Imagine it’s some day in the not too distant future—2028, let’s say. You’re sitting in your south-facing condo brewing coffee and watching U.S. President Ashton Kutcher on your floor-to-ceiling, OLED/QLED screen. It’s cozy and warm, courtesy of your state-of-the-art, solar-powered heating system. And now, your friend, Niko, who lives on the other side of the complex, is enjoying it too.

Not long ago, Niko was cursing these damp, overcast mornings. While you had more sunlight that you could use, the photovoltaics on her building didn’t even get a chance to power up, forcing her to buy energy from the utility company at crazy prices. But these days her smart meter can jump on the blockchain and do a deal with your solars, diverting its surplus energy to warm her tootsies.

In many of today's developed economies, utilities are still highly regulated and peer-to-peer (P2P) energy transfer is prohibited. But that's changing: Blockchain startups around the world are racing to introduce distributed-ledger technologies to the energy space, with P2P transfer and other tantalizing applications bringing major benefits to consumers. And the utility companies? With its potential to upend traditional models of energy consumption, blockchain has some of them worried—but not all.

In the U.S., some states exhibit more regulatory friendliness than others. Take Austin, Texas, for instance, where blockchain/energy startup Grid+ started pumping excess solar electricity among four houses, in a bid to disrupt the big utilities before they can do this themselves.

Building blockchain’s electric dreams

And last week, TRENDE a Japanese, online renewable energy retailer, successfully closed a $6.5 million Series A funding round led by the investment arm of Japan’s largest energy utility, TEPCO Ventures, together with Showa Shell and the Dubai Electricity and Water Authority (DEWA). TRENDE’s mission is to accelerate the widespread adoption of solar power in Japan, the first step in enabling a P2P energy trading marketplace.

The Tokyo Electric Power Company (TEPCO) is best known for the meltdown at its nuclear-power plant Fukushima Dai-ichi, in 2011. It’s an unlikely advocate of techno-anarchy. But, in an approach that some liken to throwing pasta at the wall to see if it sticks, TEPCO is trying to reinvent itself as a blockchain pioneer, with the aim, no less, of overthrowing the old order in the electricity business to make it more decentralized.

Last year, TEPCO announced a partnership with Grid+ and also invested an undisclosed sum in Electron, a British startup focused on multiplying options for flexible demand in electricity systems for Japan's and Singapore's main electric grids, among others. In April, TEPCO signed an agreement with Singapore-based Electrify, to experiment with P2P electricity trading. Tuesday’s investment in TRENDE, a TEPCO spin-off, cements a key piece in the utility giant’s decentralized jigsaw puzzle.

So how does TRENDE plan to achieve its grand aims? To kick off its digital retail business, it began in March by offering attractive, flat-rate energy plans. Phase two, which started in August 2018, entails turning these consumers into prosumers via an offer to install, operate and maintain rooftop solar panels for free, sharing cost savings with homeowners and handing the panels over to them at the end of the contract term. It has the rather lovely moniker “Hot Denki” (“denkii” is Japanese for electricity or electric light).

“Phase three, the launch of our P2P platform, is still 2-3 years away,” says TRENDE’s co-founder and chairman, Jeffrey Char. He believes that, in the future, P2P will no longer be prohibited by regulation. “But, for now, it is probably more accurate to think of something like P2Retailer2P.”

And blockchain? Char is cautious on this subject. “We rarely talk about our plans for blockchain because we view blockchain as merely another tool in our toolbox,” he says. “We will use blockchain, or not, depending on whether it helps us to solve a problem we are facing.” But he concedes that TRENDE’s focus on accelerating the adoption of distributed solar in Japan, using distributed-ledger technology, means it “would appear to make sense at some point in the future.”

Jumping up and down

It’s not only Char who’s distancing himself from some of the hype, hope and hyperventilation that has enveloped the blockchain/energy space throughout the past months. The bottom line is that, despite all the furor, almost all blockchain applications are still experimental. But, when it comes to energy, their scope is so wide that optimists can be forgiven for jumping up and down a bit.

In the past year alone, something like 120 startups in the blockchain-energy space have collectively raised a total of $324 million.

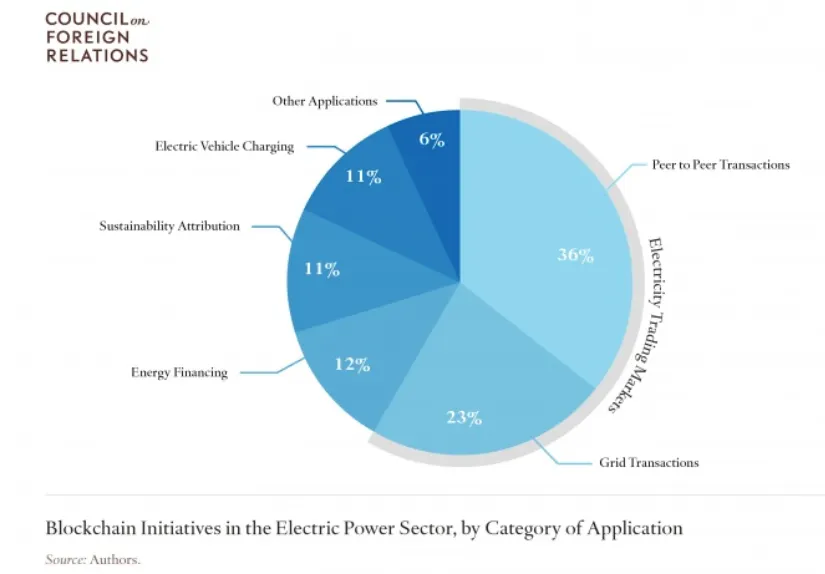

In the energy sector, blockchain uses range from ways to promote P2P buying, selling or trading to balancing wholesale electricity markets (ensuring that supply always matches demand). Potentially, blockchains can make it easier for households to provide charging stations for electric cars. They can be used for carbon trading and to fund the development of solar power in the developing world. This partly explains why, in the past year alone, something like 120 startups in the blockchain-energy space have collectively raised a total of $324 million.

A substantial chunk of this, $40 million, went to Estonian green energy platform WePower, which wants to enable full-cycle, blockchain-based energy trading across the Baltic state.

Combined with AI and the internet of things, blockchains can also give grid operators a better overview of the resources they manage and can track the large volume of transactions that stem from the shared nature of energy resources.

And for those not convinced that it’s worth having a planet that’s greener and leaner, startups such as Powerledger, and UK-based Energimine are developing blockchain-based rewards systems, whereby people can earn tokens for energy-saving behaviors, such as reducing their power consumption. In some cases, the tokens have a market value, so can be redeemed to pay for bills, electric vehicle re-charging or exchanged for fiat. Energimine is also introducing an electronic debit card, which can be used anywhere that accepts debit and credit cards to pay with cryptocurrency, and is announcing a new partnership almost every week.

Not chained to the radiator

Harder to convince are those who believe that blockchains aren’t up to the task of managing millions of energy transactions. For now, they may have a point. Although work is underway to overcome the challenges, the fact remains that today’s blockchains are costly, slow and do not scale well.

There’s also the problem that blockchains may guzzle too much electricity for energy applications to make sense. But this assumes that projects will use a public blockchain such as bitcoin, requiring lots of computing power and time to verify each transaction. Energy firms could in fact employ blockchains in which only trusted participants can join.

Another way to deal with the problem is to use a radically different blockchain design, such as the directed acyclic graph (DAG) or IOTA’s tangle, which has been designed for the internet of things. ENGIE Lab Crigen, a research group dedicated to energy resources, recently announced an agreement with IOTA to put the tangle to the test.

Given the enthusiasm surrounding these projects, whether completely utility free or not, it's possible that P2P energy trading arrives sooner than later. Experiments to leverage the blockchain in energy transfer started relatively recently, in 2016, with the Brooklyn microgrid, in New York, managed by LO3 Energy. Take a look at the project’s inspirational video:

Because the electric power sector is highly regulated, policymakers will play a crucial role in determining whether and how blockchain’s potential can be realized. So, a partnership (yes, another one—lots are needed in this business) in July, between LO3 Energy and the Energy Web Foundation, two of the most respected names in the business, will look at standardizing the data used for future energy blockchains. Keen to capitalize on its early-entry advantage, LO3 is also expanding, with a series of other projects around the world.

On the other side of the pond, events are moving fast too. In London, earlier this year, British startup Verv executed the UK’s first physical trade of energy on the blockchain, at a solar powered social housing complex in London. 1 kWh of energy was sent from one roof of a building of apartments to another on the same complex. The results of the Hackney Banister House Estate trial will be used to roll out more energy trading communities across the UK.

Distributed-ledger technologies can address some problems surrounding energy supply and consumption. The sector also presents an opportunity for the technology to more easily demonstrate its true worth. A blockchain servicing a real chain of apartment blocks, enabling them to trade energy, provides a 3D dimension to something that’s often difficult to grasp or explain. To succeed, blockchains need these kind of bridges to the real world. They make the technology tangible, verifiable and attractive--especially if you like your heating turned up high.