New crypto rules in the UK mean crypto firms looking to lure in retail will have to tighten up, said the country's financial regulator.

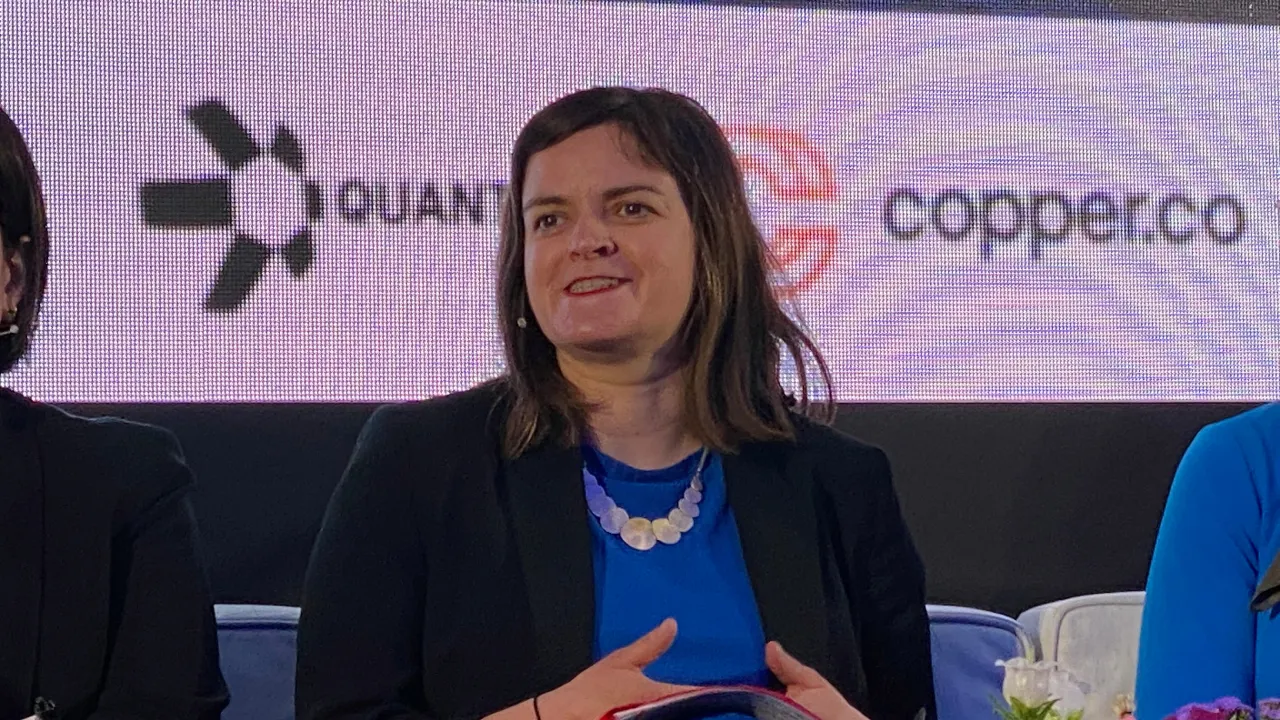

"We will bite on firms marketing to UK consumers," Executive Director of Supervision, Policy, and Competition, Markets at the FCA Sarah Pritchard said. "We will be on the lookout for firms that are not abiding by those rules. And if necessary, we will seek to take enforcement action."

The legislation will require the marketing materials to express that there is "high risk" involved in the investment. Pritchard wants the public to be investing in crypto assets with "their eyes open."

This rule will apply to those operating outside of the UK too. Importantly, the FCA will punish firms that refuse to follow this rule.

"We don't believe that consumers understand the level of risk currently," she continued. "Which is why we repeat that line, 'if you're prepared to lose all your money.'"

Similar rules already apply to other high-risk investments in the UK with simple labeling that highlights "this is a high-risk investment" and "make sure you understand the risks" are currently in place.

Pritchard expects the new marketing rules applying to crypto firms to take a "similar approach."

These rules have not come into force yet and are subject to legislation and "confirming the rules." But they expect firms to comply with the rules once in place.

She also highlighted the importance of a global standard for crypto regulation and international cooperation between regulatory bodies.

"Individual countries develop their regime from a UK perspective—certainly the FCA's argument—is to show that the market works well with integrity," Pritchard said at the Financial Times's Crypto and Digital Assets Summit. "But, we're also looking for consumer protection there and that's where a conversation about do consumers understand that risk is important."