Ladies and Gentlemen, the time has come https://t.co/xMTZN1hCMk pic.twitter.com/qweiqtFw01

— Nick Maggiulli (@dollarsanddata) October 24, 2022

Bitcoin’s correlation–not causation–with the McRib

Bitcoin winter blues

$67,801.00

-0.73%$2,002.87

1.30%$1.48

0.52%$616.68

-1.11%$0.999913

0.00%$84.87

-1.64%$0.281297

-1.09%$0.101046

1.23%$1.031

1.38%$566.17

0.78%$51.53

-0.08%$0.282546

-1.40%$0.999113

-0.08%$8.61

0.75%$29.49

-2.52%$0.999174

0.04%$0.166639

2.70%$8.86

-0.22%$339.28

0.80%$0.167361

-0.13%$0.999489

0.10%$291.76

1.01%$0.0095223

-0.89%$0.101743

1.25%$54.25

-1.82%$0.999671

-0.03%$9.06

-1.35%$0.0000065

-0.63%$0.966871

-0.97%$1.43

-0.75%$0.079422

-0.20%$0.116477

16.04%$1.54

5.64%$4,912.77

0.52%$4,936.52

0.42%$1.35

-1.60%$3.56

-0.24%$0.63542

-0.97%$127.41

1.68%$1.00

0.00%$0.00000439

-0.36%$193.07

-1.20%$0.715467

-0.32%$0.997129

-0.01%$0.190274

5.97%$79.80

0.75%$2.37

-0.71%$0.999616

-0.03%$1.12

0.00%$0.0000017

-0.63%$0.999971

0.03%$0.063049

-6.05%$8.70

-0.71%$1.047

-0.44%$0.275729

-0.52%$0.998837

-0.03%$2.37

-1.25%$10.99

0.01%$0.00216387

-1.50%$0.111087

3.74%$0.02138304

25.17%$7.20

-0.70%$2.29

-0.05%$8.41

-0.40%$0.390291

-2.09%$70.00

1.39%$0.120692

-1.28%$0.057184

1.11%$0.890673

-1.17%$0.0319161

0.10%$0.999471

0.07%$0.093472

-0.77%$0.00973811

0.55%$3.49

3.71%$1.48

5.54%$1.24

0.03%$1.45

-0.27%$0.03694528

0.29%$0.961979

-0.58%$1.027

0.00%$114.32

0.03%$0.920635

-1.31%$0.999577

-0.03%$1.11

-0.42%$0.00811949

-0.61%$0.113249

-0.77%$0.0801

0.06%$0.00000651

-0.40%$0.996115

-0.09%$1.095

0.00%$0.999547

-0.01%$0.163945

-1.00%$1.00

0.02%$0.02904337

-5.74%$0.01295152

0.42%$0.074655

-0.85%$0.99804

0.03%$37.70

-0.44%$1.087

-0.23%$0.26307

-0.39%$1.18

0.05%$0.00716614

0.03%$0.439018

-30.06%$1.31

-0.76%$0.397604

0.13%$0.241031

16.42%$0.639912

-2.17%$0.04069396

-0.38%$23.47

-1.77%$1.14

-1.52%$0.187965

-0.33%$0.9985

-0.05%$0.171309

-0.67%$1.56

-3.85%$160.10

1.40%$0.042883

0.58%$0.252179

-0.89%$0.08459

0.73%$0.47958

0.45%$0.00000034

2.19%$0.00000034

0.40%$0.36413

12.30%$0.057429

-0.72%$16.66

-2.00%$124.35

-3.70%$0.0170295

-1.48%$0.056698

-0.06%$0.999582

0.01%$0.174554

-10.13%$1.55

-6.73%$3.11

-0.78%$1.02

0.02%$0.00003173

-1.23%$0.34352

-0.13%$0.02779118

-0.37%$0.069141

-1.84%$0.320387

0.02%$0.00593946

-0.93%$3.01

0.63%$0.997521

0.06%$0.34225

0.41%$0.244591

-0.70%$0.054444

-0.66%$0.991384

0.01%$0.078612

2.76%$17.40

1.27%$0.04852749

-0.32%$1.41

-3.21%$0.00275725

0.15%$6.84

1.28%$0.00259586

5.10%$0.02180279

-0.77%$1.29

-22.16%$1.50

2.07%$0.087178

0.50%$0.02141321

-6.34%$0.555792

-2.52%$0.230757

-1.15%$1.35

-2.16%$0.999636

0.04%$5,912.10

4.24%$0.999918

0.00%$1.075

0.01%$0.988006

-0.00%$0.999662

-0.02%$0.097112

-3.56%$22.86

2.65%$0.00211835

1.47%$0.205762

-0.80%$1.22

-0.54%$2.18

9.54%$0.00000095

-1.82%$2.81

-0.11%$0.101536

-0.21%$0.00528486

-1.03%$0.193953

-1.65%$0.128818

0.50%$0.081973

1.40%$0.00405449

-0.56%$0.05319

0.93%$1.00

0.00%$0.097937

2.89%$0.00003431

-0.79%$0.190108

-1.95%$0.04838302

-0.40%$18.75

-4.80%$4.16

-4.12%$1.45

-1.06%$0.180395

-2.19%$1.00

0.00%$2.22

2.90%$2.29

-0.25%$1.001

0.08%$0.650604

-3.55%$8.70

-32.37%$0.757496

-4.64%$15.23

-12.82%$0.053378

0.00%$1.80

-0.07%$0.00000812

-2.11%$47.98

0.00%$1.015

0.08%$0.02196222

-1.56%$0.994275

-0.02%$1.27

0.18%$0.998045

-0.01%$0.214443

2.18%$1.001

0.11%$0.333293

-3.59%$0.999591

0.14%$1.001

2.25%$0.169944

-1.00%$0.405418

0.04%$0.306795

-1.77%$0.65758

1.61%$0.085902

0.62%$0.13869

-2.66%$0.276117

1.13%$4.68

-1.04%$1.77

2.77%$0.136609

6.55%$9.01

-1.38%$0.638265

-5.55%$0.083826

1.05%$0.095423

0.32%$0.311392

12.59%$2.03

-0.66%$0.0015559

-0.72%$0.265298

-0.70%$1,097.82

0.07%$0.37918

-1.53%$0.0041875

-0.30%$0.072646

-7.32%$0.313779

-2.54%$0.994791

0.01%$0.130729

-0.23%$0.208364

-1.42%$0.00238966

-0.85%$2.46

-0.31%$1.058

0.03%$1.001

0.13%$0.211576

-2.14%$0.02079238

-5.70%$0.0296943

-9.13%$0.126994

-0.82%$0.121012

1.53%$0.115248

0.08%$0.999799

-0.05%

With the famed McRib making a comeback next month, fintwit and crypto advocates have been quick to highlight a rather unusual correlation.

McDonald’s typically keeps the oblong sandwich off its menu, only to bring it back as a limited-time offering (variously attributed to its marketing strategy and the price of pork, among other factors).

Now, with less than a month before it hits menus again, market spectators have tried establishing a link with McRib’s return and global asset prices–including Bitcoin.

Nick Magguilli, COO for Ritholtz Wealth Management, pointed out that the S&P 500 has enjoyed a 0.04% higher average daily return when the McRib sandwich was available versus when it wasn’t.

Ladies and Gentlemen, the time has come https://t.co/xMTZN1hCMk pic.twitter.com/qweiqtFw01

— Nick Maggiulli (@dollarsanddata) October 24, 2022

Obviously, it’s ridiculous and a reminder that correlation doesn’t mean causation. Still, for an industry that runs on memes, this one’s about as savory as it gets.

Some crypto analysts are now busily drawing lines on charts to draw parallels between the McRib’s juicy presence on the menu, and the price performance of Bitcoin.

The results? Pretty mixed.

Since 2016, McDonald’s has relaunched the McRib every year, and of the last seven arrivals, the price of Bitcoin has risen four times.

The peak return over the 90 days following the reintroduction of the McRib in 2016 and 2020 was just above 50%. In 2017 and 2021 the returns over the same time are far more pronounced, surpassing 200%.

The latter rise, though, coincided with the bull rallies those years.

In 2019, Bitcoin held flat following the saucy sandwich’s return, rising briefly during the same month McDonald’s relaunched McRibs. Likely more influential to this bit of price action was the Chinese government introducing support for the local blockchain industry.

The bullishness ended, however, in 2018 and 2022. In both cases, the reintroduction of the McRib coincided with a significant downturn.

Bitcoin plummeted to $3,250 after falling close to 50% in 2018 and 22.5% in 2022, reaching lows of $15,500 in the following weeks after the McRib’s reintroduction.

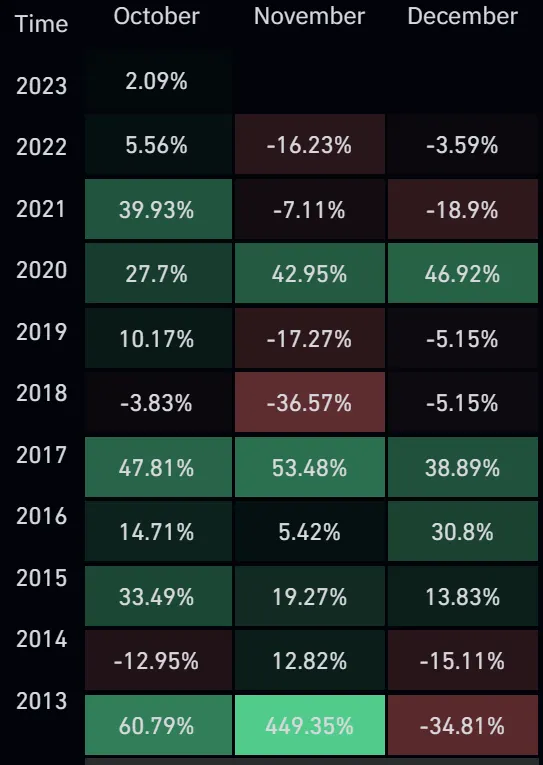

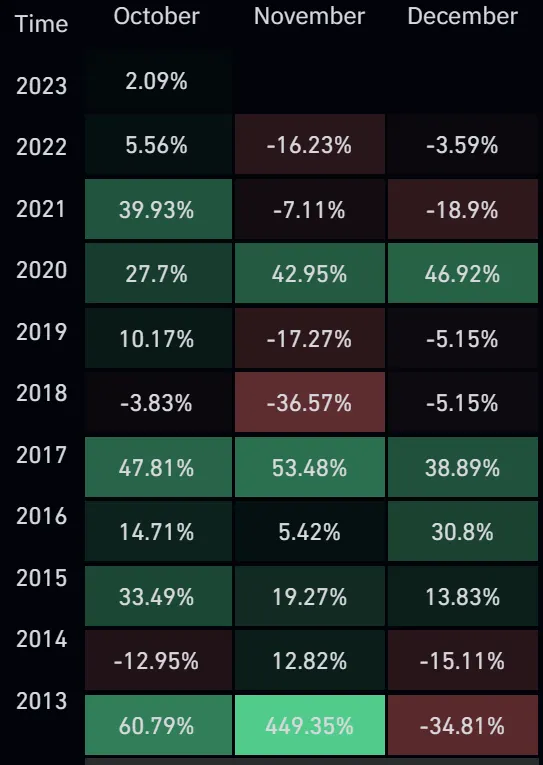

It's worth noting that McDonald's typically reintroduces the sandwich towards the end of the year, specifically in October, November, and December.

According to CoinGlass data, since 2016, Bitcoin has shown positive performance in October six out of seven times–birthing yet another meme: Uptober.

However, in November and December, it has only been positive three out of seven times.

Bitcoin’s performance in October, November, and December in the last decade. Source: CoinGlass

Ben Lilly, the other co-founder of Jlabs Digital, linked the urge to find a correlation—be it with the McRib or seasonal changes—to market boredom.

“I’m guessing not everyone even knows what the pressed-like-a-rack of ribs questionable meat sandwich is, but the fact we are talking about it goes to show you just how slow things are,” he said. “Analysts are starting to find any explanation for price movement.”

The lack of a definite trend and causality suggests that the correlation is likely just a (delicious) meme. And that's probably just fine.