In brief

- Deribit has integrated the new ClearLoop solution into their Bitcoin derivatives exchange.

- Developed by Copper, ClearLoop enables instant transfers from Copper custody holdings to the Deribit exchange.

- ClearLoop can be integrated with other exchanges, providing a major catalyst for the crypto options market.

Bitcoin options trading just got a little less risky.

Deribit, the Panama-based Bitcoin derivatives exchange announced on Thursday integration of ClearLoop, a new solution for instant and frictionless off-chain transfer settlement. With added protection against liquidations caused by blockchain transaction congestion, the solution could lead to a flood of institutional asset managers into the world’s most popular Bitcoin options exchange.

Developed by London-based crypto infrastructure provider Copper, ClearLoop allows asset managers and options traders to continue using their crypto assets while keeping them in secure, insured custody accounts provided by Copper. Bitcoin options are a type of derivative product that allow traders more leeway—an options contract gives traders the right (but not the obligation) to buy Bitcoin at a given price.

Many institutional investors are wary of keeping large holdings crypto exchanges, which often lock up funds during wallet maintenance and are vulnerable to hacking attacks. As a result, it’s difficult to write large option contracts that require collateral to be kept in exchange hot wallets.

Crypto derivatives are also risky during price swings, when network congestion can delay transactions that would otherwise prevent liquidations. For example, if prices are changing fast like they did during the Black Thursday market crash in March, being able to move funds quickly could be the difference to stop from being liquidated.

Using ClearLoop, options traders can instantly add collateral from secure Copper custody accounts without waiting for blockchain confirmation.

“We worked with asset managers and exchanges for over a year to develop a solution to the three key market issues,” Copper founder and CEO Dmitry Tokarev said in a statement.

“ClearLoop, the fruit of this collaboration, allows investors to settle trades instantly, keeps their assets secure and insured in third-party custody, removing concerns about self-custody, all the while eliminating counterparty risk and the associated limitations with volume."

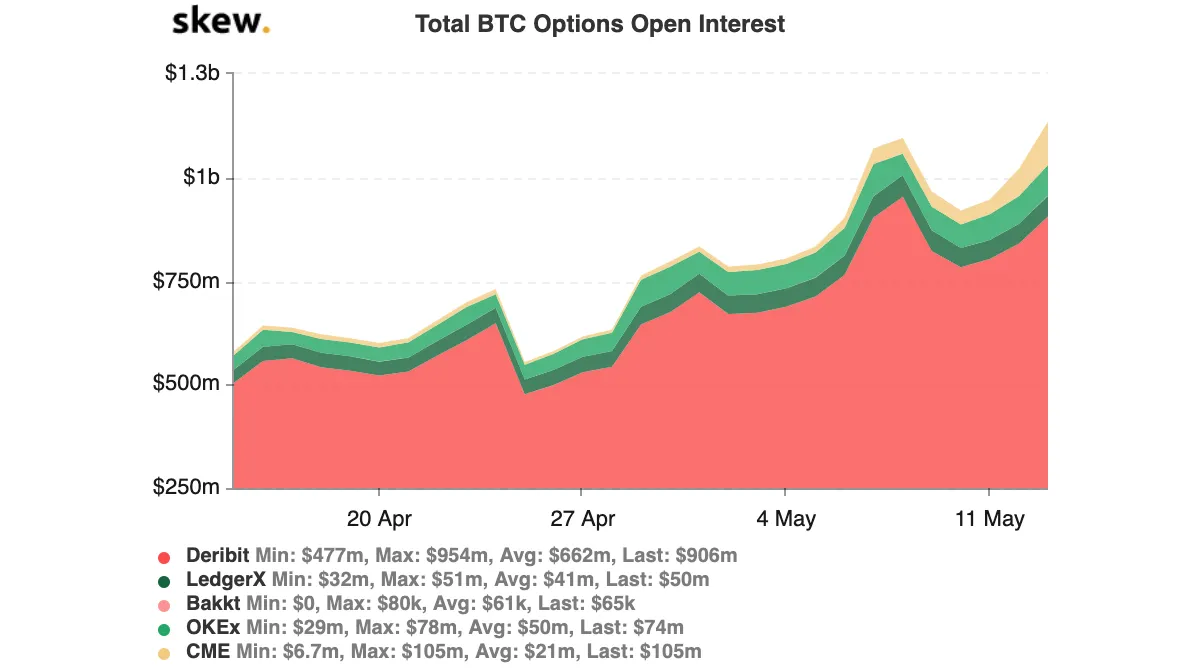

Deribit launched in June 2016 originally based in the Netherlands and moved operations to Panama in 2020. Deribit accounts for nearly 80% of Bitcoin options open interest market which has nearly doubled since April 15, according to data from crypto analytics firm Skew. The market grew from $580 million to over $1.1 billion on May 14.

“Integration with ClearLoop is a natural next step for Deribit, as it could potentially solve some of the most critical issues faced by the derivatives market,” Deribit co-founder and CEO John Jansen said in a statement.

While integrated with Deribit at launch, it’s likely ClearLoop will be added to other derivative exchanges as well given the unique benefits to that crypto asset class. It’s yet another tool in the chest for those institutional investors willing to test the waters of the decentralized finance tsunami.