Yam Finance, the yield farming sensation which aggregated $600M in assets in less than 48 hours before being shut down, is set to see a second life.

The team that became instantly DeFi (in)famous for its brash launch, is now moving more carefully. After receiving $115k in donations to seed a security audit, Yam presented a two-phase rollout in which the protocol transitions to a fully audited system.

Migration

In the great DeFi migration, YAMv1 holders will migrate to YAM2 - a 1:1 match of YAMv1 with no rebases in place. YAM expands and contracts (or rebases) its supply twice a day to keep its $1 peg.

Once the results of the audit have been implemented, YAM2 will undergo a migration to YAM3 - the final form of the protocol (for now) which incorporates all code updates and re-enables both rebases and community governance of Yam’s treasury in Curve Finance’s liquidity pool yCRV.

Farmers Still Farming

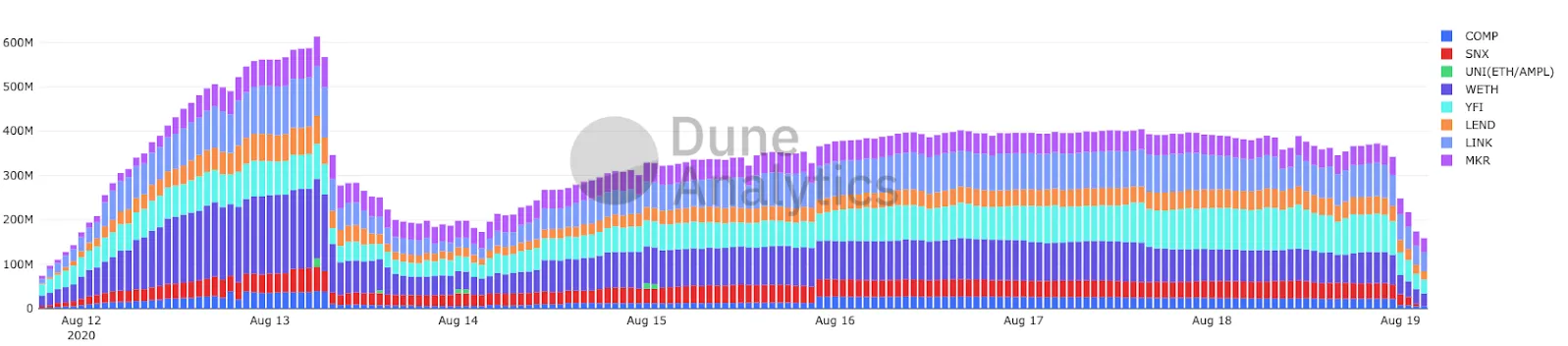

Despite V1 marked as a failure, optimistic farmers have continued to farm YAM, with roughly $175M in DeFi tokens still staked in the protocol.

And while new food coins like PASTA, SHRIMP and TACO are coming to eat YAMs lunch, the protocol’s team is doing its best to compensate those who banded together to save V1.

Quick History

As a quick refresher, Yam held its first (and only) governance proposal to try and save the YAM treasury from a bug which caused infinite rebasing. A minimum of 160,000 YAM was needed in a governance vote to issue a proposal for a fix, and YAM holders had to delegate their tokens to reach this threshold.

Despite reaching the target, the infinite rebases made it impossible to reach quorum , rendering the proposal useless and V1 being shut down.

YAMthusiasts

Now, those who acted to save YAM by delegating (as dictated by this snapshot) stand to earn 1:1 matching rewards in future iterations of the protocol subject to a community vote.

For YAMthusiasts, the next week will show whether or not YAM can continue to aggregate its dominant standing among yield farmers.

—By Cooper Turley

[This story was written and edited by our friends at The Defiant, and also appeared in its daily email. The content platform focuses on decentralized finance and the open economy and is sharing stories we think will interest our readers. You can subscribe to it here.]

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.