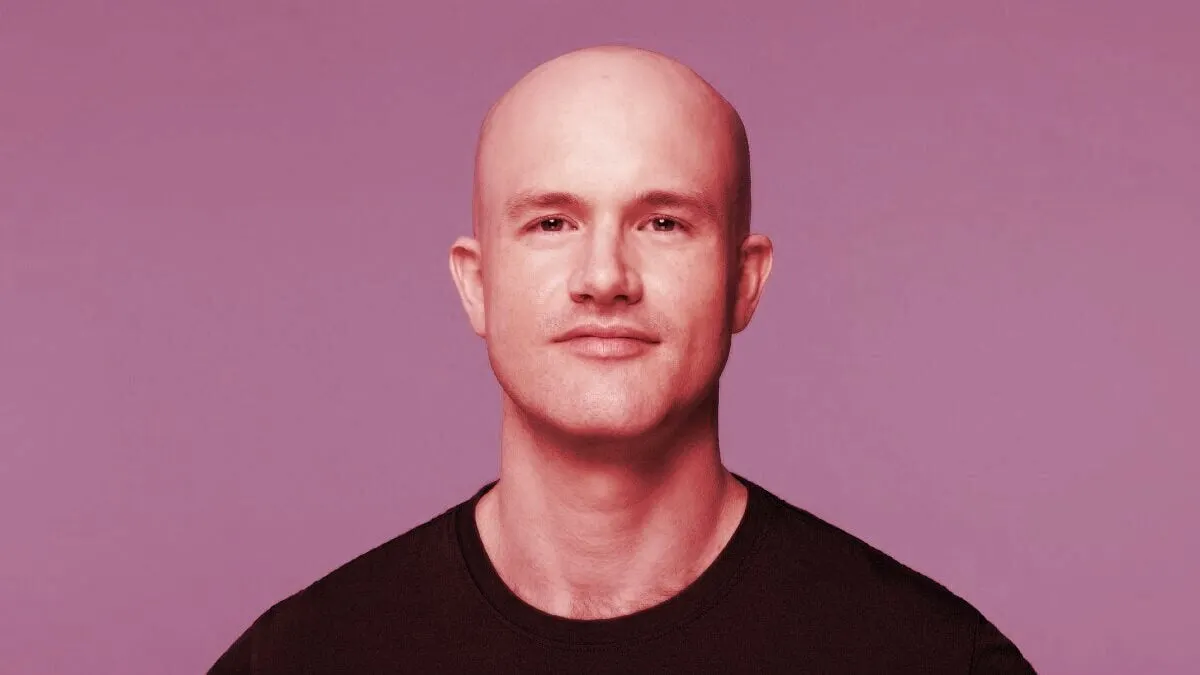

Brian Armstrong, CEO of cryptocurrency exchange Coinbase, said Wednesday that the company’s interests run parallel with those of the Securities and Exchange Commission (SEC), the federal agency tasked with protecting investors in the U.S.

Armstrong said that Coinbase, the only publicly-traded cryptocurrency exchange in the U.S., has maintained a “good relationship” with various staff members and commissioners at the SEC, including meeting with SEC Chairman Gary Gensler.

“We’re going to continue to invest in those relationships,” he said during an interview Wednesday morning on Bloomberg TV. “Our interests are aligned.”

Bringing the digital assets industry “within the regulatory perimeter” of the U.S. is an interest that both Coinbase and the SEC share, the San Fransisco-based exchange’s CEO said, adding it would provide consumers with better protections. Even so, Armstrong said he wants to preserve the potential innovation that cryptocurrencies could provide to financial markets.

Following the collapse of the cryptocurrency exchange FTX last November, regulators have looked at companies involved with digital assets with a greater degree of scrutiny, taking enforcement action against companies that the agency claims are in violation of securities laws.

Earlier this month, the SEC levied a $30 million fine against cryptocurrency exchange Kraken for failing to register its staking-as-a-service program as a security. Kraken agreed it would wind down its staking service in the U.S. as part of the settlement.

Kraken is the second largest exchange by volume that’s based in the U.S., according to data from CoinGecko. Kraken CEO Jesse Powell has been vocal on Twitter following the settlement, stating that the SEC’s so-called regulation by enforcement approach “does not help the industry nor consumers.”

Coinbase’s Chief Legal Officer Paul Grewal has also been critical of the SEC’s approach to regulating digital assets as well as the products and services that may accompany them. “The public shouldn’t have to parse complaints in federal court in order to understand what a regulator expects,” he said during Coinbase’s latest earnings call with shareholders.

In his television appearance on Wednesday, Armstrong said that Coinbase’s staking product is not a security and has “many differences” compared to the product offered by Kraken. A fundamental aspect is that Coinbase customers do not turn over the ownership of their digital assets to Coinbase when engaging with the company’s staking product, Armstrong said.

“They're always in the customer's possession and we're really just providing a service that passes through those coins to help them participate in staking, which is a decentralized protocol,” he said.

Staking is a process by which an individual can pledge their tokens to a network in order to validate transactions in exchange for rewards, often in the form of the cryptocurrency that was originally staked. Networks that support staking include Ethereum, Solana, and Binance’s proprietary blockchain Binance Smart Chain.

When the SEC announced its charges against Kraken, Gensler released a video on Twitter, outlining the agency’s stance on why staking-as-a-service should come with “proper disclosures [and] safeguards” that are required by U.S. law.”

The Coinbase CEO acknowledged the exchange has received investigative subpoenas from the SEC but claimed they are “really just requests for information.”

He also mentioned that the company seeks to have a productive relationship with the regulator regarding its staking product—but it is prepared to fight the agency if it must.

“We're prepared to defend that in court if we need to, but we're never looking for a fight,” Armstrong said. “I think we're well within the law, given the stance the SEC has been taking regarding defining certain assets as securities.”

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.