$64,029.00

-2.91%$1,869.55

-4.63%$597.71

-2.84%$1.30

-5.97%$0.999915

-0.00%$78.99

-5.04%$0.279431

-1.77%$1.048

3.08%$0.089015

-6.35%$48.04

-2.34%$0.999808

-0.01%$0.263494

-6.92%$446.95

-5.59%$8.82

0.52%$27.51

-1.94%$0.162431

-4.98%$0.999405

0.01%$326.31

-4.33%$8.32

-5.83%$0.149153

-6.45%$0.999836

-0.04%$0.00923599

-0.72%$0.999851

0.02%$0.095064

-5.25%$51.81

-5.32%$8.50

-5.87%$208.21

-7.95%$0.00000549

-6.25%$0.837176

-8.23%$1.24

-4.96%$0.072853

-4.94%$0.107542

-6.17%$5,382.92

4.06%$5,469.86

5.16%$1.48

2.35%$1.49

-3.99%$3.57

-5.25%$0.618309

-3.06%$1.00

0.00%$1.12

0.02%$1.00

0.01%$0.996562

-0.10%$0.685872

-1.50%$106.77

-7.52%$167.62

-7.43%$73.84

-3.85%$0.164353

-3.06%$0.065445

-3.17%$2.14

-1.80%$0.999947

0.01%$0.00000347

-7.01%$0.00000157

-2.72%$1.06

-4.48%$0.999343

-0.00%$8.20

-6.34%$2.29

-8.21%$0.241422

-7.84%$11.00

0.01%$6.70

-4.18%$0.10233

-7.71%$0.37164

-6.42%$0.00174975

-5.03%$7.51

-11.37%$1.75

-2.73%$0.01712126

7.08%$0.055005

-7.23%$61.30

-4.02%$1.80

-4.87%$1.001

0.10%$0.824407

-2.73%$1.24

0.10%$0.096203

-7.35%$0.02879321

-6.05%$0.00899293

-5.49%$3.25

-3.37%$114.44

0.02%$1.00

0.27%$0.082735

-4.61%$1.028

0.00%$1.11

-0.00%$0.930104

-7.36%$0.876031

-8.82%$1.31

-8.57%$0.03273198

-3.61%$0.03087472

-14.70%$0.608021

-3.24%$0.080628

0.79%$0.00690852

-7.61%$1.096

0.00%$0.996633

-0.11%$0.091778

-12.33%$1.00

0.04%$0.146342

-5.23%$29.22

-14.88%$0.01287689

0.59%$0.998562

-0.01%$0.00000557

-7.88%$1.088

-0.05%$0.999949

0.01%$1.18

-0.11%$0.246803

-5.77%$0.246899

-0.72%$0.06351

-8.40%$0.635373

-8.03%$0.04720731

2.68%$172.98

3.77%$1.25

-3.58%$0.00635843

-8.13%$31.05

-9.03%$0.361855

-7.37%$1.85

28.87%$1.00

-0.00%$0.999712

0.00%$0.4712

-7.20%$0.230768

-6.50%$1.019

-0.03%$0.077341

-4.82%$0.00000033

-0.10%$0.00000033

-3.10%$0.145611

-9.10%$0.03184113

-4.07%$1.31

-3.82%$121.13

-4.33%$3.22

-3.28%$0.886326

-9.60%$1.53

-9.62%$0.05275

-5.43%$15.15

-3.98%$0.01568176

-2.70%$0.319549

-8.51%$2.93

-7.31%$0.993242

-0.45%$0.064039

-6.06%$0.999202

1.69%$17.11

-0.46%$0.300662

-8.81%$0.04594153

-10.92%$0.02460139

-7.75%$0.00526382

-7.78%$0.00002672

-8.09%$0.275378

-11.07%$1.55

-0.11%$0.071185

-8.99%$0.210345

-10.93%$12.35

11.72%$0.282682

-7.81%$0.00241377

-0.72%$1.28

-6.57%$0.0024875

-2.22%$0.0457711

-7.42%$0.110772

-9.88%$1.83

-3.41%$1.00

0.21%$1.01

17.58%$0.00004109

3.59%$5.76

-7.66%$0.999987

-0.00%$4.91

0.85%$0.984022

-0.22%$0.999825

-0.00%$0.01994179

-4.44%$0.295351

-17.55%$1.076

0.01%$0.116993

-1.96%$0.03895994

-7.41%$1.24

-7.61%$0.078205

-8.27%$22.79

0.00%$0.00000099

-0.11%$0.090296

-5.78%$0.478542

-2.53%$0.098058

0.24%$1.19

-6.74%$0.00195711

-4.59%$1.00

0.00%$4,988.18

-0.46%$0.185676

-9.97%$0.050686

-4.68%$0.185657

0.50%$0.07713

-4.79%$1.00

0.00%$2.54

-8.41%$0.180074

11.79%$0.177618

-7.12%$0.090774

-6.93%$1.00

0.06%$0.0045814

-9.00%$17.40

-7.18%$0.01796569

-8.03%$1.79

-0.01%$0.01999931

-0.38%$2.08

-2.17%$48.00

-0.01%$2.01

-1.22%$0.00337439

-9.63%$3.41

-3.60%$0.9958

0.08%$0.050171

-3.86%$1.26

0.34%$0.103012

-5.49%$0.15388

-10.18%$0.153172

-6.80%$0.02090776

-9.78%$0.562139

-6.75%$1.001

0.20%$1.63

-2.74%$0.998573

0.00%$0.03726453

-9.00%$0.310101

-1.31%$0.00000693

-8.82%$1.015

0.29%$0.289584

-3.38%$0.37936

-4.47%$1,096.56

0.06%$0.132626

-0.79%$0.074635

1.16%$0.152866

-10.03%$0.128526

-5.62%$0.594693

-7.66%$0.58512

-7.87%$0.249099

-6.74%$0.130537

0.18%$4.19

-7.52%$0.08745

-6.43%$0.075107

-7.31%$1.54

-7.20%$1.001

0.00%$10.78

-3.33%$0.00139788

-4.34%$0.291191

-3.21%$0.00379966

-5.64%$1.08

0.01%$0.994836

0.03%$7.60

-2.47%$0.070952

-8.76%$0.203078

-2.99%$0.227916

-7.31%$0.999674

0.01%$0.999107

0.06%$0.999599

-0.03%$0.999661

-0.00%$1.064

0.19%$0.01964461

-7.18%$0.253308

-11.14%$0.173599

-10.20%$11.65

-0.97%$0.10928

-2.90%$0.974729

-2.75%

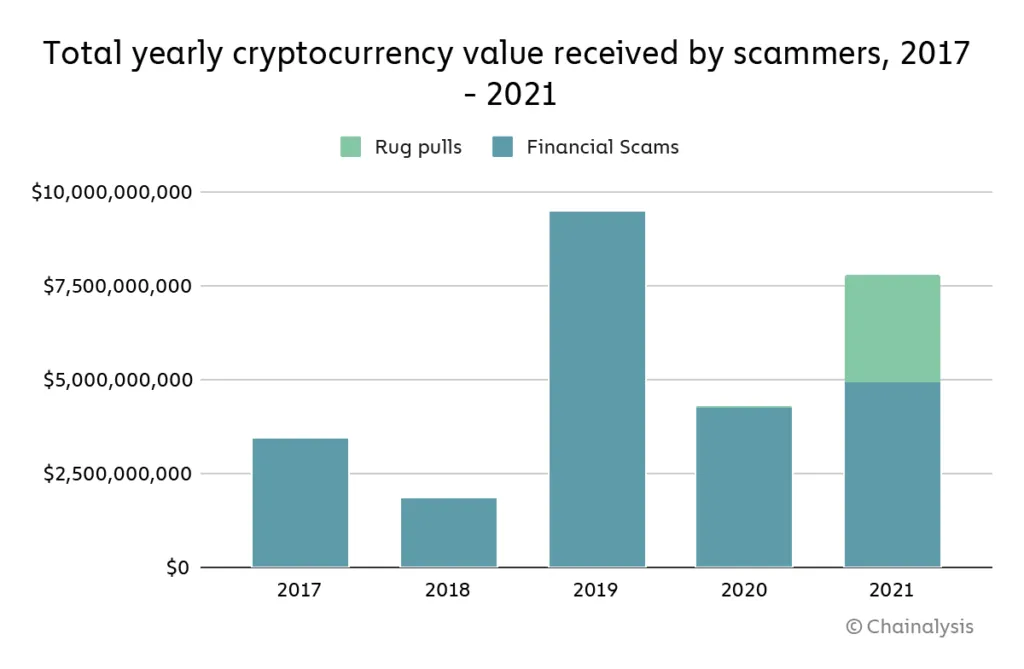

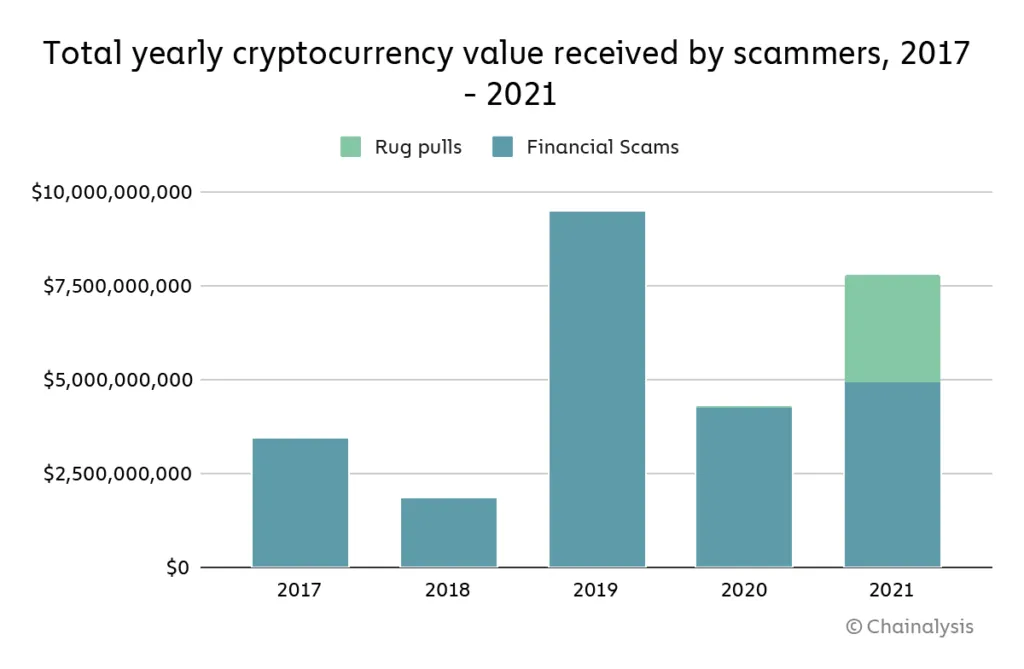

The explosion of rug pulls in the decentralized finance (DeFi) ecosystem over the past year helped to propel revenue from crypto scams to $7.7 billion in 2021, according to blockchain data firm Chainalysis.

Per Chainalysis' 2022 Crypto Crime Report, revenues from crypto scams in 2021 were up 81% on the previous year, with rug pulls accounting for 37% of all crypto scam revenue—up from 1% in 2020.

In all, rug pulls—in which developers build a seemingly legitimate crypto project and then abscond with investors' money—accounted for more than $2.8 billion worth of stolen crypto in 2021. Chainalysis highlighted the fact that code audits—which would catch the vulnerabilities that enable fraudulent DeFi projects to drain their liquidity pools—are not required to list a project on decentralized exchanges (DEXs), hence their prevalence in the DeFi sector.

Although crypto scam revenues in 2021 represent a substantial increase on 2020, they're still down on the highs of 2019, when they approached $10 billion.

And while the number of deposits to investment scam addresses dropped from 10.7 million in 2020 to 4.1 million in 2021—suggesting that there were fewer individual victims—it also indicates that the amount taken from each victim went up.

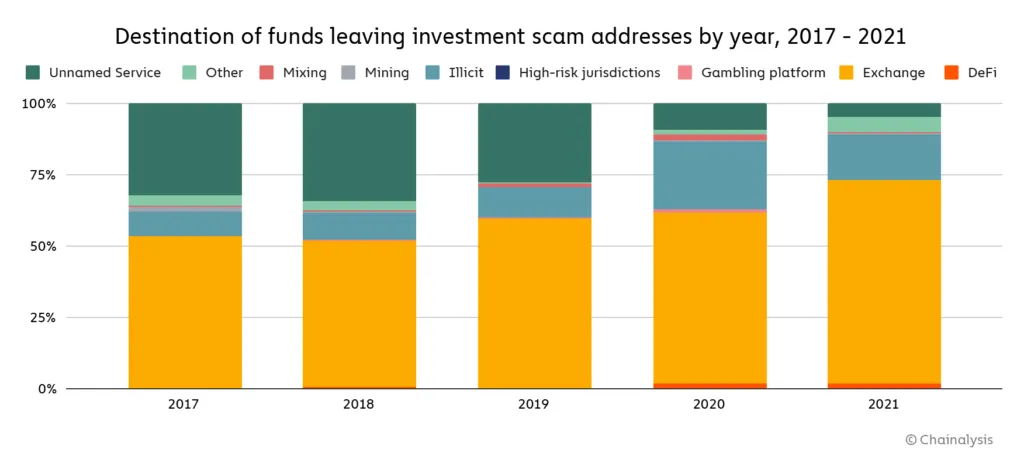

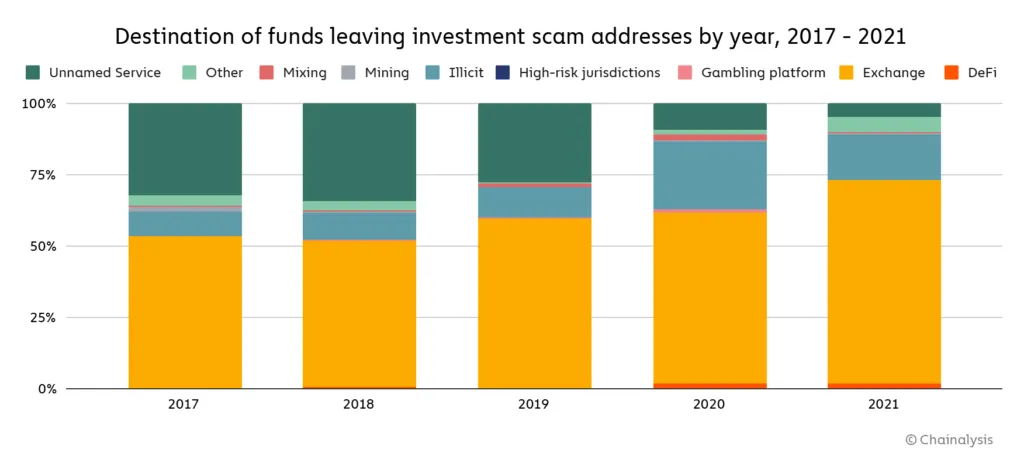

As in previous years, most crypto sent from scam addresses ended up at mainstream crypto exchanges—a fact that's not been lost on politicians and regulators, with Senator Elizabeth Warren (D-MA) among those pushing for increased regulation of the industry.

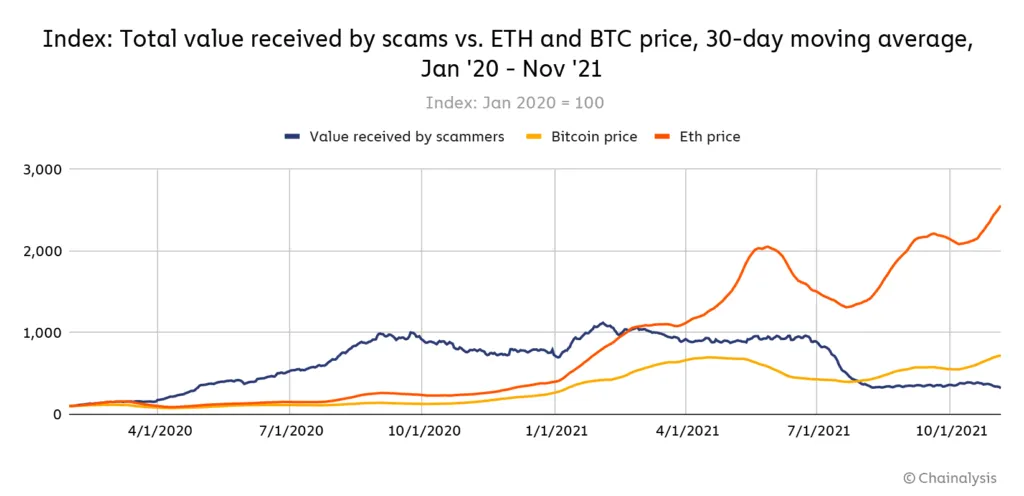

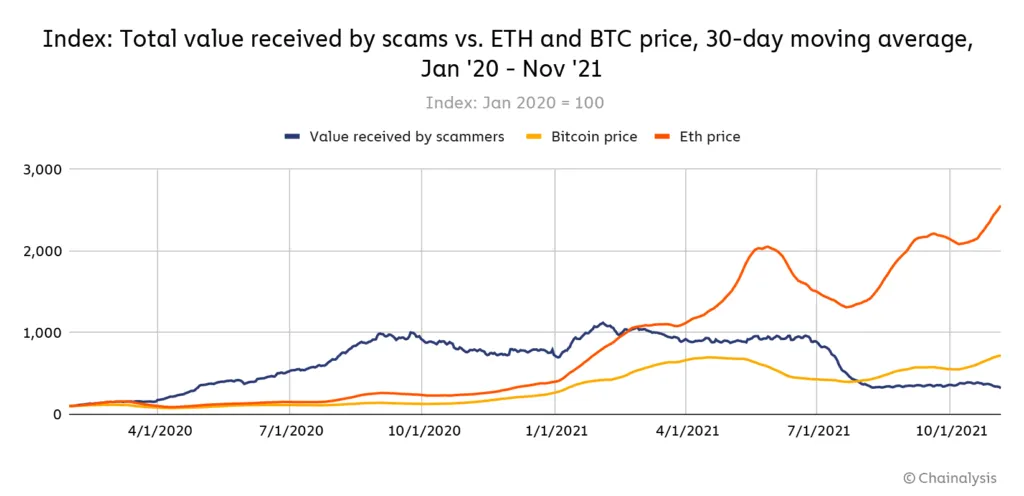

However, there is some evidence that the crypto sector is maturing; the relationship between crypto prices and scam activity seems to have been broken.

Where previous bull runs in 2017 and 2020 have seen a surge in scam activity corresponding with an influx of new (and naive) users into the crypto ecosystem, 2021 saw scamming activity flatten off even as the price of leading cryptocurrencies Bitcoin and Ethereum surged.