In brief

- Bitcoin increases its dominance over the crypto markets.

- Bitcoin Cash suffered losses after contentious hard fork.

- Stock Markets show caution as COVID cases worldwide continue to grow.

Bitcoin continued its dominance of the crypto markets and the column inches over the weekend.

BTC charged past the $16,000 mark, taking its slice of the crypto market above 65% for the first time since June of this year. It’s not difficult to see why.

Bitcoin’s realised price, a measure of the Bitcoin in circulation - as opposed to Bitcoin that has either been lost or not moved for a significant period of time - reached an all-time high over the weekend, according to crypto analytics firm Glassnode.

That’s probably linked to digital assets management company Grayscale’s purchase of $241 million worth of Bitcoin, taking its tally to $8.1 billion. The company now holds 2.29% of Bitcoin’s entire market cap and 62% of all Bitcoin owned by publicly-traded companies.

It also holds a significant amount of Ethereum as well, which also had a good weekend. Its realised price hit two-year highs as the price seems to have found a home above $450.

Bitcoin Cash however, hasn’t benefited from the recent good fortune, dropping 5% over the weekend thanks to a controversial hard fork.

The hard fork follows a major disagreement between two BCH clients, Bitcoin Cash ABC (BCHA) and Bitcoin Cash Node (BCHN), after BCHA suggested an 8% “tax” on miner profits to help fund network development.

As the fork went through, Coinbase announced a temporary pause in deposits and withdrawals of BCH. But in the last 24 hours Bitcoin Cash’s price appears to be heading back towards pre-fork levels.

Stock markets rally but record COVID cases point to tougher times ahead

Over in the stock markets, investors were keen to keep the market rally going from last week.

The S&P 500 and Nasdaq Futures both had strong weekends, with both up over 0.5% at the time of writing. The movement appears to be as a result of Donald Trump’s slow realisation that his path to a second term is now over. On Sunday Trump tweeted Joe Biden had “won” the 2020 election, but insisted it was still “rigged”.

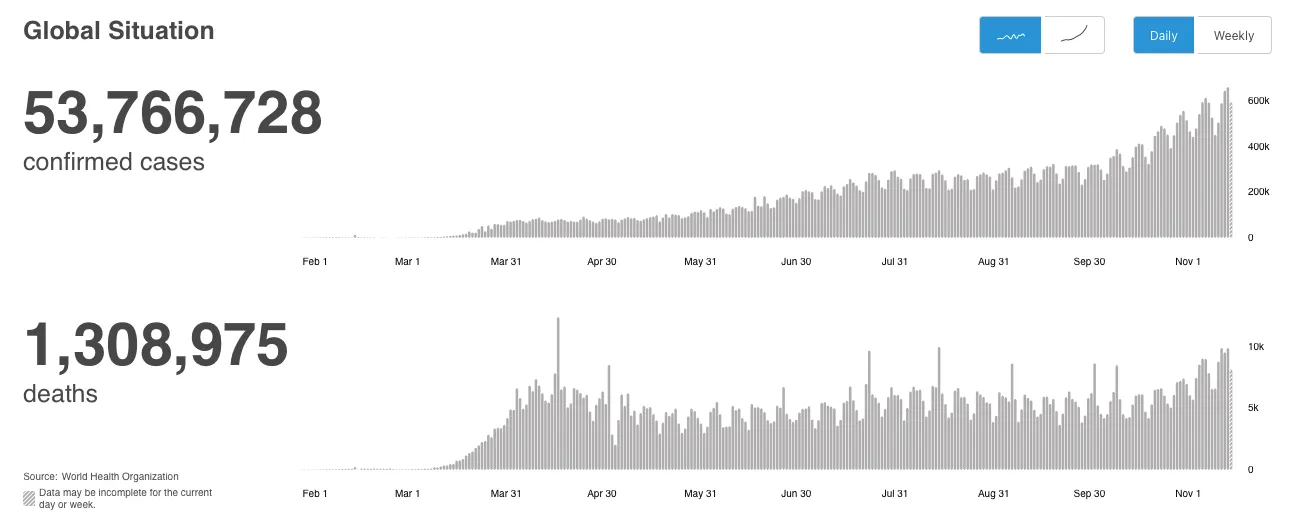

But there’s still caution drifting through the markets. At the end of last week stocks pulled back as America - and the world - recorded eye-watering numbers of new COVID-19 cases.

The US hit a grim milestone of 11 million coronavirus cases over the weekend as the death count marched toward 250,000, according to data from Johns Hopkins. An average of nearly 150,000 new infections have been reported per day in the US over the past week, a sharp uptick on the 100,000 daily cases recorded earlier this month.

The picture mirrors the global situation as the number of daily cases continues to climb, topping 600,000 confirmed cases per day, according to the WHO.

While the race for a vaccine appears to be entering the final stages, with Pfizer and BioNTech the current front-runners, the CEO of BioNTech said at best, his vaccine won’t “bash virus over the head” until Christmas 2021.

Sponsored post by AAX

Learn More about partnering with Decrypt.