Linea, Linea, March 12th, 2024, Chainwire

Lynex, Breathing Second-Wind into ve(3,3) DEX Model

Decentralized Finance (DeFi) has been redefining the financial landscape for the last few years, and the ve(3,3) token model has emerged as a game-changing framework, that is on the frontier of this movement. Initially, ve(3,3) protocols experienced turbulent beginnings due to early issues with the model. However, with the comeuppance of protocols like Lynex, and the recent success of Aerodome garnering substantial investments from the Base Foundation, these protocols have gained significant recognition, sparking interest in all ve(3,3) DEXs.

Lynex, a DEX and liquidity marketplace on the Linea blockchain, is at the forefront of the next generation of ve(3,3) DEXs. Lynex operates on Linea, the Consensy-backed Layer 2 for Ethereum, and offers a streamlined and efficient trading experience, through a boastful array of innovations and improvements to the ve(3,3) model.

What Is ve(3,3) And Why Does It Matter?

In the DeFi landscape, liquidity is pivotal for protocol success, with various solutions crafted to promote liquidity provision. Yet, achieving equilibrium between short-term and long-term incentives and aligning stakeholder interests remains intricate. With its innovative approach, the ve(3,3) model seeks to mitigate liquidity challenges in decentralized exchanges (DEXs).

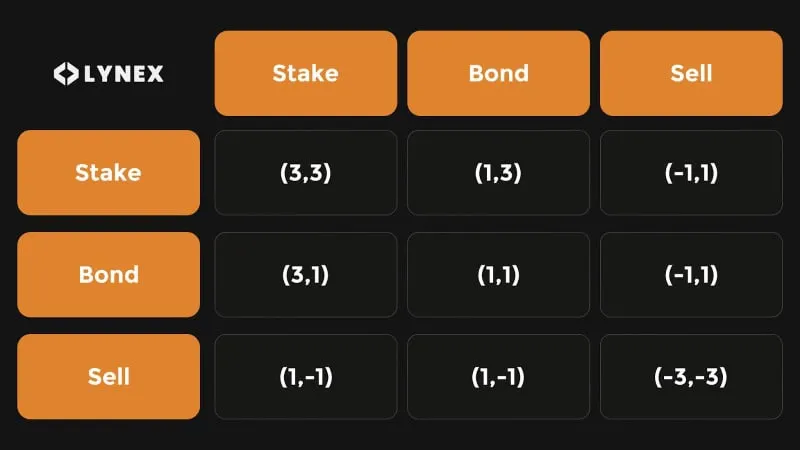

The term "ve" in "ve(3,3)" stands for "vote escrow," indicating that users can vote when they lock their tokens. The "(3,3)" part is based on the game theory model, developed by Olympus DAO, suggesting that the biggest payoffs in a 3x3 system, where users can stake, bond or sell, arise when all parties align on staking.

The concept of ve(3,3) is to enhance the community’s involvement in the protocol, giving them provenance over its direction, by being able to steer various elements such as swap fees, bribes, and rebases (an anti-dilution mechanism ranging from 0-100%), as well as control over emissions. The ve(3,3) model is designed to align the incentives of farmers, stakers, and protocols with the interests of the DEX itself.

Early iterations of the ve(3,3) model, used by projects like Solidly, aimed to tackle several hurdles faced by traditional DEXs, including:

- Token value dilution

- Mercenary capital leading to rapid liquidity withdrawal

- Inadequate fee generation

- Incentive misalignment

- Low liquidity in specific pools

- Voting power imbalance

- Unsustainable liquidity mining

The ve(3,3) model merges Olympus DAO's (3,3) game theory with Curve Finance's vote escrow (ve) tokenomics. It aligns token holder and liquidity provider (LP) incentives, emphasizes fee incentives over passive liquidity, and locks governance tokens to bolster participation.

Governance token locking grants users enhanced farming rewards and greater governance sway, temporarily reducing token supply and selling pressure. Vote-locked tokens also allow holders to earn trading fees from voted pools, facilitating efficient resource and liquidity allocation, thereby countering token dilution. This model supports permissionless pool creation, gauges for reward distribution, and bribes.

In essence, the ve(3,3) model:

- Incentivizes LPs via emissions

- Allows users to lock tokens for voting power (ve-token)

- Enables ve-token holders to control LP emissions

- Rewards ve-token holders/voters with trading fees and bribes

- Encourages protocols to offer bribes for liquidity attraction

The ve(3,3) tokenomics model revolutionizes DEX operations, addressing traditional exchange challenges and reshaping liquidity provision, governance engagement, and sustainable expansion perspectives.

The Challenges Of ve(3,3)

While innovative, the ve(3,3) model faces several challenges in the DeFi ecosystem. Its complexity and accessibility issues can deter average users, as the model's intricate tokenomics and governance systems are difficult to grasp.

Additionally, the governance structure of the ve(3,3) model can lead to centralization, as users who lock their tokens for longer periods gain more voting power, concentrating decision-making authority in the hands of a few large holders. This centralization contradicts the decentralized ethos of DeFi. Liquidity fragmentation is another issue, with the encouragement of multiple liquidity pools can lead to reduced capital efficiency and higher slippage for traders.

The ve(3,3) model also attracts outside bribers to instil mercenary capital, which seeks short-term gains and sway governance votes, which can cause volatility and instability in the ecosystem. Lastly, the emission of tokens as rewards can lead to token value dilution over time, especially if the supply is not well-managed, affecting the overall health of the protocol. These challenges underscore the need for continuous innovation and refinement in the ve(3,3) model and similar DeFi protocols to ensure accessibility, sustainability, and decentralization.

What Is Lynex And How Is It Different From Traditional ve(3,3) DEXs?

Lynex is a cutting-edge decentralized exchange (DEX) and liquidity marketplace, on the innovative Linea blockchain. Drawing inspiration from renowned platforms like Curve, Convex, Velodrome, and Olympus DAO, Lynex integrates advanced features, such as concentrated liquidity pools and ALM systems to provide a seamless trading and liquidity provision experience. It builds on the developments made by OlympusDAO and Solidly, fixing the early-stage issues with ve(3,3) DEXs.

Concentrated Liquidity: A Game-Changer

One of Lynex's standout features is its concentrated liquidity model. This approach allows liquidity providers to set specific asset price ranges, resulting in tighter prices and reduced slippage - overall more efficient liquidity provision. This innovation not only improves trade execution but also enhances fee generation, making it a win-win for both traders and liquidity providers.

Simplified Governance with Automated Voting

Governance in DeFi can often be a complex and time-consuming process. Lynex addresses this challenge by introducing automatic voting, allowing users to delegate their votes to a manager. This "set and forget" experience simplifies governance, making it more accessible to the average user while ensuring their interests are represented, and freeing up mindshare for experienced LPs who don’t want to spend too much time in the nitty-gritty of governance voting.

Professional Liquidity Management through ALM

Lynex takes liquidity management to the next level with its Automated Liquidity Management (ALM) marketplace. This feature enables average users to benefit from market-making capabilities traditionally reserved for professionals. By actively managing liquidity through smart contracts, Lynex’s ALMs minimizes the risk of impermanent loss, providing a safer environment for liquidity providers all while abstracting the hands-on management of positions away from the user.

Innovative Tokenomics for Token Value Protection

In response to the challenge of token devaluation, Lynex has introduced oTokenomics, a strategic approach to align the interests of liquidity providers and the protocol. oTokens help align LPs and reduce devaluation through a few different mechanisms, namely discounts on the native token and conversions to governance tokens, with the redemption of LP tokens on the way. This reduces selling pressure, incentivizes active governance and provides a reward-based income stream for LPs, ensuring mutual success and long-term sustainability.

Anti-Dilution Mechanism

Unlike previous ve(3,3) DEXs, Lynex boasts an anti-dilution mechanism, by which anti-dilution is capped at 52%, and decreases by 1% per week for the next year, as opposed to earlier iterations where the anti-dilution range sat at 0-100%. This ensures governance remains out of the hands of the few, and keeps the community active.

Revenue Sharing and Voting in a Unified Ecosystem

To top it all off, Lynex also offers a unique value proposition to its token holders by returning 100% of trading fees LPs. This approach ensures that token holders benefit from both revenue generation and voting rights, creating a harmonious and incentivized ecosystem.

Lynex acts as an ALM Hub, aggregating automated liquidity managers to create a competitive marketplace where users can find strategies that suit their needs. Its dynamic liquidity flywheel combines technology and strategy to improve capital efficiency within the ecosystem constantly.

Lynex's mission is to make DeFi accessible on Linea by providing a user-friendly, transparent, and secure liquidity layer. The platform prioritizes community-centric values, promotes protocol liquidity scaling, offers high rewards, and ensures a seamless trading experience for its users.

Lynex: The Future Of Decentralized Trading

In conclusion, Lynex's enhancements beyond existing ve(3,3) protocols represent a significant leap forward in the development of modern DEXs. By focusing on concentrated liquidity, simplified governance, professional liquidity management, and innovative tokenomics, Lynex is setting a new standard for ve(3,3) DEXs and paving the way for the future of decentralized trading.

The platform's focus on concentrated liquidity, automated governance, and professional liquidity management represents a paradigm shift in how decentralized exchanges operate. These features not only enhance the trading experience but also create a more sustainable and equitable ecosystem for all participants. As the DeFi landscape evolves, Lynex stands as a beacon of innovation, guiding the way toward a more efficient, inclusive, and sustainable financial ecosystem..

Contact

Growth

Marketing

Lynex Fi

marketing@lynex.fi

Disclaimer: Press release sponsored by our commercial partners.