as the “world’s leading wholesale crypto financial services provider.”

At the end of 2021, the firm had outstanding loans totalling $3 billion and was seeing $800 million in monthly trading volume in derivatives–financial contracts based on the value of an underlying asset. It had also structured and traded over $20 billion in option products by that point.

Babel Finance has around 500 customers and serves a “select clientele,” according to its May press release. Since its Series A round of funding in May of 2021, the company has grown from 50 people to over 170 employees and opened a new office in Singapore. In that round of funding it secured partnerships with companies including Sequoia Capital China, Zoo Capital, and Tiger Global Management.