Institutional investors turned their attention to a host of crypto products last month, per a new report.

Crypto data provider CCData revealed that institutional investors have been busy trading a wide variety of financial instruments that are exposed to Bitcoin and Ethereum–showcasing upticks in spot trading volumes, derivatives trading, and CME Futures Contracts for the leading cryptocurrencies.

Seemingly behind the wheel of this notable increase in linked to digital assets last month’s BlackRock spot Bitcoin ETF filing.

With a reported 575-1 track record on successful applications, the numbers indicate that this is the driving force behind June’s bullishness.

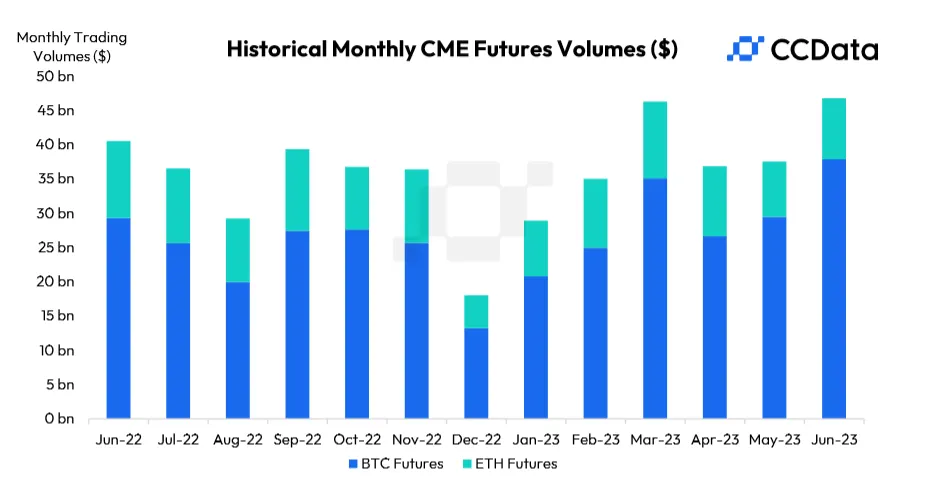

According to CCData, the Chicago Mercantile Exchange (CME) saw its best June for Bitcoin futures volumes, rising an astounding 28.6% to $37.9 billion.

A different instrument, Bitcoin Micro Futures (MBT), also jumped double digits, trading at $702 million with a 21.1% boost. These are smaller contracts, usually worth one-tenth of a standard contract. In the CME’s Bitcoin Futures case, it would be 1/50th.

Today’s report notes that there were a total of 264,323 BTC contracts traded, up 22.7% from the month prior. It’s important to remember that these contracts are backed by 5 underlying Bitcoin.

Ethereum-based instruments also saw a hefty rise, per CCData. Over 97,000 ETH Futures contracts were traded, notching a 10.8% rise in June. The underlying asset in this case is 50 ETH.

The USD value of the volume traded jumped quite substantially for both BTC- and ETH-backed products. Collectively, they recorded a 24.6% pump, with $46.8 billion changing hands. This has been the highest number since May 2022.

It appears large players are hopeful about the filing frenzy happening in the United States.

The increase in speculation and trading could have a positive spillover effect into the CME Group’s latest product, the Ethereum-to-Bitcoin Ratio Futures which–pending regulatory approval–comes to market later this month.