Derivatives exchange BitMEX is under investigation for allowing US based traders to use its platform, according to Bloomberg, which cited anonymous sources. But this shouldn’t come as much of a surprise—indeed, we managed to set up an account ourselves in less than a minute.

The Seychelles-based BitMEX, whose lack of KYC restrictions has made it fiercely popular, began blocking North American traders from its platform in January 2018, after Canadian regulators raised concerns over its lack of proper licensing. Now, the US Commodities and Futures Trading Commission (CFTC) is investigating the exchange for, allegedly, letting US citizens trade anyway.

If true, this would hardly come as a shock. As one intrepid YouTuber describes in a three minute video entitled “How to use BitMEX in the United States” (uploaded before BitMEX announced that it would stop doing business there), the restrictions levied on US traders are trivially easy to circumvent. BitMEX appears to police traders solely by keeping track of their IP addresses, a system that can be easily fooled by using a VPN—a virtual private network—which masks one’s real location by projecting it across the globe.

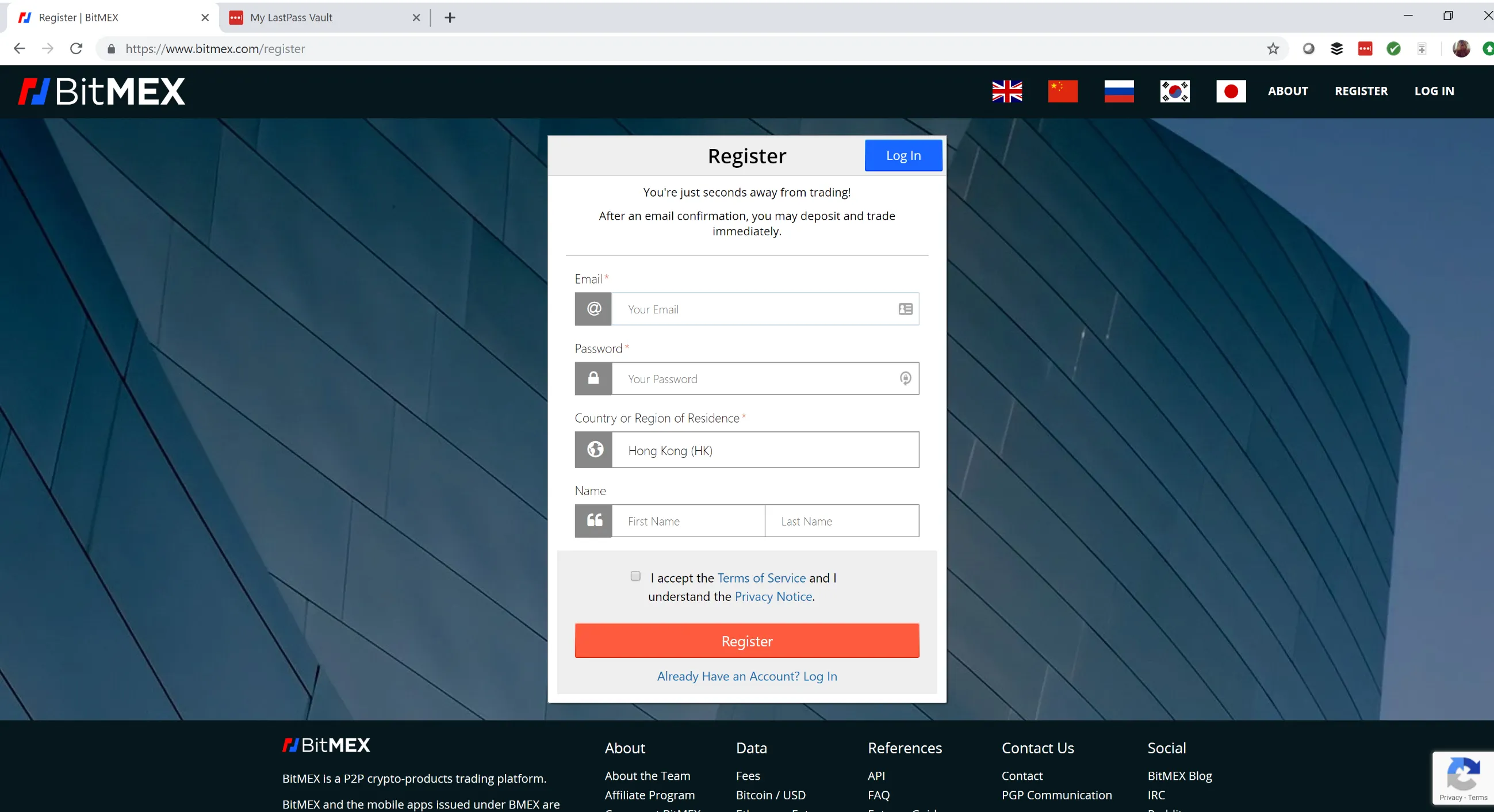

Additionally, BitMEX has continued to omit KYC restrictions, even after it began dropping US accounts. While other platforms like Coinbase and Kraken require reams of identification, we were able to set up a BitMEX account in roughly...three seconds...from New York. All it took was a functional email address.

The BitMEX login also, helpfully, pre-populated the registration form with Hong Kong, through which the VPN had been routed:

Since the ban, other traders have apparently continued to make use of this lax oversight. An online ad for a VPN posted this year informs readers that “VPN for BitMEX and Bitfinex is a reliable way to encrypt all your traffic and mask your real IP address,” while another site offers readers a pre-made, foreign account, reminding them to keep the ruse going—”You are a foreigner who takes long holidays in [the] States.”

Asked whether it is, indeed, this simple to access the platform, BitMEX declined to comment. Nevertheless, sources at other exchanges not registered in the United States, speaking to Decrypt anonymously, said that their own exchanges deployed a similarly unsophisticated means of tracking traders. (And it is unsophisticated—BBC iPlayer, for instance, easily determines whether a user is attempting to access the site from a prohibited jurisdiction.)

Whether BitMEX will succumb to the CFTC’s investigation—or even has to, since it is registered abroad—is unclear. Neither is it clear whether, if BitMEX is found to have unwittingly on-boarded US-based users, it will be held culpable. Indeed, how could it have stopped anyone?

A strong US connection

There might be a way to gauge how much trouble BitMEX is in, says one source at an exchange employing similar restrictions. The source, when facing a similar dilemma, was advised by lawyers that the “measure of whether you’re breaking the law is if you have a strong ‘connection’ to the US.” As the recent allegations against Bitfinex demonstrate, government agencies are more than willing to dredge up laundry lists of such “connections”—which might include hosting subsidiaries, staff members, partners and bank accounts in a prohibited country—to make their cases against their quarries watertight.

BitMEX, for its part, appears to have an office in San Francisco.

Despite the CFTC’s apparent complaints, BitMEX does seem, at least, to have honored the ban in the past. In its terms and conditions, BitMEX states that users falsely representing their whereabouts or accessing the platform from prohibited jurisdictions will have their accounts closed and their funds confiscated, and last year it did just that. A month before the full ban on US traders, for instance, Bitcoin booster Tone Vays wrote on Twitter that his own account had been abruptly shuttered. “Just got my @BitMEXdotcom account terminated on suspicion of being a US Citizen,” he wrote.

Cryptocurrency exchanges generally fall under the SEC’s remit, but BitMEX offers derivatives—that is, futures and long/short positions—which are governed by the CFTC. Though the agency is generally pro-crypto, the consequences of non-compliance—unwitting or otherwise—have been severe in the past. Cryptocurrency company 1pool, which was caught selling unauthorized Bitcoin contracts to US investors, settled with the CFTC for $1 million in March.

It’s unclear whether the CFTC’s investigation was spurred on by Nouriel Roubini, a vocal Bitcoin critic who over the past month has been viciously calling attention to BitMEX’s business practises after it unflatteringly edited a video of a debate between him and Bitmex’s CEO, Arthur Hayes.

In his tirade, Roubini cited myriad offenses, real and alleged. For one, he grumbled about BitMEX’s 100X margin feature, which allows users to borrow a hundred times the cash in their accounts to amplify their gains—and, inevitably, losses—and also cited the oft-repeated allegation that BitMEX trades against its own customers, which the exchange has roundly denied.

Whatever happens, savvy VPN users might want to offload the rest of their funds as fast as possible.