The biggest story this week (and perhaps 2022, at least for DeFi junkies) is the recent departure of one of DeFi’s most prolific developers, Andre Cronje.

Cronje has been a hugely influential character in the industry ever since the launch of Yearn Finance (a crypto yield aggregator) back in 2020. The project’s native token, YFI, went from $0 to just over $40,000 in a few months, earning the token blue-chip status within DeFi.

Now, though, he’s leaving. And this time, it looks like it's for good.

Back in March 2020, he quit crypto, citing the toxic community, but eventually returned. Then he quit again in August (before returning ... again). It was a mess, but this time feels different.

Anton Nell, another developer who worked with Cronje and a senior architect to the Fantom Foundation, broke the news on Sunday, saying, “Andre and I have decided that we are closing the chapter of contributing to the defi/crypto space.”

“Unlike previous ‘building in defi sucks’ rage quits, this is not a knee jerk reaction to the hate received from releasing a project, but a decision that has been coming for a while now,” Nell added.

Nell also said that roughly “25 apps and services” related to the dynamic duo would be terminated on April 3.

The most notable affected apps, such as Yearn Finance, Multichain (a cross-chain crypto bridge project), and Keeper Network (a tokenized version of Fiver or Upwork), have already migrated to other domains, and it would appear they will continue to be maintained by their respective communities.

For instance, the website for “yearn.fi” will be shuttered and users are advised to instead use what is essentially the same service at “yearn.finance.”

The news nonetheless caused havoc for the tokens related to these projects, as well as the various networks that Cronje and crew have influenced (most notably, Fantom).

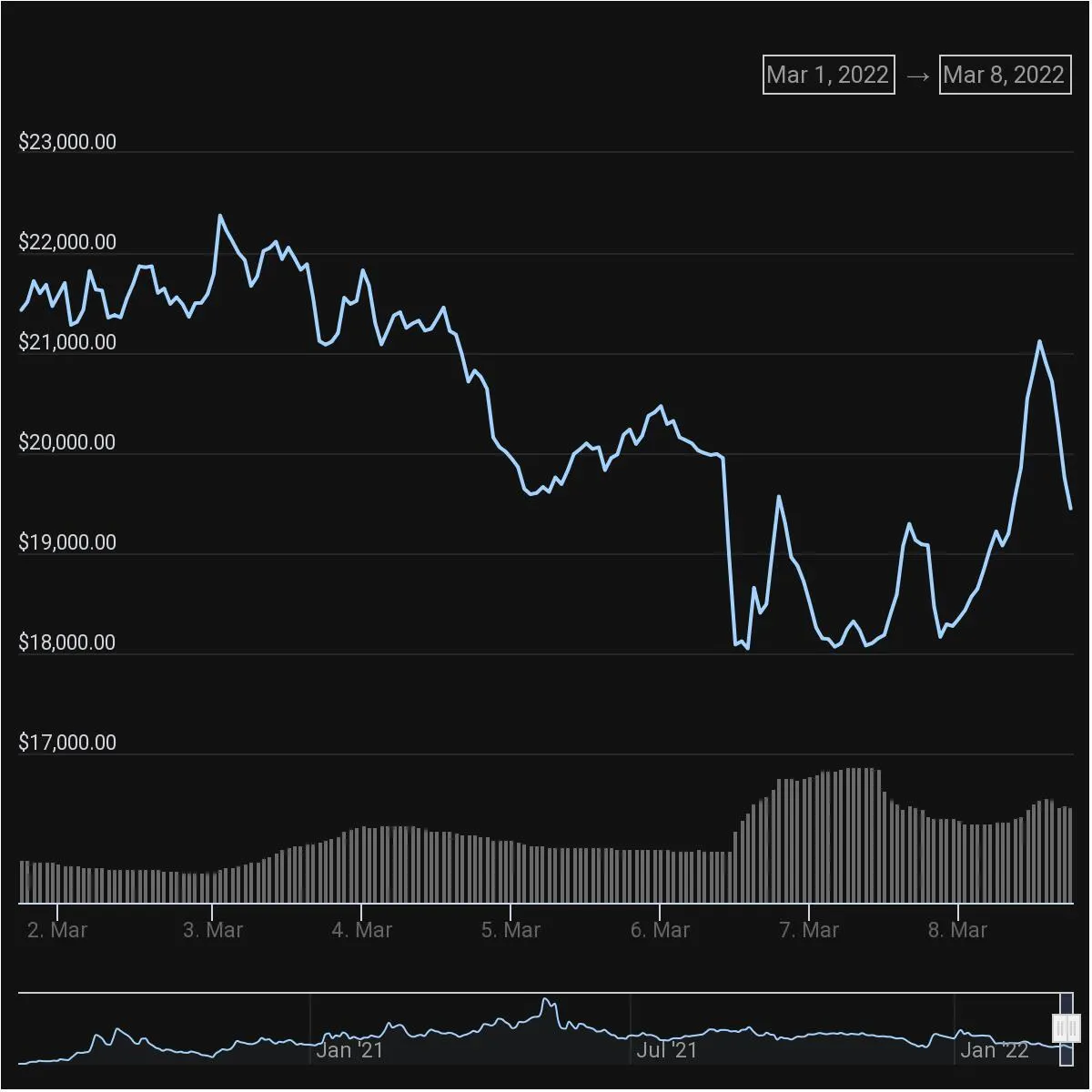

YFI plummeted from roughly $20,000 to about $18,000 in a matter of hours.

YFI has recouped some of those losses, a bounce that can likely be attributed to DeFi’s Twitterati reminding folks that Andre hasn’t contributed to Yearn in some time.

Banteg, a core developer of Yearn, said that “Andre hasn’t worked on [Yearn] for over a year,” adding that “50 full-time people and 140 part-time contributors” are maintaining the $3 billion project.

KP3R, the token for Keeper Network, hasn’t been quite as fortunate. The token dropped from about $625 to roughly $423, but unlike YFI, it’s continued to fall. Earlier in the week, it traded at $358, nearly half its price since the announcement, before rebounding slightly today to about $379.

Though the bearish action on these tokens has been dramatic, it's nothing compared to what happened to the entire Fantom ecosystem.

If you remember from a few weeks ago, Cronje and co-developer Dani Sestagalli launched a protocol-level decentralized exchange called Solidly, which also came with a token that was to be distributed to the largest Fantom-based DeFi projects by total value locked (which is another way of describing the money being used within a crypto project).

So, if your project made the cut, then the protocol would be endowed with the SOLID token. The project was then solely in charge of how to distribute it to its users. This could’ve been via a yield farming campaign, a simple airdrop, or something else. It was completely up to them.

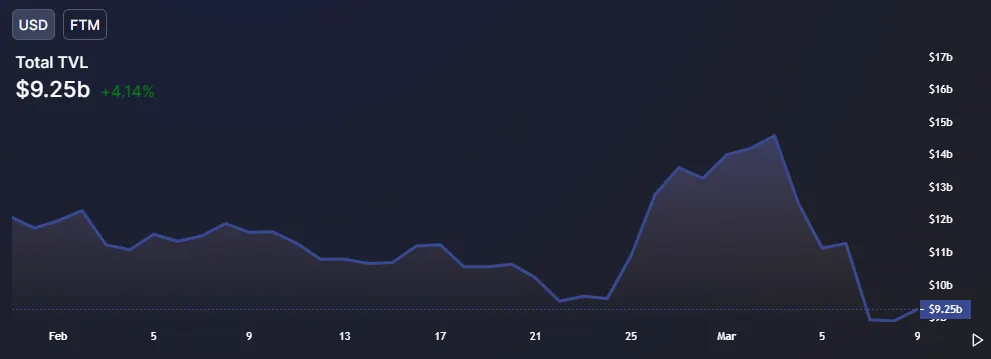

And just as every crypto investor has flocked blindly to any token attached to Cronje (and Sestagalli, to a similar extent), the Fantom ecosystem exploded with activity. In January, when the dynamics of how this new token would be distributed became clear, Fantom hit an all-time high of $15.21 billion in total value, according to DeFi Llama.

Fantom then traded sideways for a bit before spiking again on March 3. Since then, though, capital has fled the ecosystem like a fire drill.

For reference, rumors that Cronje was stepping down had already begun circulating on March 3, hence the initial drop in value beginning at that time.

The evacuation was made especially painful as investors were simultaneously spot-selling FTM, Fantom’s native coin. The coin fell from $1.62 to $1.31 between Sunday and Monday, capping a nearly 20% tumble.

So, yes, it's a lot of chaos.

But just as Elon Musk and Dogecoin fanboys have reminded the market time and again, pitching messiahs to save you and your bank account can have serious consequences.

And on the flip side, for all the builders and founders out there, even if your code is a cold-blooded robo bank, it doesn’t mean the people using it will be too.

Markets are emotional, and perhaps even more so in the wild world of immutable finance.

Decrypting DeFi is our DeFi newsletter, led by this essay. Subscribers to our emails get to read the essay first, before it goes on the site. Subscribe here.