There is a fistful of Satoshis floating around the web these days: Craig Wright, Estonian scientists, marketing specialists and more.

But whomever Nakamoto actually is, one thing is for sure: they’re rich as hell. Nakamoto is estimated to have up to one million bitcoins, worth a little over $10 billion sat in wallets, untouched. But the number of people proclaiming they are the one, true Satoshi is causing confusion and uncertainty across the industry. If Nakamoto does appear and decides to cash in the Satoshi stash—or threatens to—the bitcoin market would almost certainly collapse.

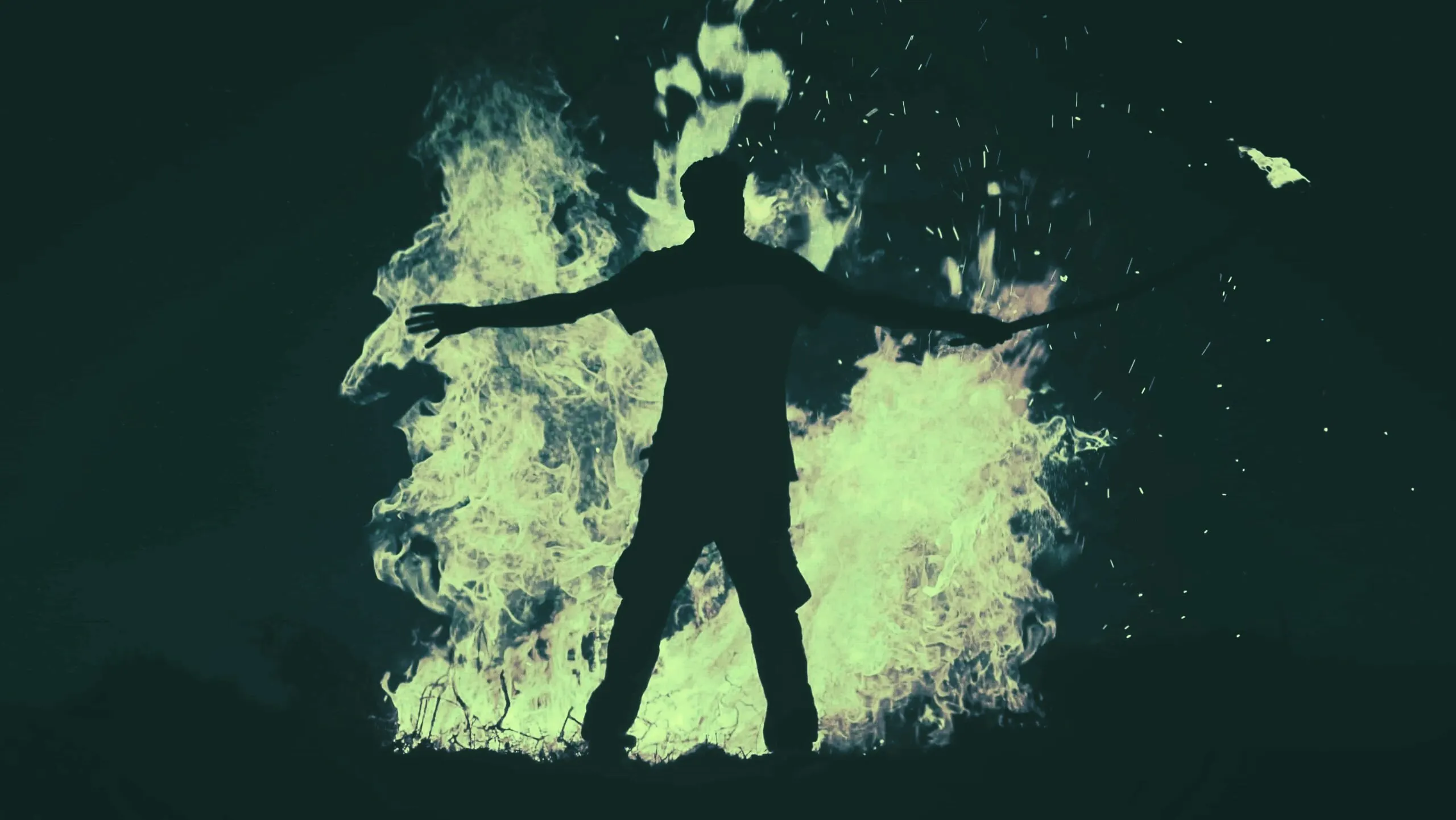

This has led Ray Youssef, founder of peer to peer bitcoin marketplace Paxful, to come up with an unorthodox solution: “Let’s burn all of Satoshi’s 980,000 [bitcoins]”.

“[One] million less coins and we lay Satoshi to rest in Peace,” he added.

By burning all of Nakamoto’s coins, the anxiety provoked by Nakamoto’s unknown identity disappears. No more Nakamoto, and one less reason for the price to crash.

Youssef appealed to his followers, tagging bitcoin investor Roger Ver, Binance CEO Changpeng Zhao (CZ), and CoinBase CEO Brian Armstrong, among others. “Whomever is with me, reply ‘burn.’ ” he said. The luminaries Youssef tagged are yet to reply.

Burning Nakamoto’s coins is possible, if incredibly unlikely. If the whole network came together and agreed to move the coins into a different, inaccessible, account, then Nakamoto would be unable to access his/her/their fortune. But Youssef would require consensus across the whole network or it would split the bitcoin network into two, where Nakamoto holds the coins on one but not on the other. But the discussion, unsurprisingly, has turned ugly.

“So, the bitcoin creator doesn't deserve this money? Whomever he may be or has been? What a totalitarian and egoistic idea,” replied a Bitcoin enthusiast called Argy Xafis.

“It's an idea as stupid as CZ's idea to roll back the chain after the Binance hack,” tweeted Mihai Teodosiu, founder of Yakkie Apps, referring to Zhao’s realization that he couldn't rewrite the Bitcoin blockchain to reverse the hack Binance suffered in May.

Arguments aside, it wouldn’t be the first time a major cryptocurrency that went through such a large-scale shift. When the DAO was hacked in 2016, the Ethereum blockchain was rewritten to steal the funds back from the hacker. This created what is now the Ethereum blockchain, while staunch opponents kept the old chain alive in the form of Ethereum Classic. And Ethereum is still going to this day, the second-biggest cryptocurrency by market cap.

Perhaps Youssef isn’t as crazy as you might think.