In brief

- Digital Currency Group's investments are ticking along despite the global coronavirus pandemic.

- DeFi was the big hitter this year.

- Rather than hurt, the pandemic has helped the crypto industry, according to DCG.

Digital Currency Group, a huge crypto VC firm that counts Abra, BitGo, Coinbase and Coindesk among its 150+ investments, today published the results of a survey that asked the founders and CEOs whom it had funded which way the wind blows.

The report found that 50% of respondents said they’d outperformed projections for the start of the year and that 66% of the companies surveyed had increased their headcount this year. And although the pandemic has brought its troubles, 35% plan to further increase their headcount this year—remote working is in the cards.

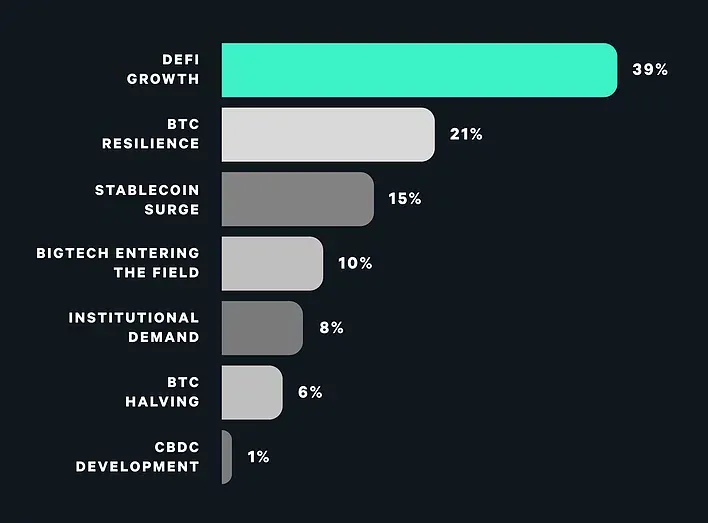

Respondents said that the “most bullish crypto development” this year was decentralized finance, the slew of non-custodial financial products into which investors poured billions of dollars this year.

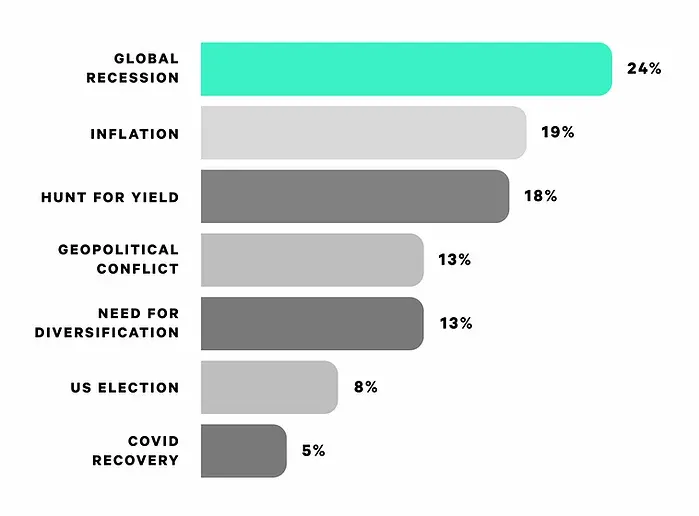

And while the global recession threatens millions with poverty and stands to decimate populations, this is one of the “main macro crypto adoption drivers.” About 60% of respondents said that “trustless, inclusive financial systems” were the biggest opportunity for the industry.

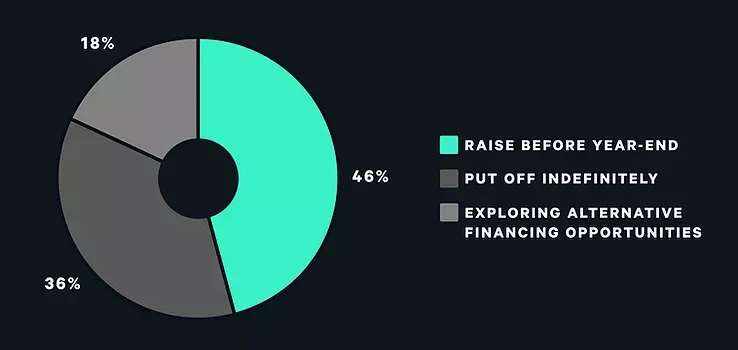

However, 60% of the executives surveyed said they’d like to raise money this year, but only 20% have so far. This is due to the pandemic: “Venture money has seemingly flocked to the crisis’ winners, while waiting for tangible signs that the harder-pressed will see relief,” wrote DCG in its report.

Of the projects that delayed fundraising, 36% have delayed fundraising indefinitely. Still, 46% are confident that they’ll raise money before the year’s end.

“2020 has been turbulent for everyone, but for the crypto industry, it will be remembered as a defining opportunity,” said Casey Taylor, VP of Network & Development at DCG, in a statement. “The industry is not only intact, but saw validation and strong growth.”