In brief

- Yesterday marked the worst market decline in over a decade.

- Oil and other commodities plummeted to unexpected lows.

- But Venezuela's cryptocurrency—the petro, which is supposed pegged to oil—hasn't followed this trend. Why?

If you thought Black Monday was bad for the markets in the United States, think about Venezuela: a country that has all of its financial eggs in one basket, oil.

The country depends almost exclusively on oil exports to support its more than 30 million inhabitants. And the government of Nicolas Maduro has been increasingly pushing its official cryptocurrency—a supposedly oil-backed stablecoin—as a way of propping up its economy. Given the falling price of oil, how is this affecting Venezuela's petro?

Yesterday, virtually every market that comprises the fundamental gears of the world economy woke up to heavy losses. West Texas International (the reference price of oil in the United States) went from almost $46 (the price per barrel of oil) to a low of $27.5. The Brent (the European reference) dropped from $50 to $30 in the blink of an eye.

The world's leading commodities—aside from gold—and stock markets also tanked in the midst of a panic spurred by the spread of the deadly coronavirus and a trade war between Russia and the Saudi Arabia-led OPEC.

The downward break affected crypto markets, too. Bitcoin dropped by about 10%, losing its gains from the previous few weeks.

But in Venezuela, the highly controversial petro, which Maduro's government says is pegged to the price of oil and other commodities, seems unaffected—its price moving independently of the markets that support it. Why?

A not-so-stable stablecoin

First, let's take a look at the official price. The government's Petro Calculator portrays a rock-solid token. But an official price of almost $60 per token demonstrates a serious discrepancy with the reality of the markets: a barrel of oil costs almost half as much.

This value is equally questionable even considering the performance of the rest of the commodities that supposedly are part of the basket of goods that determine the price of one petro.

In truth, however, the figure derived from this calculation is the least important of all when determining the real price of the petro, since no one outside of the government uses it anymore.

The price of the petro on the secondary market has always been much lower and much more volatile—despite claims from Venezuela's government that the petro is a stablecoin.

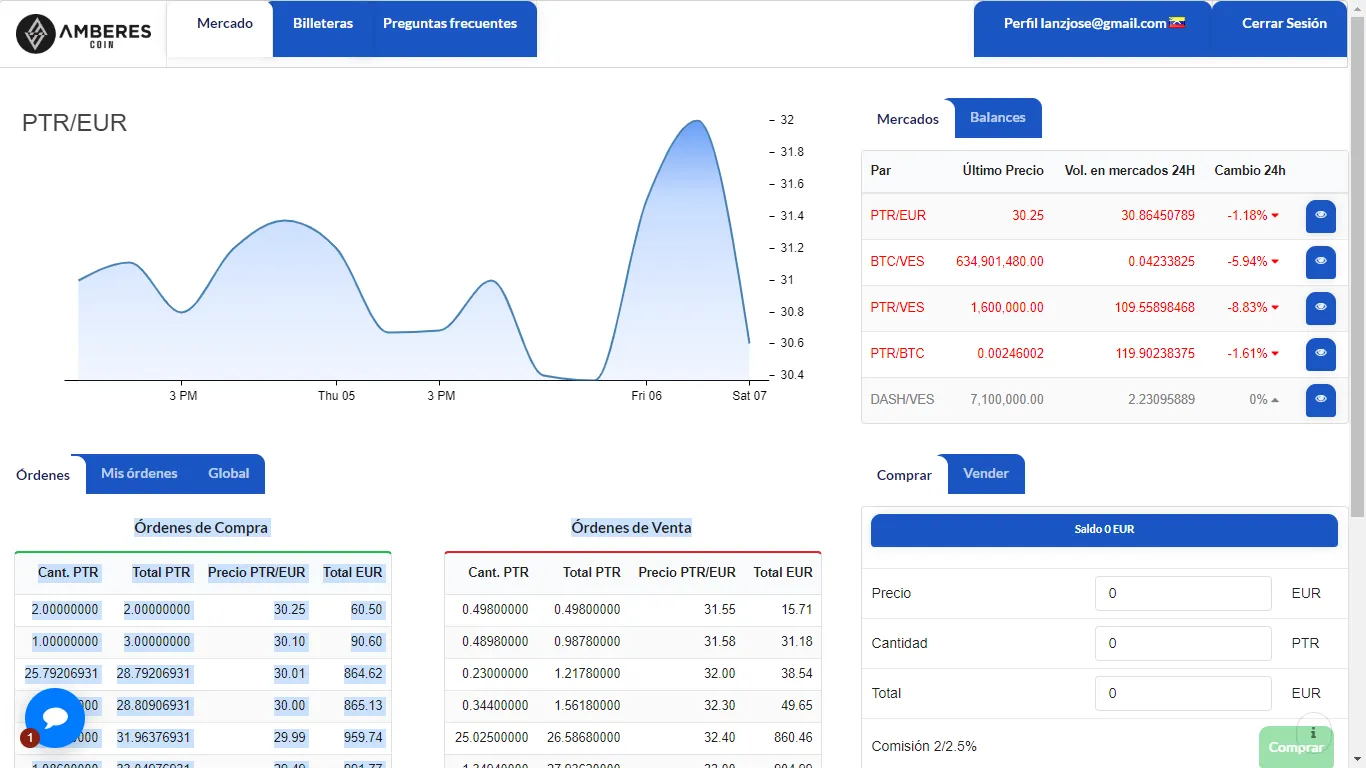

On the regional trading platform Amberes, the petro/euro pair shows a drop of just 2 euros during yesterday's bloodbath, from €32 to just over €30 per token—a value that had already been tested several times throughout the year. So, at best, the petro is sort of stable.

The petro/Bitcoin pair (the most liquid pair on the platform), on the other hand, shows a drop from 0.025 BTC per token to 0.024 yesterday. However, the token has fallen in price against the bolivar by a little more than 10%, which while closer to reality is still very distant from the real performance of the oil market.

On Criptolago, another state-sanctioned crypto exchange, the reality is equally strange. On the spot trading platform, the petro has a value of 0.007 BTC (close to $54). But on the site's peer-to-peer trading board, the price of the petro is around 0.0025 BTC (around $19).

Meanwhile, on the Cryptia exchange, the petro is quoted at 0.0046 BTC (approximately $36), although trading volume on this platform is near zero.

All that is to say that, in reality, traders do not treat the petro as a stablecoin—far from it. And no one abides by the government's official price. In fact, it seems as if each trading pair behaves completely differently and in isolation from any real market value.

For now, the market's crash yesterday hasn't affected trading in Venezuela. Data from Coin Dance, a metrics and analytics site, actually shows a recovery from the declining trend in trading volume. But if oil prices continue to fall, Venezuela's economy will undoubtedly suffer.

As for what will happen to state's "stablecoin," the petro, that is far more difficult to predict.