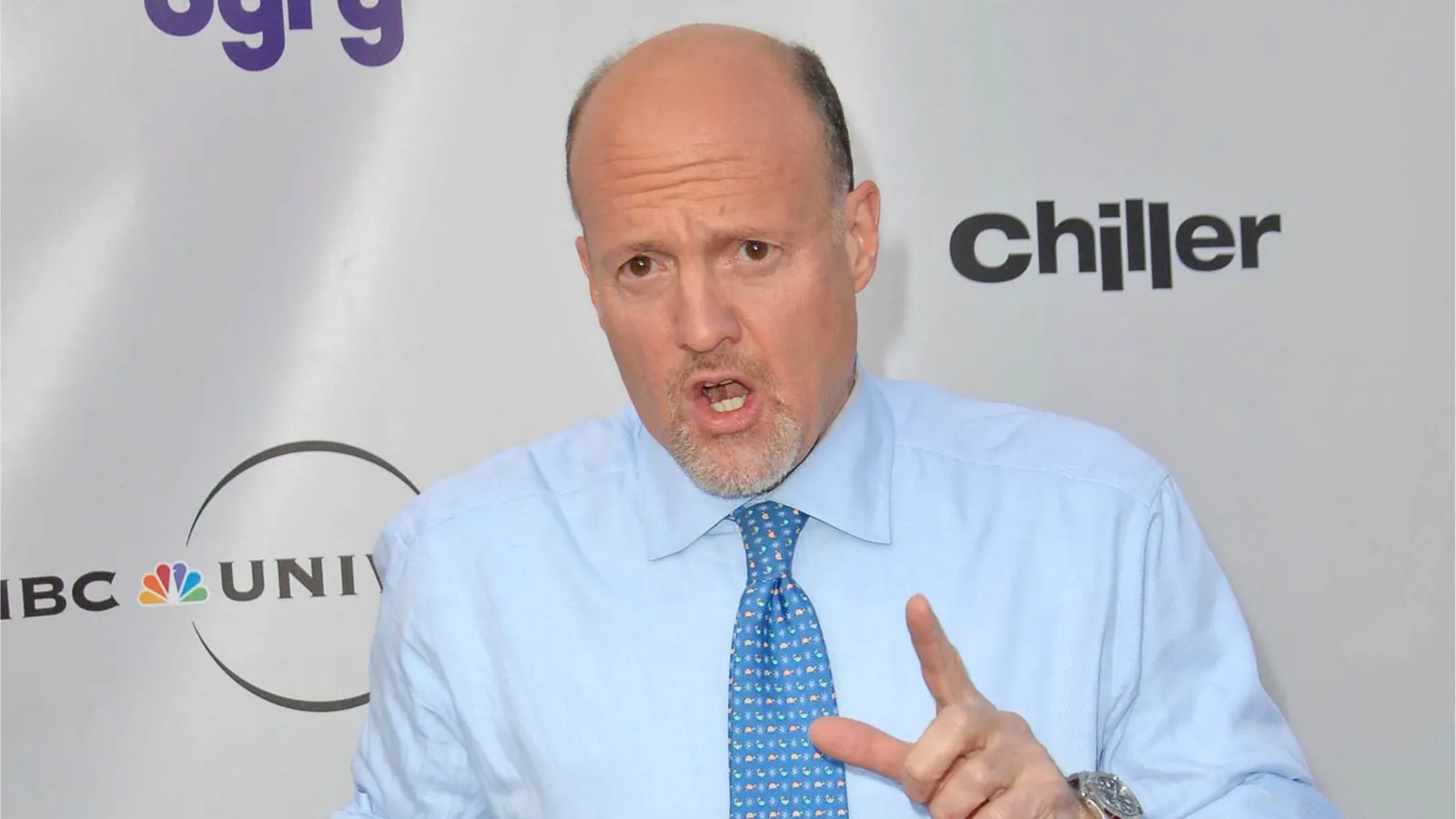

For the last year, CNBC’s Jim Cramer has emphatically urged all who would listen to get out of crypto—and specifically, away from Bitcoin.

Now, the Mad Money host is—once again—changing his tune, right as Bitcoin surges to an 18-month high.

“For a while I liked it, then I decided: You know what? The money had been made,” Cramer said of Bitcoin during a Mad Money segment earlier this week. “But I was premature.”

“When you make a lot of money, let’s not look back,” he added.

Cramer’s newfound faith in Bitcoin comes during a major surge for the world’s top cryptocurrency. Earlier today, BTC rocketed above $38,000 for the first time in a year and a half. In the last month, the coin has steadily climbed 10%. And it’s not just Bitcoin that’s up: in the same period, Ethereum has spiked 17%, hitting its own 18-month peak earlier Friday.

Much of that momentum stems from industry-wide hope for the imminent approval of a spot Bitcoin ETF—which, if finally greenlit by the U.S. Securities and Exchange Commission (SEC) after 10 years of denials, would allow traditional financial institutions to gain exposure to BTC without holding any cryptocurrency.

Blockchain analysts at CryptoQuant have previously said the product could lead to a $1 trillion boost for Bitcoin and other digital assets.

Cramer, despite having profited off BTC himself, appeared to permanently write off the coin and all other cryptocurrencies after the collapse of the crypto market in May 2022, and again after the shuttering of crypto exchange FTX rattled the industry last fall.

“It’s never too late to sell an awful position, and that’s what you have if you own these so-called digital assets,” Cramer said last December.

A year later, with Bitcoin back on the rise, Cramer’s now claiming he’s always supported those with long-term faith in the coin.

“If you like Bitcoin, buy Bitcoin,” the television personality said Tuesday. “That has always been my view.”

Many in the crypto and finance communities have long skewered Cramer’s ever-shifting stances on financial products, with some claiming that doing the inverse of whatever he advises can generally be considered very sound financial advice.

Last year, the SEC received multiple applications for real-life “Inverse Cramer ETFs,” which would automatically invest user’s funds using the opposite of Cramer’s instructions as gospel.

Given such logic, some crypto investors have taken to social media to posit that Cramer’s revived confidence in BTC could spell doom for the ascendant cryptocurrency—and erase the encouraging gains of the last month.

Edited by Andrew Hayward

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.