American software company MicroStrategy, the largest corporate holder of Bitcoin (BTC) reserves, is now in profit on its cryptocurrency bet.

In its April 5 filing with the SEC, MicroStrategy said that during the period between March 24 and April 4 the company and its subsidiaries purchased about 1,045 Bitcoin for approximately $29.3 million.

This took MicroStrategy’s overall tally to about 140,000 Bitcoin acquired at an aggregate purchase price of approximately $4.17 billion and an average purchase price of approximately $29,803 per coin.

With the leading cryptocurrency soaring 6.2% over the past 24 hours, and now trading hands at $30,108, this means that MicroStrategy’s Bitcoin holdings are now worth more than $4.2 billion.

MicroStrategy didn’t immediately respond to Decrypt’s request for comment.

MicroStrategy's Bitcoin bet

MicroStrategy made headlines in 2020 when the company first purchased $250 million worth of Bitcoin as part of its treasury reserve strategy. Since then, the company has continued to add to its holdings.

The move was initially met with skepticism, as many experts in the financial industry were unsure about the long-term viability of Bitcoin as a store of value.

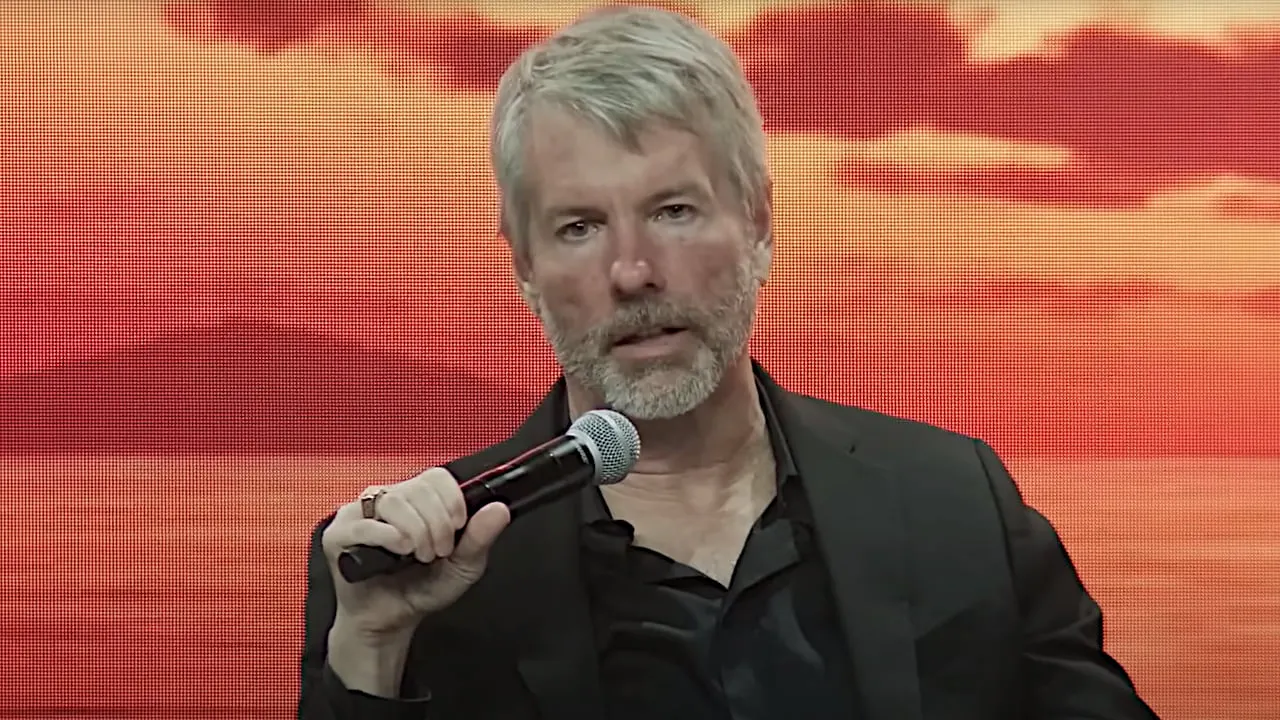

MicroStrategy's executive chairman Michael Saylor has become a vocal advocate for Bitcoin, arguing that it has the potential to outperform traditional asset classes such as gold and stocks.

Saylor has repeated that MicroStrategy has no intention of selling its Bitcoin holdings in the foreseeable future, except for a single instance at the end of last year when the company sold a portion of its holdings solely for the purpose of securing "tax benefits."

MicroStrategy's investment in Bitcoin has also been a significant driver of its recent stock price performance.

On Monday, the company's shares (NASDAQ: MSTR) closed at $312.78, marking a 7.82% increase over the course of the day. Notably, the stock has seen a remarkable growth of 40% in the past month.