In brief

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

$67,926.00

-4.01%$1,975.49

-4.90%$627.49

-2.82%$1.37

-2.57%$0.999904

-0.00%$84.17

-4.57%$0.283826

-0.87%$1.024

-1.05%$0.090779

-3.00%$54.40

0.07%$0.999904

0.00%$0.258452

-3.91%$447.80

-2.15%$9.06

0.05%$30.32

-1.92%$349.28

-3.58%$8.78

-4.59%$0.999396

-0.01%$0.15281

-2.33%$0.152053

-3.71%$0.999495

0.05%$0.00906932

-2.45%$0.999816

0.04%$0.096631

-3.18%$53.61

-3.34%$8.99

-4.02%$0.902071

-5.46%$207.87

-7.89%$1.34

0.04%$0.0000054

-3.13%$0.075545

-2.49%$5,142.19

1.06%$0.0981

-4.47%$1.50

1.22%$5,180.62

1.02%$1.50

-1.39%$3.80

-4.04%$0.236063

18.34%$0.679303

-3.16%$97.06

-0.87%$1.12

0.00%$1.00

0.00%$0.998043

0.06%$0.694475

-1.46%$0.999981

0.01%$176.30

-5.77%$109.86

-6.54%$0.06959

-9.70%$0.999844

-0.01%$1.21

-3.89%$2.16

-1.42%$0.0000016

-0.61%$0.00000336

-3.66%$2.45

-5.29%$0.9993

0.01%$8.18

-5.40%$0.252204

-5.70%$6.98

-2.02%$0.387013

-4.60%$0.0018632

-9.56%$11.01

0.01%$0.097985

-3.53%$7.82

-2.29%$1.82

-6.93%$0.058164

-3.04%$65.69

-1.67%$1.12

-0.36%$1.82

-1.52%$1.22

0.15%$0.101998

-10.58%$0.860067

-3.16%$0.999625

-0.01%$0.02981231

-2.66%$0.008897

-3.50%$114.50

0.01%$0.084053

-3.69%$0.954197

-5.30%$1.026

0.05%$0.01339972

-2.06%$0.969028

-4.56%$3.11

-3.94%$1.00

0.00%$1.34

-4.66%$0.0330596

-4.72%$0.176034

-5.11%$0.079838

-0.11%$0.00704699

-3.96%$1.00

0.02%$0.02891882

7.10%$0.099002

-4.54%$1.096

0.01%$1.00

0.00%$0.997872

-0.08%$0.0000058

-5.58%$0.01265947

0.19%$28.64

-6.38%$0.99957

-0.06%$0.26062

-2.21%$0.264922

-8.64%$1.09

0.08%$1.16

-0.03%$0.67618

-5.16%$0.06583

-5.16%$1.34

-3.41%$0.04884663

0.04%$0.00676735

-5.22%$172.77

5.37%$32.26

-6.16%$0.528951

-4.64%$0.364619

-5.23%$0.999688

-0.02%$1.88

-2.11%$0.999507

-0.06%$0.03557632

-5.37%$0.366706

5.77%$0.99968

0.02%$0.240133

-5.26%$0.00000033

-0.04%$125.03

-4.86%$0.144758

-5.27%$0.00000033

-2.10%$1.022

-0.22%$0.425817

-9.43%$0.052748

-2.25%$0.01603858

-0.57%$0.168969

-2.54%$0.331997

-6.12%$3.13

-1.81%$0.31764

-9.07%$0.824702

-7.22%$0.324709

-5.35%$2.87

-5.30%$1.14

-4.27%$14.46

-27.19%$14.05

-4.16%$0.064466

-2.29%$0.989043

-0.22%$0.00551559

-2.26%$0.02539492

-3.42%$0.234504

-2.35%$0.04694206

-5.38%$0.00002785

-3.98%$1.001

-0.09%$17.17

-1.40%$6.03

-0.26%$1.18

-21.37%$1.62

2.96%$0.074899

-1.00%$0.119191

-5.90%$0.04855612

-3.20%$0.294594

-6.07%$0.00259552

-4.14%$0.02216592

2.36%$1.88

0.65%$0.00233373

-1.22%$0.00004175

-2.44%$0.00000108

0.62%$0.999667

0.19%$0.100198

-15.45%$5.86

-4.99%$1.20

-0.01%$0.984022

0.00%$0.999636

-0.02%$0.080333

-5.06%$1.076

0.01%$0.20979

-5.86%$0.03798747

-6.19%$22.75

0.00%$0.484863

-2.86%$1.22

-4.44%$0.0020395

-2.76%$1.14

-5.75%$2.10

1.23%$1.00

0.00%$0.187333

-13.19%$0.190472

-2.18%$0.185636

-4.83%$4,888.62

-0.42%$0.098797

1.70%$0.050925

-1.58%$0.093054

-5.05%$2.54

-3.28%$1.00

0.00%$0.00474344

-4.51%$0.074794

2.18%$0.01897318

-2.39%$0.02408854

5.41%$0.054772

-4.90%$2.18

-3.87%$2.11

-1.26%$0.9996

-0.07%$17.44

-3.40%$1.82

-0.88%$0.07463

-4.34%$0.02034752

0.91%$3.54

-2.15%$48.00

-0.02%$0.00336576

-4.97%$0.994065

-0.06%$0.158329

-10.01%$0.578586

-5.87%$1.25

0.66%$0.03247157

-50.76%$0.154729

-8.89%$0.284447

2.96%$0.150436

0.02%$0.999647

-0.24%$0.03936314

-5.37%$0.422182

-5.53%$0.098237

-5.05%$0.02426798

3.29%$0.999889

-0.07%$0.00000682

-2.77%$0.303907

-2.90%$0.077985

-1.56%$1.014

0.08%$0.235574

-3.92%$0.264153

-2.62%$0.154758

-5.16%$0.285141

0.59%$1,095.51

0.03%$0.092779

-4.96%$0.603975

-2.82%$0.078006

-1.59%$0.125982

-4.59%$0.130498

-0.05%$1.082

0.01%$1.56

-7.33%$0.121909

6.56%$11.06

-14.65%$4.10

-2.33%$1.004

0.37%$0.295785

-1.50%$0.00141419

-1.84%$0.520469

-3.56%$0.236303

-3.04%$11.18

0.00%$0.99997

0.01%$0.180589

-7.50%$0.257888

-5.00%$1.064

0.04%$0.364867

-1.61%$0.00367798

-3.45%$0.999603

-0.04%$2.24

-5.68%$0.316808

-4.10%$0.53

-4.33%$1.00

0.05%

An array of niche cryptocurrencies have collapsed in price following the news that Ripple is embroiled in a regulatory battle with the SEC over XRP.

Cryptocurrencies other than Bitcoin are typically referred to as "alt coins," and many of these assets are susceptible to being pulled up or down by major market movements. XRP's price got cut in half following the SEC's announcement of action against Ripple, and many other alt coins are feeling the burn, too.

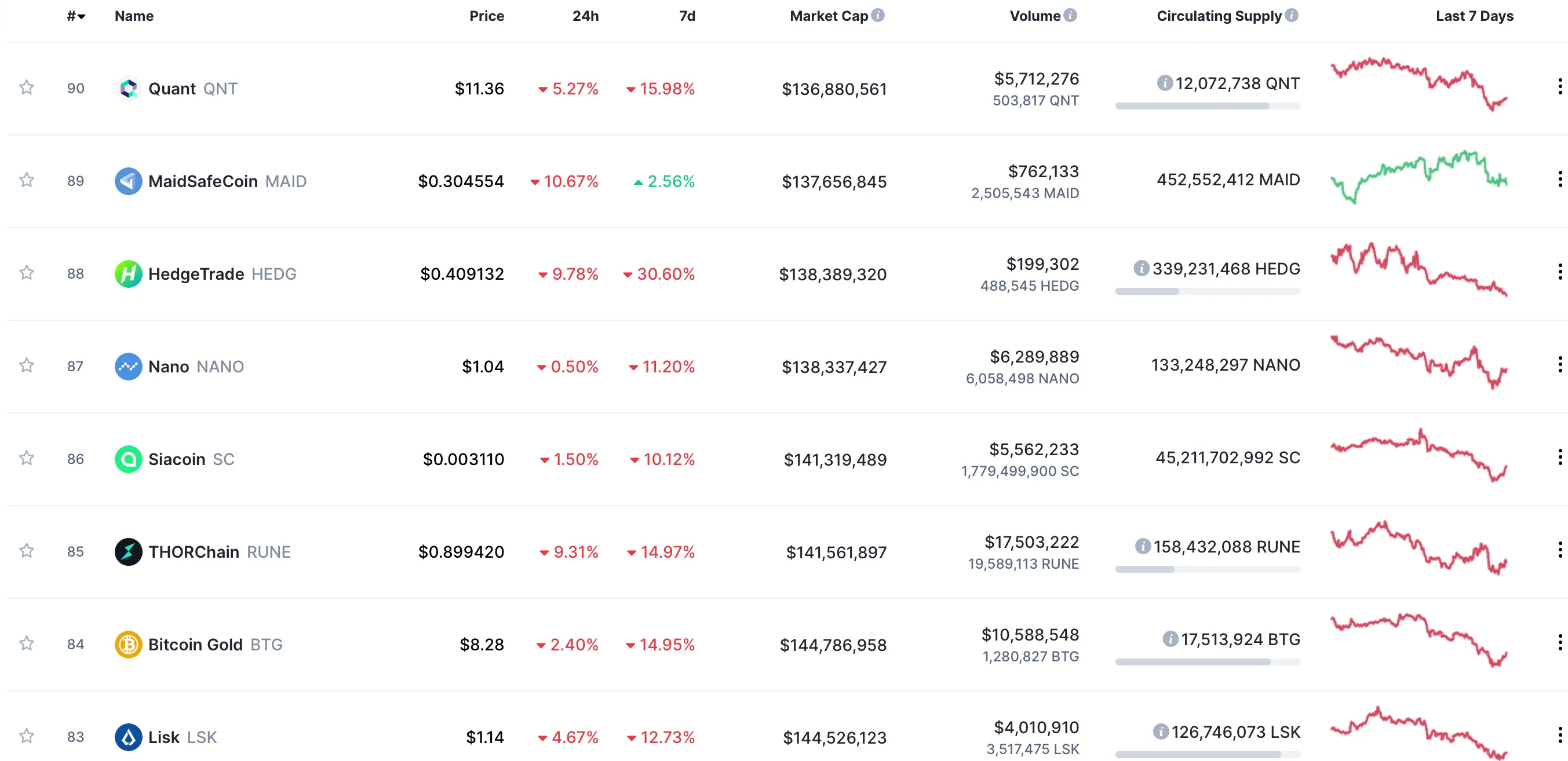

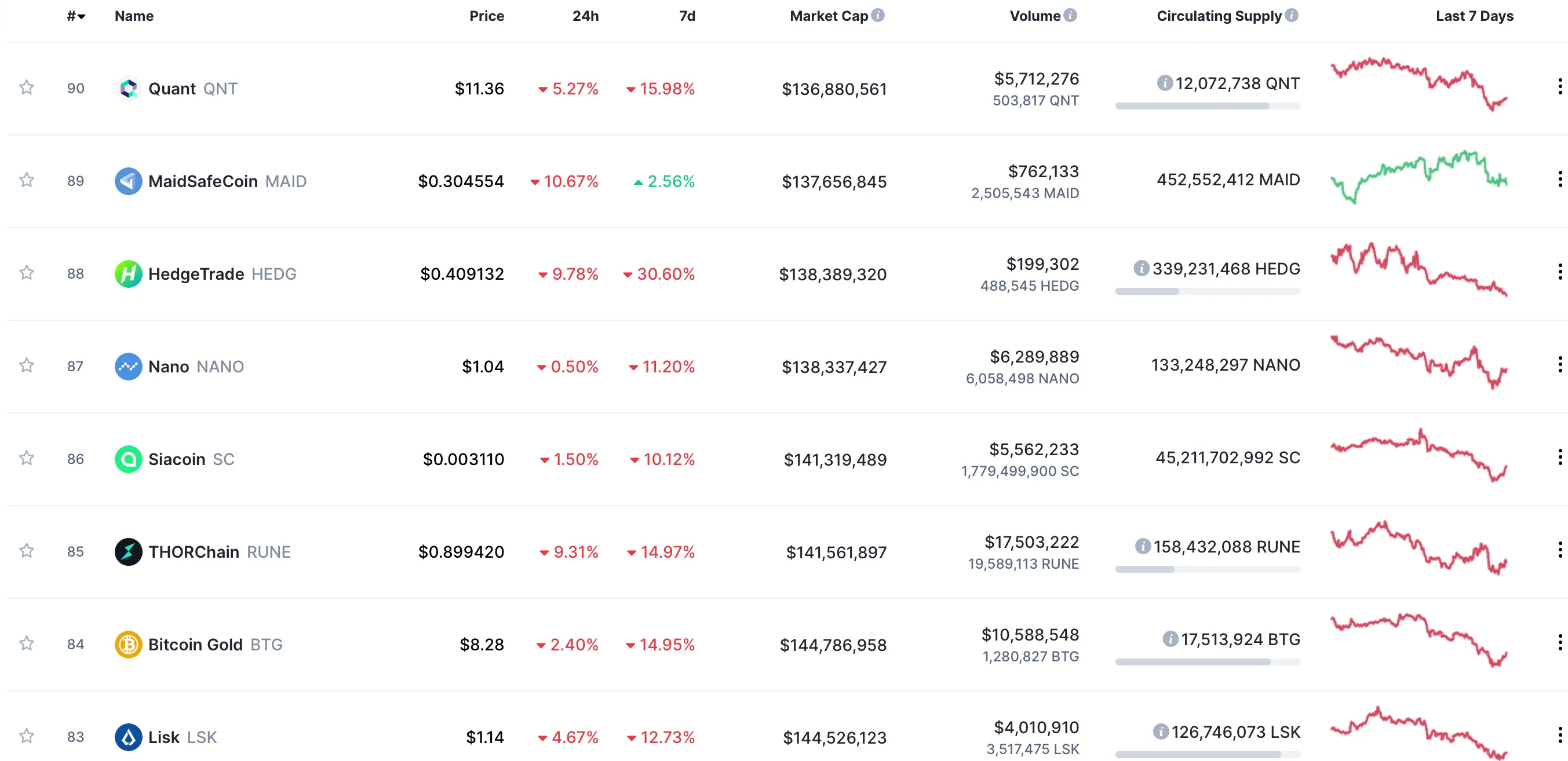

Take HEDG, the coin that powers Hedge Trade, a place for traders and investors to share their knowledge. Per CoinMarketCap, the HEDG coin is down by over 30% during the last seven days, and fell by 6.36% today. Its market cap is $143 million.

Or ABBC Coin, which trades on small-time exchanges like BitZ, CoinTiger, ZBG and DigiFinex. Despite a near 3% uptick during the last 24 hours, the alt coin's value has dropped by almost 15% during the last week.

Another striking example is Nano, an altcoin that made headlines in the UK earlier this year as a cryptocurrency you could earn while gaming at a bar in the North East of England. During the last week, Nano's price has dropped approximately 11%.

While the general altcoin outlook is pretty bleak, some are rising up against the grain.

For example, SwissBork's CHSB token increased by about 1% in the past day and 57% in the last week. Swissbord, based in Lausanne, Switzerland, aims to decentralize wealth management. And in this crazy market, it kinda has.

It will be interesting to see how the altcoin industry reacts to any further updates from the SEC.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.