In brief

- Binance recorded its highest-ever futures trading volumes in August.

- Its futures offerings saw over $195 billion across Bitcoin and various altcoins.

- The exchange said the rise of DeFi projects fuelled the rush in altcoin futures.

Crypto exchange Binance had its best month yet for its futures offering with billions of dollars in trade volumes across all altcoins, the firm said in its August market outlook.

Futures markets allow investors to take leveraged bets on the price movements of an asset without them necessarily purchasing that asset. They also allow traders to profit from price declines by letting them bet against the market, in contrast to spot trading where investors can only either buy and hold an asset or sell to fiat for a loss.

As one of the crypto space’s biggest exchanges in terms of volume and retail participation, Binance has reaped the benefits of a booming futures market led by the rise of various DeFi projects, the firm noted.

Binance said it listed over 17 new futures contracts in August, including DeFi projects like yield aggregator Yearn Finance’s YFI token—and even its Chinese fork “YFII”—among others.

In August alone, Binance’s market share in the altcoin futures space grew as high as 41% and stabilized in the range of 35-40% in the month’s last week. The exchange even marked one of its highest single-day altcoin futures volume on August 14 with over $5.8 billion traded, it said in the report.

“A significant portion of the volume growth is attributed to altcoin contracts as traders shift their attention towards altcoins, [and] in particular, DeFi-related cryptocurrencies,” the firm said.

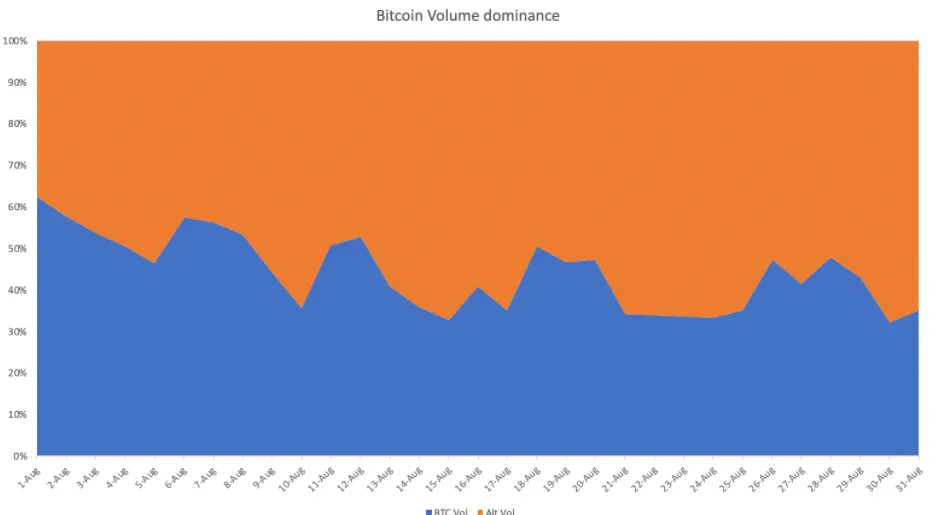

Overall, volume on Binance Futures increased by 79% month-on-month to $195 billion, its highest monthly volume since its inception, the firm said. Meanwhile, as altcoin volumes grew, Bitcoin’s total volume dominance declined throughout the month.

DeFi markets pump up altcoin trading

Binance said much of the activity in the altcoin space was attributed to investors betting on a myriad of new projects.

In the last month, obscure DeFi projects with funny-sounding names like Sushiswap and Kimchi Finance mirrored the efforts of yield aggregator Yearn Finance to offer various yield farming projects to investors—which sees the latter group lock up millions of dollars worth of crypto to lend out to other traders and earn interest rates as high as 100,000% annualized.

The rush has led to the Total Value Locked (TVL) across the DeFi ecosystem surpass a mammoth $8 billion figure. Of that, projects like decentralized exchange Uniswap account for over $1.66 billion in TVL alone.

However, not all industry observers are convinced with these metrics, with some stating the current market shows a bubble-like behavior last seen in 2017’s initial coin offering frenzy.

But until then, Binance is having a blast.