Origin Dollars' $OUSD got exploited for $5.5M in ETH, around 11,800 ETH AND $2.2M in DAI

Attack: https://t.co/opyaZY2hjs

Attacker's Address:https://t.co/fkaUqphEqx

Share, stay vigilant pic.twitter.com/xHIdP1Md63

— Krisma (@KRMA_0) November 17, 2020

$68,271.00

4.18%$2,067.94

8.08%$1.44

4.74%$628.88

4.54%$0.999806

-0.01%$88.24

6.95%$0.286361

-0.11%$0.100188

6.94%$1.031

-0.24%$50.94

4.05%$0.294549

9.29%$501.09

1.67%$0.999817

-0.01%$8.80

1.32%$28.63

6.52%$0.174992

8.04%$9.28

8.31%$346.36

2.83%$0.999312

0.02%$0.164293

6.63%$1.00

0.04%$0.00956922

1.74%$0.10291

5.43%$56.27

6.44%$0.999103

-0.08%$246.99

2.97%$9.38

8.23%$0.959416

7.30%$0.00000616

2.54%$0.117574

2.57%$0.078507

3.94%$1.29

-1.03%$1.61

24.98%$5,158.11

-0.18%$4.06

14.61%$5,191.73

-0.18%$1.36

-4.60%$0.652018

8.44%$1.00

0.00%$1.12

-0.00%$188.24

6.85%$0.997297

0.01%$115.39

-2.35%$0.712701

2.17%$0.00000404

1.15%$78.77

4.15%$1.00

0.04%$0.070285

5.52%$0.168747

2.13%$0.99986

-0.01%$2.23

0.44%$0.00000163

-1.50%$1.14

12.48%$9.05

6.98%$0.274096

6.91%$2.41

9.30%$0.999167

-0.02%$0.111058

-3.39%$0.410536

2.30%$11.00

0.01%$8.68

1.55%$7.16

3.70%$0.00184041

4.88%$0.060143

4.67%$1.93

-6.29%$64.83

-0.57%$0.01707376

1.75%$0.114364

12.29%$0.857669

2.86%$0.03178833

8.09%$0.843191

7.94%$1.00

0.00%$0.00976618

4.50%$3.55

3.32%$0.090387

5.06%$1.24

0.11%$1.48

5.28%$1.013

10.90%$1.00

0.06%$0.967949

12.95%$114.41

0.01%$1.027

0.00%$1.12

1.22%$0.03528523

6.30%$1.86

3.96%$0.00773925

6.66%$0.03544677

24.25%$0.080421

0.27%$0.100954

7.21%$1.096

0.01%$0.998149

0.14%$0.00000637

7.17%$0.159723

7.20%$0.298531

15.81%$1.00

0.01%$30.24

8.33%$0.01287659

-0.75%$0.998754

-0.02%$0.264247

5.90%$0.071032

3.98%$1.087

-0.21%$0.705723

-1.54%$0.99976

-0.02%$1.18

0.20%$0.00719408

6.39%$35.29

5.01%$1.32

4.62%$0.395931

5.49%$0.04691412

2.08%$166.17

-0.33%$0.523005

2.38%$1.00

0.02%$0.165509

5.58%$0.25379

6.73%$1.48

6.39%$0.084638

5.65%$1.044

1.40%$0.03410625

0.06%$0.379451

13.17%$0.999606

-0.01%$130.63

5.82%$1.02

0.06%$0.00000034

2.01%$0.056994

4.42%$0.00000033

0.38%$1.58

118.24%$16.40

2.25%$0.44246

18.83%$3.22

1.15%$1.59

6.44%$3.21

1.40%$0.01627484

-1.58%$0.053242

1.67%$0.070872

5.05%$0.328794

9.23%$0.342673

8.79%$0.00603684

4.34%$0.02738216

3.93%$0.998382

0.23%$0.00002997

3.78%$0.237778

4.80%$17.61

2.51%$0.323144

5.51%$0.078768

4.62%$0.983851

-0.64%$0.051501

2.99%$1.42

2.84%$0.123992

4.86%$1.59

-1.23%$0.00269416

4.39%$0.136686

-1.58%$6.45

4.46%$0.04469294

6.70%$0.00245705

-1.07%$0.02237241

10.49%$0.086417

6.67%$0.998872

-0.06%$1.35

4.25%$1.82

6.02%$0.098527

11.19%$1.00

0.00%$0.985539

-0.29%$0.999769

0.01%$1.075

0.01%$1.30

2.71%$0.21418

8.32%$0.00215723

1.98%$0.503426

-1.49%$22.79

0.00%$0.00000098

2.43%$0.098189

-1.35%$0.0000365

2.50%$2.81

5.95%$0.879476

14.44%$5,238.12

-0.41%$0.1978

7.69%$0.19771

-1.42%$0.054085

2.60%$10.00

6.64%$0.098566

6.67%$1.00

0.00%$0.188791

4.29%$4.26

8.56%$0.080547

3.85%$0.02009219

0.36%$0.00490317

2.00%$18.61

2.68%$1.00

0.00%$0.00378583

6.33%$0.116558

-3.19%$1.90

3.72%$0.999699

-0.09%$0.055039

6.20%$0.17174

9.77%$0.628409

3.85%$2.15

5.94%$0.02318027

-3.14%$3.58

3.69%$1.80

0.55%$0.01999872

-0.78%$2.03

-2.01%$48.00

0.02%$0.0421289

5.28%$0.994859

-0.08%$0.00000792

3.65%$1.26

-0.17%$0.999199

-0.02%$0.332959

5.76%$0.148426

-1.46%$0.998245

0.01%$0.172145

3.48%$0.413824

3.53%$1.012

-0.15%$0.303264

-0.14%$0.654504

0.77%$0.137522

9.58%$0.096489

6.38%$0.082335

1.82%$4.57

3.25%$0.620679

0.33%$0.133137

3.86%$0.264352

2.81%$1,096.46

-0.13%$0.074479

-2.00%$0.079807

5.45%$0.228447

4.01%$0.289674

-0.15%$0.312266

-2.32%$11.47

0.56%$0.0014934

2.16%$0.364542

0.08%$0.251588

0.70%$0.00405936

2.76%$0.02175828

-6.22%$0.130405

-0.06%$0.202208

3.68%$1.001

0.00%$12.52

7.49%$2.38

2.43%$0.995661

0.03%$0.337183

2.31%$1.46

1.01%$0.04576976

11.84%$1.00

0.01%$0.112559

-7.01%$1.72

-10.89%$1.063

0.07%$0.999719

0.01%

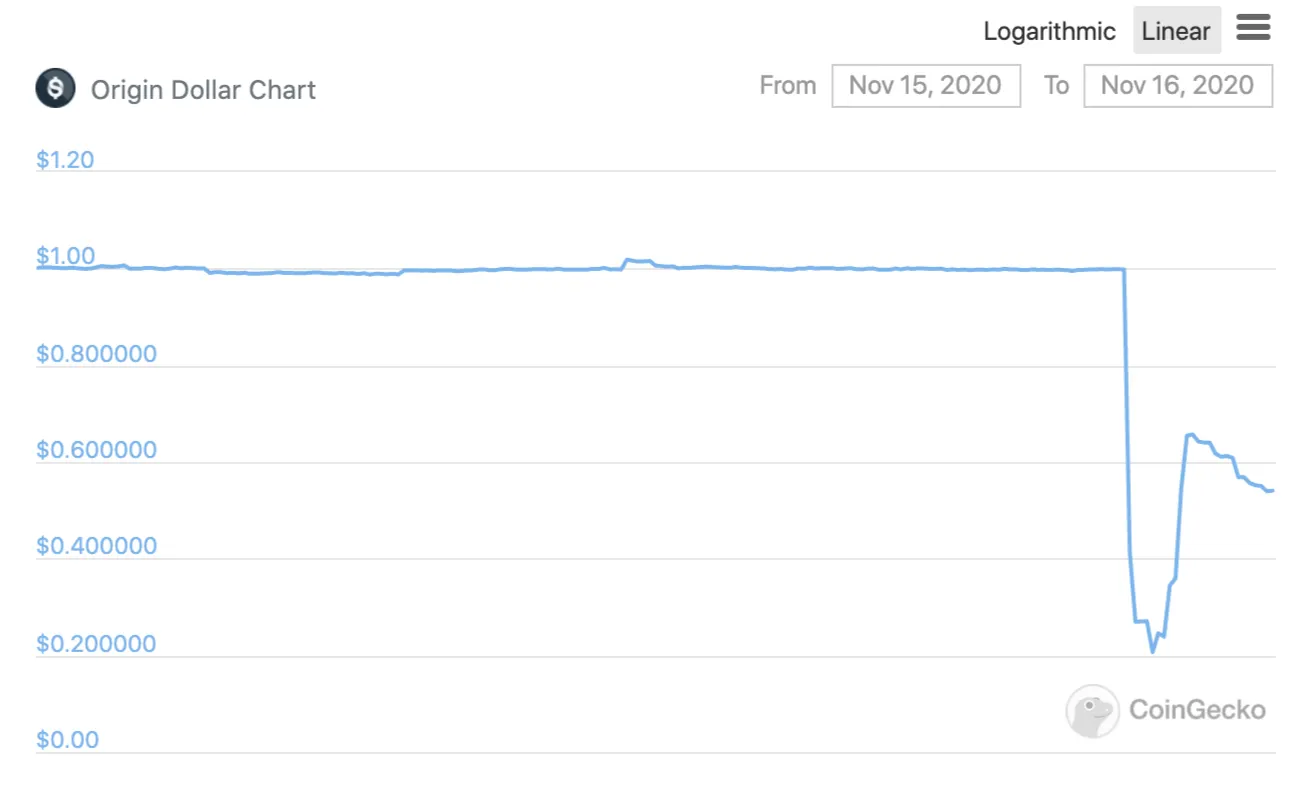

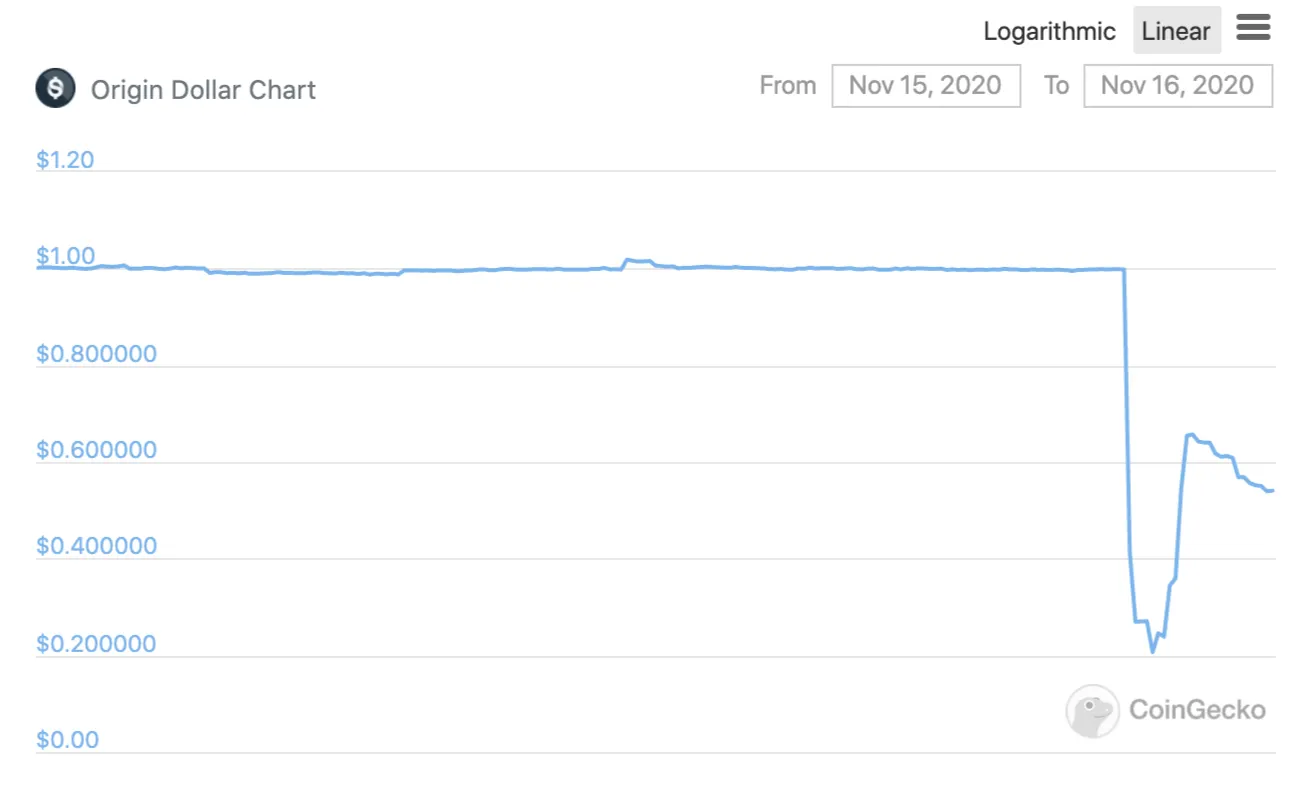

Origin Protocol co-founder Matthew Liu on Monday night confirmed an attack on the Origin Dollar (OUSD) vault.

"The team is all-hands on deck attempting to figure out what vulnerability was exploited and how the hacker was able to access users’ deposits," he wrote.

Though the exact exploit—some form of flash attack—isn't yet known, the Origin team estimated $7 million—a combination of ETH and DAI stablecoin—had been taken.

Origin Dollars' $OUSD got exploited for $5.5M in ETH, around 11,800 ETH AND $2.2M in DAI

Attack: https://t.co/opyaZY2hjs

Attacker's Address:https://t.co/fkaUqphEqx

Share, stay vigilant pic.twitter.com/xHIdP1Md63

— Krisma (@KRMA_0) November 17, 2020

Liu indicated he wasn't yet certain whether the funds—over $1 million of which he said came from Origin employees and founder—could be recovered.

To quell rumors, Liu said, "This is not a rug pull or internal scam. Despite this setback, it is very much in our intention to make OUSD a safe, secure, and successful product that builds on the broader Origin mission of peer-to-peer commerce."

Origin is a blockchain-based e-commerce platform. It introduced the OUSD stablecoin at the end of September; it's backed not by fiat but by other stablecoins, including DAI.

As a result of the hack, the stablecoin—meant to be equivalent to $1.00—dropped to $0.54.

The attack may further undermine confidence in the security of decentralized finance protocols, many of them built on Ethereum. In the last month, Harvest Finance, Akropolis, and Value DeFi have all been attacked via flash loan vulnerabilities that have led to over $40 million in losses.