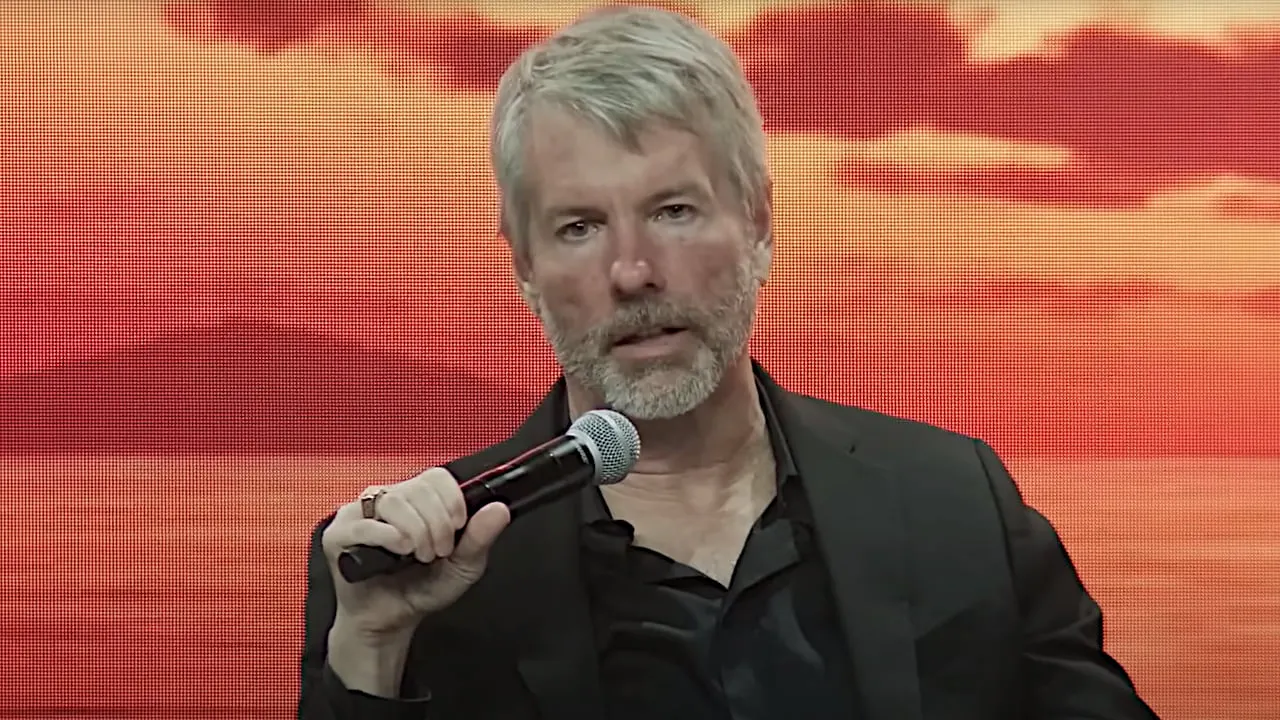

Faced with an onslaught of regulatory enforcement actions, MicroStrategy’s Michael Saylor believes the United States crypto industry is poised for a “Bitcoin-focused” future.

In an interview with Bloomberg on Tuesday, the executive chairman of the business intelligence software firm claimed that recent declarations from the U.S. Securities and Exchange Commission (SEC) are “laying the foundation” for the next Bitcoin bull run.

“Regulatory clarity is going to drive Bitcoin adoption by eliminating the confusion and anxiety that has been holding back institutional investors,” said Saylor. Much of that confusion stems from other “crypto securities” for which regulators “don’t see a legitimate path forward” in the United States.

“They have a view of crypto exchanges which is far constrained,” he added. “Their view is crypto exchanges should trade and hold pure digital commodities like Bitcoin.”

The SEC sued Coinbase—the largest crypto exchange in the US—last week, alleging that the company had listed over a dozen securities on its platform without registering as a securities exchange. The agency had generally been hesitant to comment on whether a specific token classifies as security until filing a lawsuit, for which it's been criticized by the industry and Congress alike.

The SEC has ruled out Bitcoin from being a security, however, deeming it sufficiently decentralized to be called a commodity. As such, Saylor believes the regulatory crackdown on stablecoins and other tokens will likely send Bitcoin's long-term dominance back above 80% of the total crypto market.

“The public is beginning to realize that Bitcoin is the next Bitcoin,” said Saylor. “The next logical step is for Bitcoin to 10x from here, and then 10x again.”

Saylor’s company is one of the world’s largest holders of Bitcoin, now possessing 140,000 BTC bought at an average price of $29,803 per coin. It hasn’t touched any other crypto tokens, deeming Bitcoin the “only institutional grade investable asset in the crypto space.”

Michael Saylor has previously argued that Ethereum (ETH)—the second-largest cryptocurrency by market cap—is a security, due to having an ICO, pre-mine, and management team.