At least a few Ethereum enthusiasts are as bullish as ever on the network.

Per data collected from Nansen, gross staking deposits have hit $198.7 million, or 94,800 ETH, over the past 24 hours.

Staking has taken center stage following the network’s latest Shanghai upgrade on Wednesday. This change allowed users who potentially had their ETH locked up for two years to finally withdraw their holdings. Staking is when users pledge cryptocurrency to the network to keep it running. Ethereum requires staking because it now runs on a proof-of-stake blockchain—which uses validators instead of miners to secure the network.

Those who stake earn digital currency rewards in the process. Ethereum made the move to proof of stake last year in a highly-anticipated transition, known as the merge.

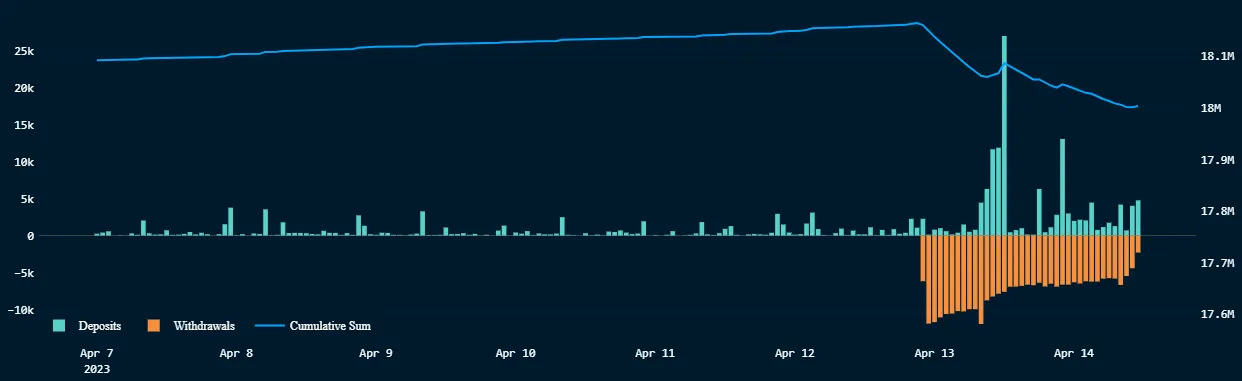

Getting back to the latest data, ETH deposits are still negative, however, indicating that there remain overall more entities withdrawing than staking assets.

“That’s expected since it’s just the beginning,” Nansen analyst Martin Lee told Decrypt. “Validators that have accrued excess ETH from earnings would want to unstake since they’re only accruing rewards on 32 ETH.”

Validators can either choose between a "partial exit" or a "full exit" when leaving the network. A partial exit refers to validators simply skimming off any accrued rewards, but continue to keep their 32 ETH stake on the network. A full exit refers to validators that choose to withdraw their rewards, initial 32 ETH deposit, and leave the network entirely.

Interestingly, yesterday there was even a brief moment in which deposits far outpaced withdrawals, with 27,000 ETH deposited and just 7,615 ETH withdrawn.

"Top deposits so far have come from a few entities. Lido, OKX, Kiln.fi, Frax," said Lee. "However, most notably from this wallet that we have labeled as 'P2p ETH2 Depositor.' [They] Deposited 50,000 ETH."

As for withdrawals trending downward, Lee indicated that the network will soon hit a “baseline” once this first wave of validators can claim any accumulated rewards.

“It’s expected to see a surge at the start since, as mentioned above, even validators that want to continue staking would want to withdraw their accrued earnings and restake it,” he told Decrypt.

At press time, there are more than 874,000 ETH still waiting to exit the network.

Based on current trends, though, it’s likely that some of that ETH will get put right back to work.