Wormhole, a protocol that allows users to transfer crypto assets across blockchain networks, was exploited for $320 million last week. The breach was specifically related to how the cross-chain bridge was connected to Solana (though it can connect between a ton of other blockchains).

Whenever users want to move, say, ETH from Ethereum over to Solana, they have to lock up the ETH and in return get Solana-based Wrapped ETH (WETH). These two assets are thus 1:1 pegged; 1 ETH equals 1 WETH.

But a flaw in the protocol’s code allowed the attacker to freely mint 120,000 WETH on the Solana side without having to lock up any ETH at all. With that WETH in hand, the attacker then moved at least 93,750 WETH back across to the Ethereum network and used it to claim real ETH. The remaining WETH was converted to Solana’s native coin SOL.

The attack also affected the price peg of WETH on Solana, disrupting several Solana projects that interacted with this wrapped asset.

Hacks are nothing new in the crypto world, but this attack was interesting for a few different reasons. First, this was the third attack on a crypto bridge this year, after Multichain and Quibit.

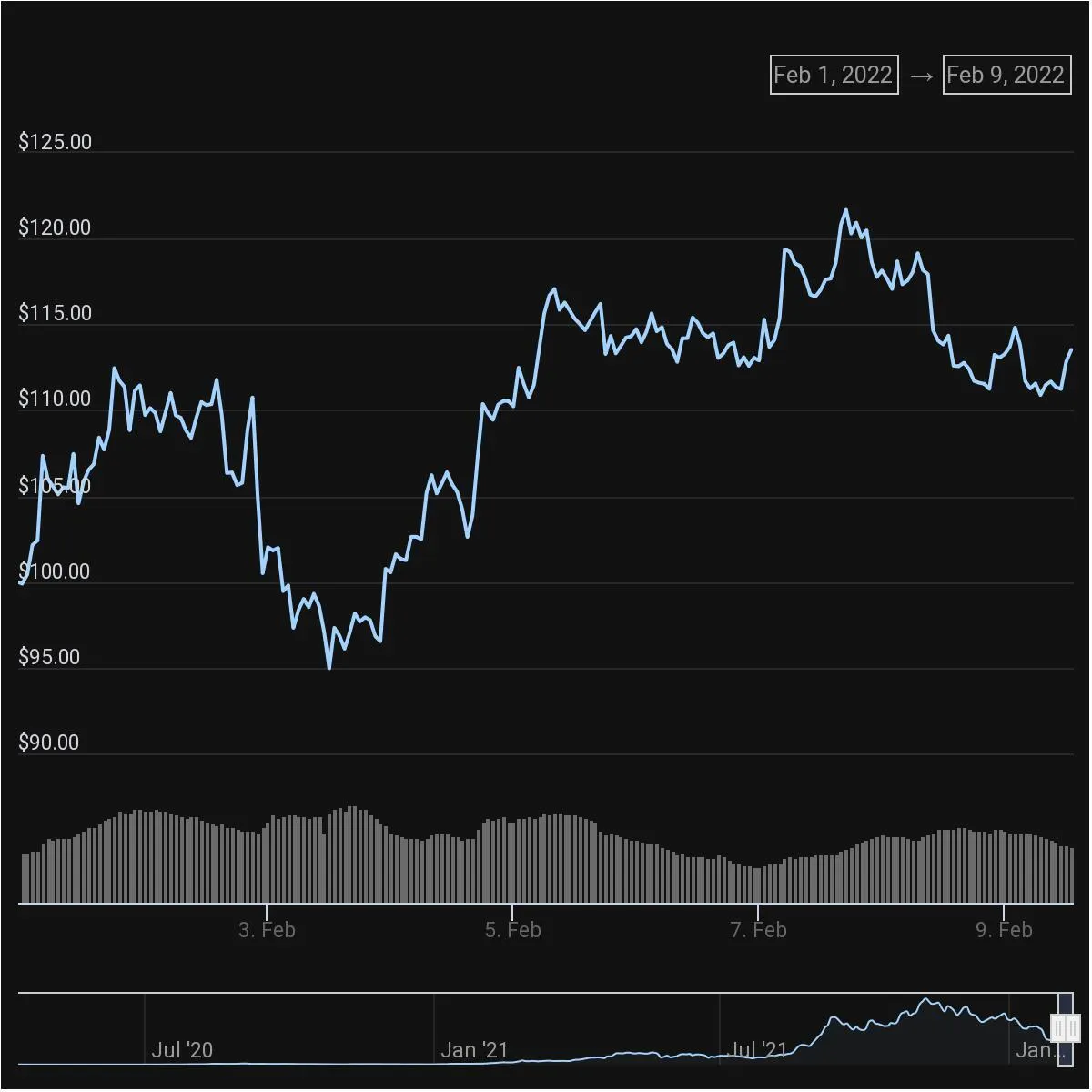

Second, it plummeted the price of Solana’s native coin, despite the exploit being primarily an issue with Wormhole (rather than Solana’s code).

Third, and perhaps most interesting, the Wormhole exploit introduced everyone in cryptoland to a previously little-known investment firm: Jump Crypto.

The Chicago-based trading desk stepped in and replenished the exploited ETH, essentially bailing out Wormhole and much of the Solana ecosystem that relies on a wrapped Ethereum asset. So, why did Jump step in to make this bridge project whole?

Jump Crypto is the crypto-specific arm of the Jump Trading Group, a traditional trading firm akin to Citadel Securities or GTS.

Jump was formed in 1999 by two traders, Paul Gurinas and Bill Disomma, working in what’s called the “open outcry pits.” These pits are where trading happened before everything went digital and basically involved people just yelling “buy low” and “sell high” in a big room all day. The firm was quick to spot the next trend with the rise of the internet and went digital.

These days, it’s a key player in high-frequency trading, even meeting with Gary Gensler in 2010 when he was at the CFTC to discuss the pitfalls and dangers of things like spoofing (a trading practice that means bidding up an asset without ever really executing the actual trade). Jump has also had its fair share of run-ins with the New York Attorney General’s office, as well as the SEC.

From paper trading to algorithmic trading strategies, it was pretty clear where Jump would land next: crypto.

In September 2021, the firm formally announced the launch of Jump Crypto to focus specifically on trading digital assets, though the division had reportedly been operating in stealth for the past six years. And like the mothership, this division is doing a whole lot more than simply flipping coins for quick cash.

As outlined by Jump Crypto’s spritely 25-year-old president, Kanav Kariya, the group is also focused on partnering and participating in the growth of the ecosystem. It’s essentially planting its own harvest.

Jump put up 120k of it’s own ETH because we believe in Wormhole and want to support it in this stage of its development. And we're going to come out stronger than ever

Detailed incident report from Wormhole to come soon

— Kanav Kariya 🦬 (@KariyaKanav) February 3, 2022

What’s more, Kariya and his colleagues have been heavily involved with all things Solana.

This includes supporting the Solana-based order book exchange Serum, Solana’s native oracle Pyth, the Solana wallet Phantom, and (you guessed it) Wormhole. So, the incentives for Jump in bailing out Wormhole were pretty clear.

Decrypting DeFi is our DeFi newsletter, led by this essay. Subscribers to our emails get to read the essay first, before it goes on the site. Subscribe here.