Thomas Newman liked the idea of customers at his graffiti gallery in Asker, Norway, paying for things in Bitcoin. So, nearly a year ago, he purchased an XPOS, a mobile point-of-sale device that would allow his clientele to easily use Bitcoin to buy cans of spray paint, or murals.

But now the thing is gathering dust. “Norwegians are not really ready to embrace blockchain technology,” said Newman, who runs an online storefront and showroom, Montana Cans. “It works magnificently, it’s a great machine, it has amazing potential ... But if the customers are not willing to actually use crypto to pay for stuff, what’s the point?”

It's not just Norwegians. Hardly any consumers, anywhere in the world, are ready to use crypto as a payment scheme, if the experience of Pundi X—which manufactures the XPOS—is anything to go by.

Pundi X's dream

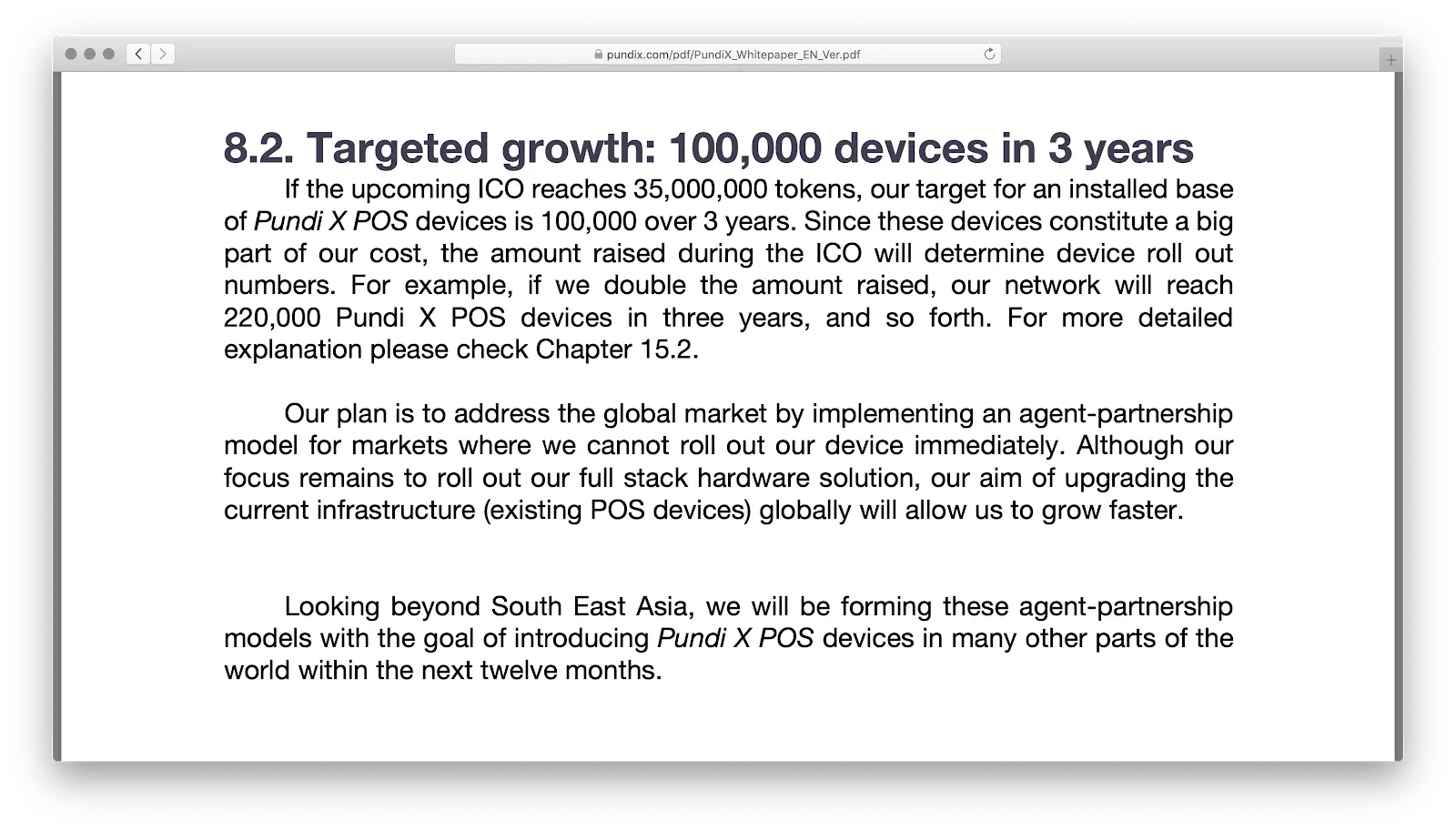

The company, known as a fintech innovator, was an ICO high flyer after it raised $34 million in January, 2018, and an “emerging star” in KPMG’s FinTech 100 report. It had ambitious plans to sell more than 100,000 of its crypto POS terminals by 2021. But so far, large-scale retail adoption hasn’t taken hold and lucrative deals that the company has announced, for upwards of $17 million worth of devices, haven’t yet materialized. Indeed, of the 100,000 terminals it expected to ship, only a few thousand have moved. A scant 1,000 are “activated” today, the company told Decrypt.

Among the largest and best-publicized point-of-sale companies, Pundi’s strategic misfires make it a bellwether for an industry which has struggled to find users. But although the company acknowledged its lackluster performance, it remains optimistic that “if you build it, they will come,” as co-founder and CEO Zac Cheah said in late 2018.

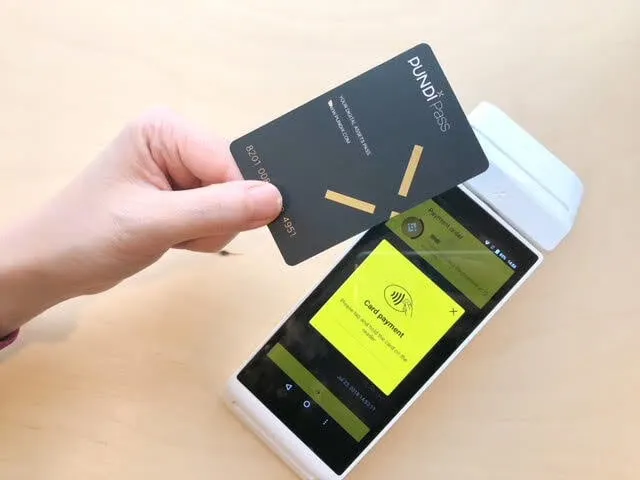

“As of today, over 1,000 XPOS [have] been activated,” Judie Liu, a Pundi X spokeswoman, told Decrypt. She said that despite the modest number of machines in use, “in 2019, we have handled 22.6 million USD worth of crypto transactions across XWallet, XPOS and XPASS cards.”

“We do believe that all the currencies will eventually move to the blockchain,” she added. “The XPOS platform plays an important part in facilitating speedy blockchain-based transactions in physical retail outlets.”

A short history of Pundi X

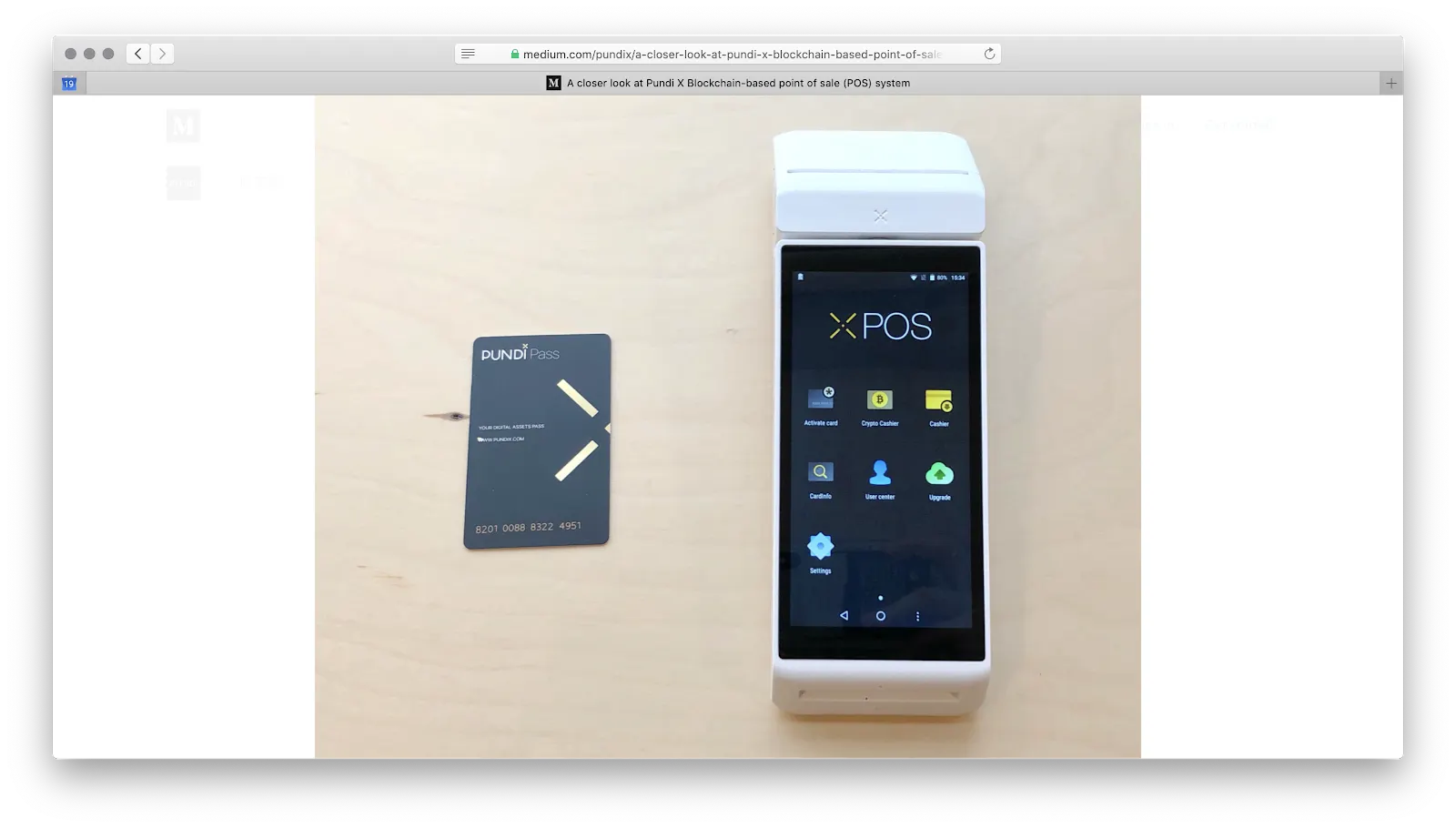

Pundi X was co-founded by Cheah, a former staffer at Opera Software, among other places. It started in Jakarta, where it pioneered the use of QR code-based cashless payments, via an app called Pundi-Pundi. In November, 2017, as the crypto bubble was burgeoning, Pundi “unveiled” the XPOS system, which was reportedly based on the Pundi Pundi app. A company press release said the XPOS aimed to be in 700,000 stores across Asia, and could one day reach a global market of 100 million people.

The company relocated to Singapore a year later, due to Indonesian’s tough regulations around using crypto for payments, to work full bore on the XPOS network. Its work drew coverage in cryptocurrency trade publications, as well as glossy, mainstream papers.

It subsequently published a white paper outlining its ambitious plan: Building an open-source network on a proprietary blockchain, Function X, that would facilitate crypto-to-fiat transactions, via a mobile application, a contactless smart card and point-of-sale (POS) terminals.

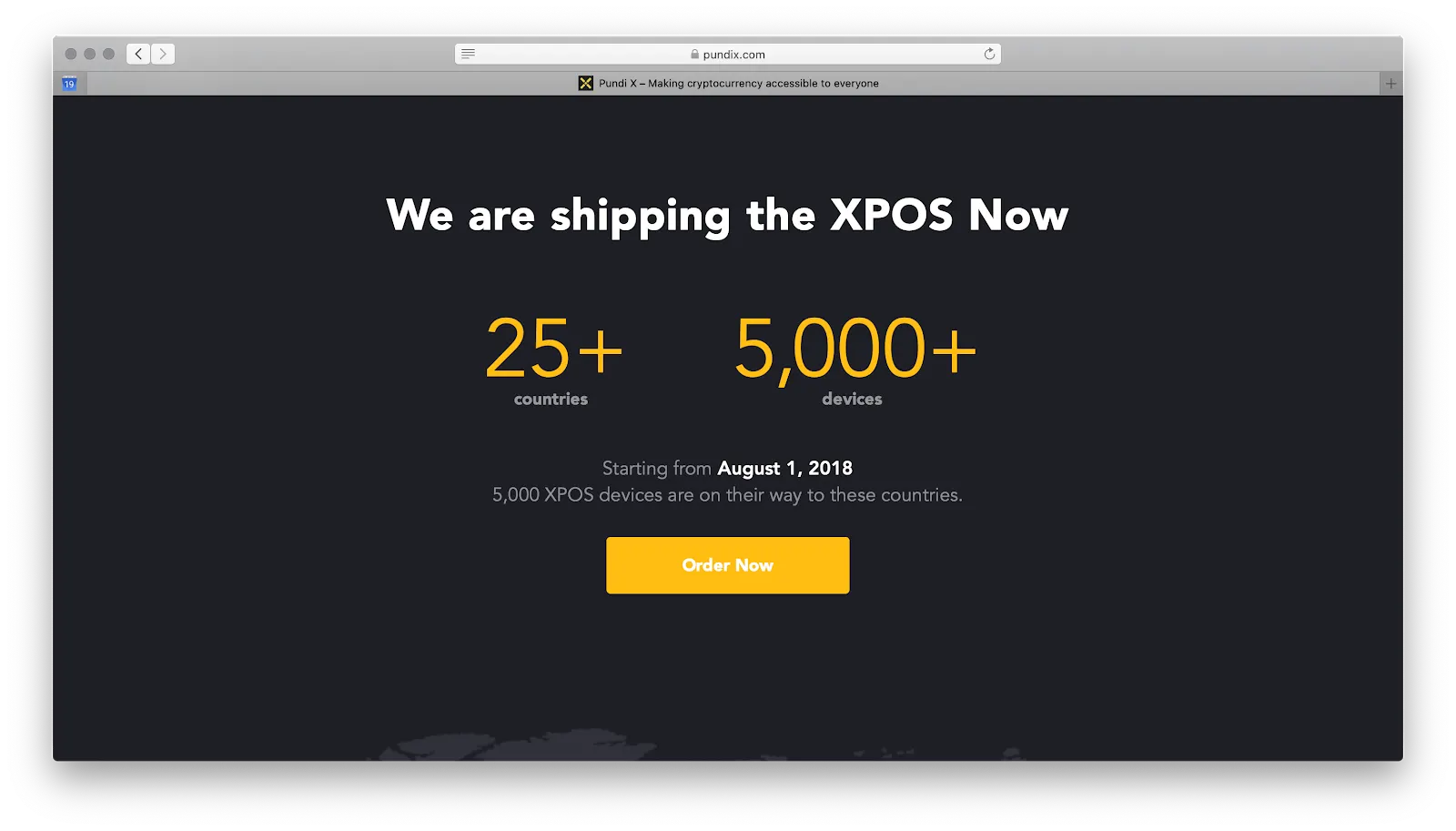

At the heart of the network was the XPOS, a roughly $300 hand-held device that can easily handle the transactions in stores. The company hoped to manufacture and distribute 100,000 XPOS units to over 25 countries by 2021. It said the product would help bring about the “rapid mainstream adoption of cryptocurrencies and the merging of the crypto-economy ... with the much larger mainstream economy.”

Newman, of Norway, was among thousands of crypto diehards worldwide who bellied up to buy Pundi’s “NPXS” tokens—175 million sold at Pundi’s January 21, 2018 ICO.

Early demand for the network appeared to be brisk: The company announced a number of high-profile deals, including a plan to build and ship 20,000 customized terminals—paid for with $17 million worth of privately raised cash—in April, 2018.

But Pundi X never built the devices.

Bad timing for Pundi

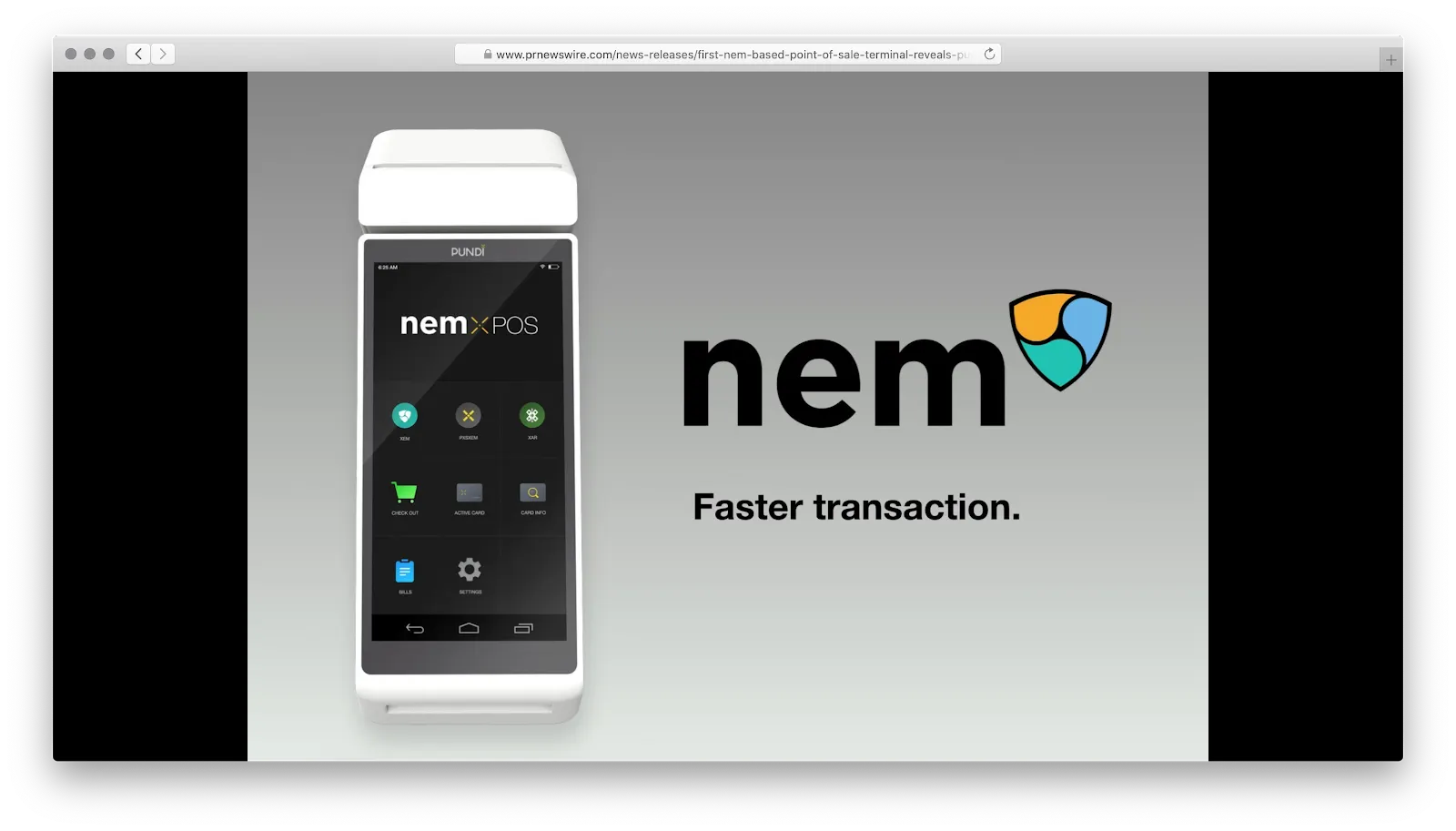

Pundi’s timing couldn’t have been worse. Token prices imploded soon after its launch, posing a challenge for its new business. The $17 million "private placement" committed Pundi to manufacturing 20,000 bespoke “NEM XPOS” devices, payment terminals wired to exclusively support NEM’s token, XEM. Though Pundi announced in a report that it had “fielded orders” for the units, the plan was scrapped when Pundi X decided to stick with the standard XPOS unit, which would support XEM regardless.

“The distributors and merchants [only] want one blockchain-based point-of-sale terminal,” said Liu.

NEM Foundation CEO Alex Tinsman declined to comment, saying the deal had been negotiated by her predecessor, Lon Wong. Wong said that he did indeed push for the collaboration but, “there was no formal partnership per se then.” Wong added that after he left “I don’t think there was any follow up” by the Foundation.

Likewise, in June 2018 Pundi X announced that another payments company, the Switzerland-based UTrust, had committed to acquiring 1,000 devices. “Today’s deal with UTrust takes the number of units of Pundi X technology that have been ordered for use by clients in global retail to over 25,000, or over one-quarter of the company’s three-year sales target of 100,000 devices,” the company said at the time.

But UTrust’s CEO, Nuno Correia, told Decrypt that ultimately, no units were shipped, and no money changed hands, “due to legal constraints in the jurisdictions we are headquartered [in].” He added that in the end, UTrust “decided to work on our own POS application that does not require a native hardware device."

Liu nevertheless maintains that, "for UTRUST, they’ve committed to acquiring 1,000 units of Pundi’s XPOS in [a memorandum of understanding]."

Add to these disappointments Pundi’s announcement in October 2018 that the government of Dubai would use XPOS devices in “hundreds, ... if not thousands” of Dubai stores for “Emcash,” a large-scale digital payments infrastructure that would allow residents “to make digital payments for school fees, bills and retail purchases with a stable, digital currency.”

That plan involved a partnership with Ebooc, a payments company, and Emcredit, a state-backed subsidiary of the Dubai Department of Economic Development. Dubai even appeared to grant Pundi X regulatory approval.

“Zero progress has been observed or communicated to the Pundi community about this.” .

“I bought NPXS [Pundi’s token] after this happened,” said Jason Rouse, a Dubai-based investor. “I viewed the Pundi Dubai deal as one of the biggest deals in the crypto world. The possibility was there for crypto to be spent in retail outlets in Dubai.”

Yet Rouse is disappointed. A year and a half on, there's nothing to show for it, he said. “Zero progress has been observed or communicated to the Pundi community about this.” Ebooc, meanwhile, is listed as "inactive" in records; its website is now defunct.

Liu however said that the deal “remains unchanged,” and that Pundi X is continuing its work under the aegis of a different government agency, the Department of Digital Force Pro Information Technologies. Pundi X still displays the deal on its website.

Unmoved, Rouse said: “It’s a lot of hype with zero follow through, so far.”

Neither Ebooc, Emcredit, nor the Dubai Department of Economic Development could be reached for comment.

XPOS is a work in progress

Pundi’s spokeswoman, Liu, admitted that, when it came to the NEM and UTrust partnerships, it had been a mistake to characterize the large orders as done deals—as the company still does on its website—when in reality they often took between one and three years to process. The company has resolved not to announce large shipment orders anymore: “We learn[ed] that it takes time.”

The upshot is that Pundi X appears to be far from its 100,000 target. Promotional materials still say that more than 5,000 devices have shipped to more than 25 countries, a figure the company has clung to since 2018. When questioned, however, Liu qualified that, saying the figure actually refers to the number of units “pending shipping”—that is, in stock, but not shipped.

So how many have shipped? Liu would only reiterate that “one thousand are live.”

XPOS sales info thus far

As for the units that were shipped, retailers have reported mixed results. In late 2018, Pundi X unveiled the “World’s First Crypto Street”—it said it distributed devices to nine shops in a shopping district in Singapore. Today, five of the businesses are marked as “permanently closed” on Google Maps, and only one vendor, Yixing Xuan Teahouse, claims to still own an XPOS.

It “works well,” the vendor said, before hanging up.

Two vendors, meanwhile, didn’t respond, and Ronald Lim Chun Loong, the restaurant manager at another, Sen of Japan, said that “management had decided to stop [using the machine] entirely.”

Wholesalers, meanwhile, are selling devices, albeit slowly. Crypto news site Bitcobie says it purchased 200 last June, but has sold only 40, while Ethereum startup MakerDAO claims to have given away 70 out of the 750 that it subsidized, having agreed to split the bill with Pundi on the order. (Although Liu disputes this figure, saying none have yet been dispatched.)

Both companies maintain, however, that they still believe in Pundi X’s technology. “Pundi X is doing a great job in Latin America,” said Mariano Di Petrantonio, MakerDAO’s community lead there. “They have a very clear understanding of what’s going on in each country.”

A lackluster consumer reaction

Pundi X says that it has already sold XPOS units in more than 25 countries. Liu, the spokeswoman, referred to an online map of 121 retailers that have “self-reported” their presence online.

But some of those retailers told Decrypt that the devices are hardly being used. And others say they ditched their units outright.

“We were very excited to get the unit and to have it advertised on our site and in our physical store,” said Christiaan Boshoff of Filtershop, in South Africa. “Unfortunately in the last 6 months, we have only had people come in and ask if it is a good idea to buy Pundi’s coin and not a single customer wanting to pay using crypto.”

“So overall it is a nice platform but in our case, it has had zero use.”

The phone numbers for 45 of the businesses were no longer functioning. Of the 18 that responded, 11 said they had owned a device but abandoned it. Five denied ever having received one, and two said that, at best, roughly two or three customers used the device each month.

The regulatory challenge

A rep at Dirty Bar, a nightclub in Malaysia, told Decrypt that it received a device but had to return it immediately, because it lacked the certification required to transact crypto in the region.

Liu said that difficulties with compliance had made distributing the machines slower than expected. “In Malaysia, crypto has been recognized as security by the government, despite the fact that tokens listed on XPOS are utility tokens,” she said. “Nonetheless, we have decided to withdraw XPOS operation from this market to avoid potential legal complications.”

She added that, broadly, “crypto adoption” is still in its infancy. “Compared with fiat, crypto transactions are still not common today,” she said. “In some countries, the bear market and tightening regulations have hindered the crypto adoption.”

She did, however, echo MakerDAO’s assertion that there is far more uptake in Latin America, where the need for alt-currencies is apparently more urgent.

Still building and waiting for the crowds

For now, the company, which employs around 100 people according to Liu, is working to keep merchants engaged. A major upturn in crypto ought to help the market for POS devices. In the meantime, Liu told Decrypt that Pundi is currently allowing vendors who use the XPOS terminals to keep the transaction fees, as a goodwill gesture.

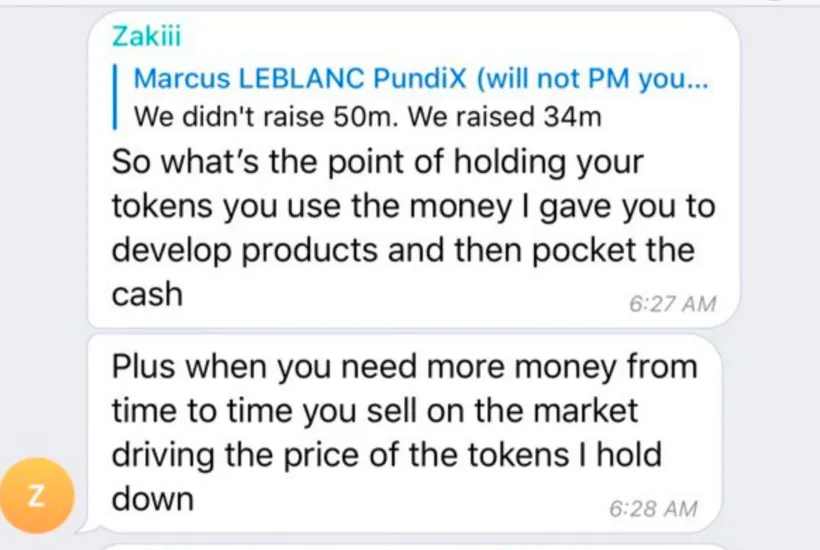

Though sales might be in the doldrums, the company itself acknowledged on Telegram last year that it sells off tranches of its circulating token supply, currently capitalized at $42 million, to finance itself.

“You think businesses run on air?” replied Markus LeBlanc, a group administrator who represents Pundi.

Liu said that the company was also generating revenue from transactions on both XPOS devices and the adjacent XWallet, hardware sales, decentralized applications (DApps), enterprise solutions, and “open platform operations.”

“We know that the industry is at its early stage; therefore, we've been very cautious about spending since day one,” she said. “Yes, we are confident in our finances.”

So, Pundi soldiers on. Indeed, if anything, the company is doubling down, and recently showed off its new blockchain-based mobile phone, at CES in January. The so-called BOB, which Cheah says will run on Pundi’s own proprietary blockchain (it currently supports multiple blockchains), was a massive hit. It even won a CES Innovation Award.

It has a way to go. On January 10, the company reached another, sadder milestone: its proprietary crypto-token, NPXS, hit its all time low price of one millionth of a Bitcoin, roughly $0.0001.