In brief

- Satoshi Nakamoto predicted Bitcoin transaction fees will become the main compensation for nodes.

- Post-halving, Bitcoin miners will have to charge more in fees to continue being profitable.

- Some blockchain experts argue that instead, mining difficulty will fall.

Sometime around the middle of May, 2020, the supply of Bitcoins issued as mining rewards will halve. The monetary policy, known as the “halving”, is hardcoded into Bitcoin’s protocol, and happens around every four years. It’ll keep happening until 2140, the year the last of Bitcoins are mined into existence.

In the past, the Bitcoin halving has been associated with a rise in Bitcoin’s price—many think that this will happen in May, too. And some, like Josef Tětek, Bitcoin & Ethereum analyst at TopMonks Blockchain Studio; Dan Held, director of business development at Kraken; and Satoshi Nakomoto, the creator of Bitcoin, suggest that Bitcoin halvings could make the network more expensive to use.

Satoshi’s vision for fees and rewards

“In a few decades when the reward gets too small, the transaction fee will become the main compensation for nodes. I’m sure that in 20 years there will either be very large transaction volume or no volume,” said Nakamoto in a forum on BitcoinTalk. In other words, if the network doesn’t fail, fees will rise to replace mining rewards.

The rough theory is, with fewer mining rewards, Bitcoin miners will have to charge more in fees to continue being profitable. They can't choose the fees per se, but they might only process transactions with higher fees, causing prices to rise over time.

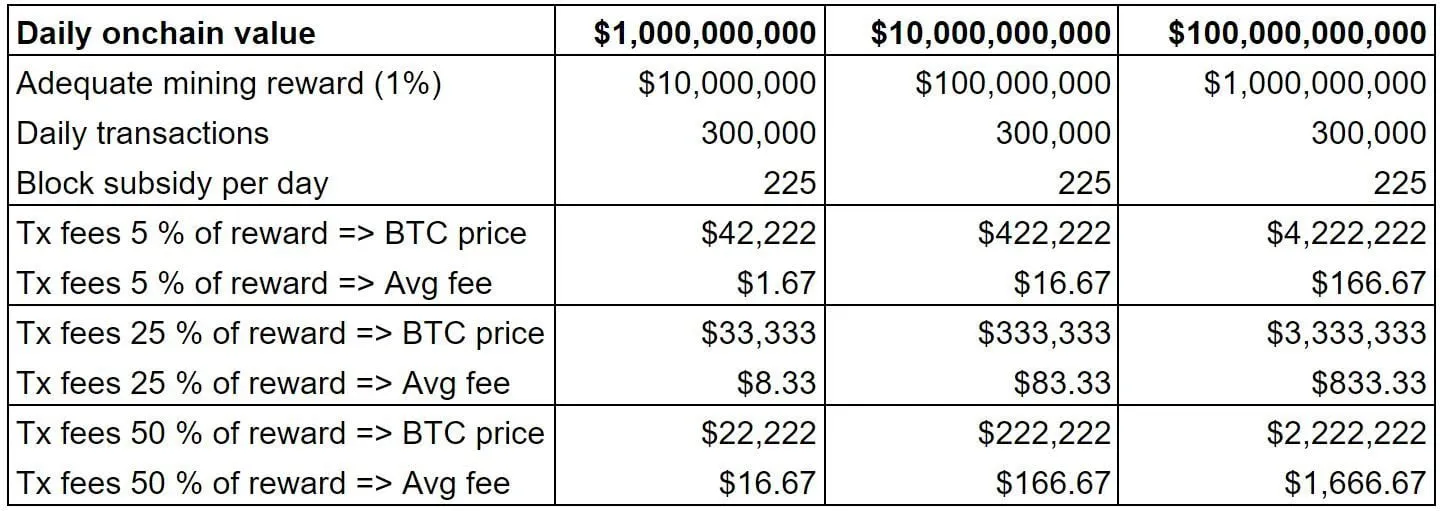

Check out the table below, per Tětek, in a post at Hacker Noon. He models what could happen in nine years—in May 2028, when the daily block subsidy falls to 225 Bitcoin. It’s a simplistic table (he assumes the amount of daily transactions is constant, at 300,000). But he predicts that transaction fees could increase as a percentage of mining rewards.

Dan Held, of Kraken, agrees. “As inflation trends towards zero, miners will increasingly obtain an income only from transaction fees,” he wrote in a Medium post in May. “As the price of BTC increases, the value of the block reward increases as well, which incentivizes miners to bring more hashrate online to mine,” he added.

The case against transaction fees

Other blockchain experts Decrypt spoke to dispute the above reasoning.

“Bitcoin miners haven’t shown an ability to cartelize to set fees,” Nic Carter, a partner of Castle Island Ventures, told Decrypt. What’s more likely to happen, he said, is that mining difficulty will fall: “If bitcoin miners refused to process lower-fee transactions, that would just be a market opportunity for new miners to come in and handle those [transactions],” he said, “because there’s virtually no barriers to entry in mining.”

Bitcoin miners haven’t shown an ability to cartelize to set fees

Eric Wall, chief investment officer at Arcane Assets, also cast doubt on the idea. “Miners cannot really reject transactions because the fees are too low since it's a permissionless system,” he told Decrypt. “Miners must always pick up all the transactions they can,” he said. At best, what’ll happen is that some other miner will pick up those transactions, and collect the block reward themselves.

The Bitcoin halving: a damp squib?

More generally, Wall finds that the speculation and rhetoric around Bitcoin’s halving event misses the target—it’s been known about for over a decade, and he doesn’t expect any surprises. “There is very little reason from a long-term fundamental point of view to suddenly start pricing Bitcoin differently,” he said.

He thinks the attention given to variations in Bitcoin’s supply is misleading. “The demand side, which can vary much more greatly than supply will, is ironically blissfully ignored in these conversations as a factor. And what the demand will look like is something we just can't predict with any accuracy,” he said.