In brief

- Bitcoin market data shows that investors are putting more faith in the coin than ever before.

- According to data from eToro and Binance, both have experienced sizable growth over the last year and the first quarter of 2020.

- Many of these users are new, small account holders, though institutional investors are coming on board as well.

In the maelstrom of events that has become 2020, the refrains “this is good for Bitcoin” and “Bitcoin fixes this,” shibboleths of the Bitcoin community, have increasingly come into focus.

And while these endorsements of Bitcoin may conjure up polarizing sentiments, they appear to have been concretized in the order books of crypto exchanges around the world, according to the public exchange data available.

But Bitcoin proponents are not the only ones putting their money where their mouth is; statistical insights shared with Decrypt by Binance and eToro illustrate buying pressure from the average joes all the way up to the suit—along with a surge in new users.

The Roaring 20s

In particular, the United States has seen surging interest from retail investors. Square’s CashApp, for example, announced in May that they had their greatest financial quarter on record at the beginning of 2020 as Bitcoin purchases accounted for nearly a quarter of the company’s $528 million in revenue.

Other exchanges are basking in the retail-fueled buying as well, including cryptocurrency and traditional investment platform eToro. The retail brokerage service began providing cryptocurrency trading for Bitcoin, Ethereum, Litecoin and others in April of last year. Since launching this new frontier for trading, crypto-seeking investors have flocked to the platform—particularly in the US.

“Ever since December, we’ve seen a 300-400% increase in trading volume in the US [for cryptocurrencies], and an 800% increase since May 2019,” eToro US head Guy Hirsch told Decrypt. This has accompanied a 270% increase in revenue and a 288% increase in newly-funded accounts from January to May, according to Hirsch.

Hirsch said that eToro’s US platform only allows its clients to trade cryptocurrencies and not the other assets it lists like equities, ETFs, and derivatives.

The service is retail focused, so the majority of buyers on eToro are slinging amounts in the $10, $100, and $1,000 range, Hirsch said. eToro won’t shy away from opening larger accounts with clients, but its focus on otherwise under-serviced or ignored investors around the world is eToro’s “bread and butter,” Hirsch said.

“We see [legitimization] across the board. The entire industry has seen a boom since the beginning of the year. Everything that’s happened with COVID-19, we see very strong resilience in cryptoassets, particularly Bitcoin, and an increase in interest from web searches, family and friends asking about it.”

“I wouldn’t be surprised to see similar growth across the industry,” he said.

Institutions getting in on Bitcoin

Indeed, the buying boom from retail investors has been felt in institutional circles as well.

Binance, for example, has emerged from Black Thursday as an undisputed leader in Bitcoin’s unregulated derivatives market. While these derivatives can be traded by anyone with a Binance account, it also accommodates large account holders.

And these high net-worth individuals are signing up to Binance in droves, according to its founder and CEO, Changpeng Zhao.

“Institutional clients are signing up to trade on Binance at a faster rate this quarter. The number of new institutional clients onboarded in 2020 Q1 was 47.4% higher than in 2019 Q4,” he told Decrypt.

With these new signups comes 113% growth in Binance’s institutional spot markets and 217% on the futures end, Zhao said. Binance’s Bitcoin futures market saw over $2 billion dollars in volume over the last 24 hours, and its open interest (or, the total value of open trades on Binance’s futures market), is just above $260 million.

According to statistics shared with Decrypt, Binance’s US arm, which launched in September of 2019, is enjoying similar growth. The platform experienced a 82% increase in trading in March following the economic downturn in the US as a result of the coronavirus pandemic. To build out its institutional-grade offerings, Binance US now offers personal client support for account holders of $10,000 or greater.

Bitcoin growing up in the eyes of investors

Both eToro and Binance’s growth reflects a larger trend in the industry. Bitwise’s Bitcoin volume tracker continues to post $1 billion plus trading volumes for Bitcoin’s spot market, and post-mortems for Black Thursday show that retail buyers lead Bitcoin’s rally from $4,000 to $10,000.

And if we look in the derivatives market, we see growth both from regulated and unregulated futures offerings alike. Bitcoin futures offered by the Chicago Mercantile Exchange (CME), for example, have continued to climb to new all-time high volumes in 2020, consistently clocking in just under or around $1 billion in 24-hour volume.

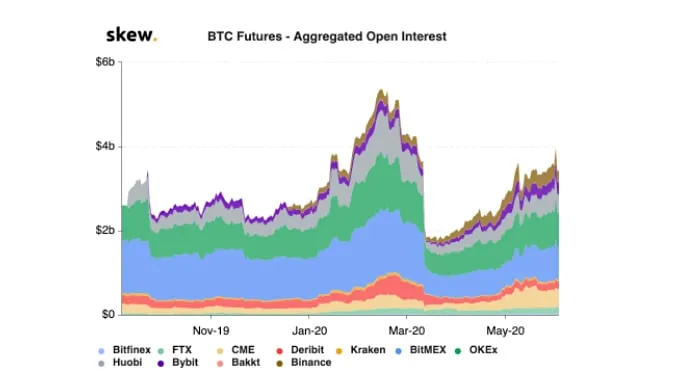

Aggregate open interest in Bitcoin futures across regulated and unregulated markets is flirting under $4 billion, a double rebound from the open-interest lows set in the aftermath of the mid-March crash. Before this tumble, aggregate Bitcoin futures volume peaked at around $5 billion in mid-February.

With volumes growing across both spot and futures markets, Hirsch said the bullish signal proves that investors who were on the sideline are starting to buy into the “Bitcoin as a hedge” narrative.

“I believe that COVID-19, central bank money printing, and the threat of inflation have been drivers of interest in gold, or—in this new case—its digital equivalent in Bitcoin,” said Hirsch. He added that most of eToro’s new users are “new to trading and investing,” and that many of these tenderfoots found their path to the investing world through Bitcoin.

Given the current trajectory of global events (and Bitcoin’s price showing signs of reclaiming $10,000), this inpouring of new users could be just the beginning.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.