Terra’s “proposal 1623,” outlining plans to revive the collapsed Terra ecosystem, has been approved by the community.

On May 16, Do Kwon, the creator of the Terra ecosystem, proposed revival plans which included the creation of a new blockchain and issuing new LUNA tokens.

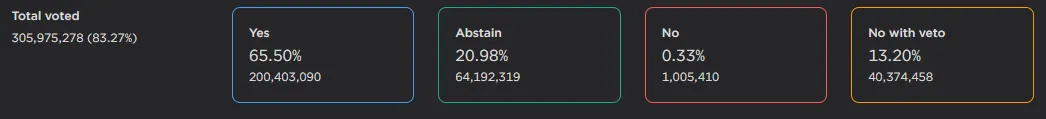

According to data from Terra Station, 65.50% of all voters support the proposal. More than 20% of voters abstained and 13.20% of the votes strongly opposed the proposal with a “veto.”

Following the successful approval from the community, Terraform Labs (TFL), the organization supporting all things Terra, will go ahead and deploy the new Terra blockchain. The relaunch is slated for May 27.

There’s also a new LUNA token to go with it.

The distribution model for the new LUNA tokens includes 30% for the community pool, 35% for LUNA holders before the crash of the ecosystem, and 10% for pre-crash Anchor-staked UST (aUST) holders, 10% for post-crash LUNA holders, and 15% for post-crash UST holders.

Snapshots of user balances were taken before and after the crash of Terra ecosystem. Users who held through the entire period are entitled to multiple distributions including both the pre- and post-crash allocations.

The distribution of tokens is also subject to a vesting period and cliff, meaning users won’t get their tokens instantly on May 27.

The proposal also includes the removal of Terra’s algorithmic stablecoin UST, among other items.

What happened to Terra?

Earlier this month, the algorithmic stablecoin UST lost its dollar peg and never recovered.

Algorithmic stablecoins are governed by smart contracts, rather than real-world assets. In the case of UST, the algorithm is an arbitrage mechanism between UST and LUNA, Terra’s native token.

Whenever UST drops below its peg, users can buy the discounted stablecoins and swap (and burn, removing from circulation) with $1 of LUNA. Conversely, if UST moves above its peg, users can make the opposite trade.

The algorithm proved inefficient when the dollar peg of UST fell, opening up tremendous arbitrage opportunities between UST and LUNA. As a result, the price of both LUNA and UST wiped out nearly $40 billion from investors.

According to data from CoinMarketCap, LUNA is up 14.10% over the past 24 hours and trades currently at $0.0001844.

LUNA declined 100% from its all-time highs of $119.18 recorded in April 2022, a month just before the crash.