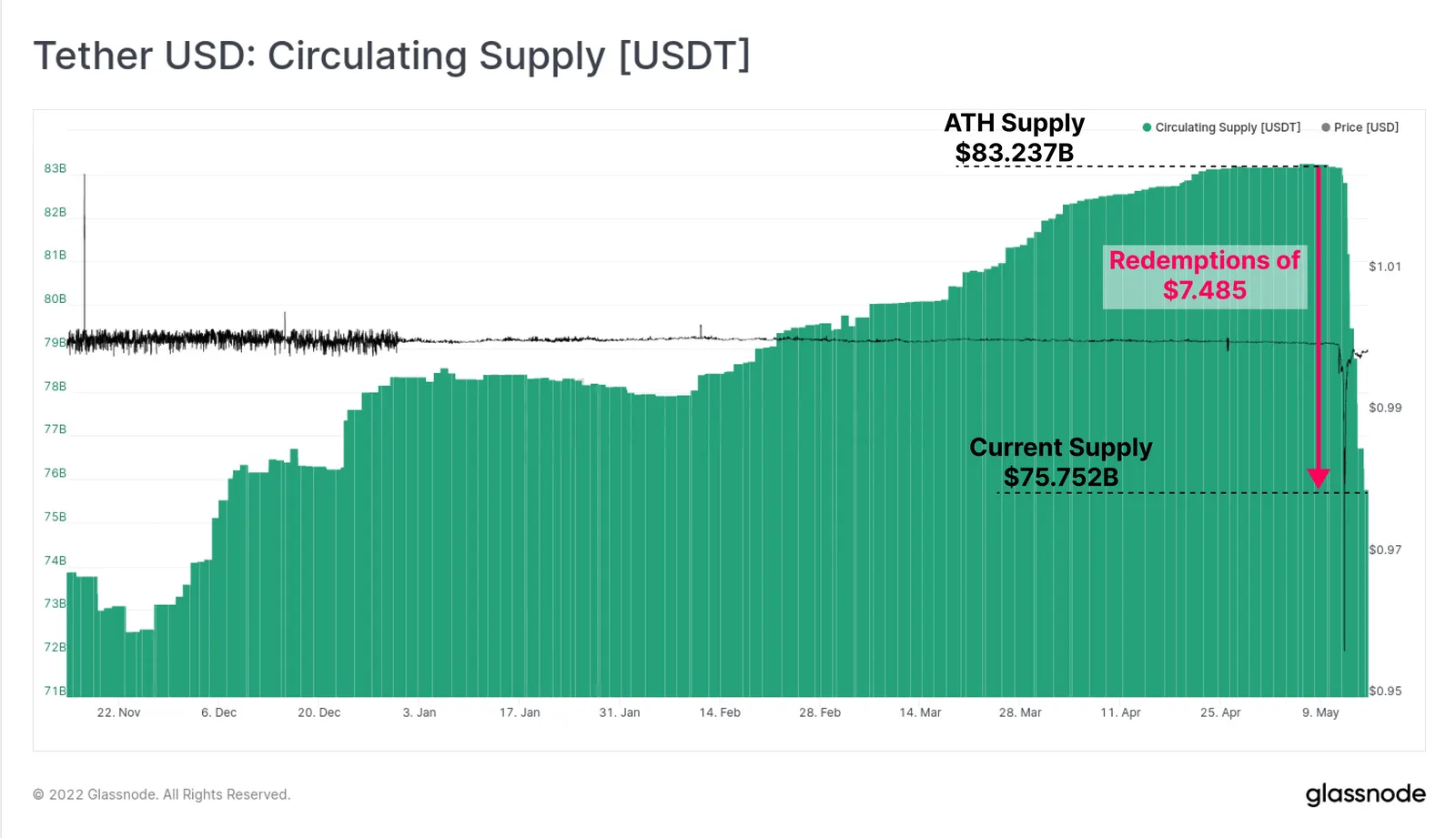

Amid the dramatic events surrounding last week’s TerraUSD collapse, Tether (USDT), the crypto industry’s largest stablecoin, has dropped more than $7 billion.

Tether’s market capitalization plummeted from an all-time high above $83 billion on May 11 to $75.6 billion today.

The decrease in USDT supply coincided with the stablecoin briefly losing its dollar peg by 5% last week before recovering to trade at a slight discount of $0.998 within the next 36 hours.

Today, USDT is trading at $0.9991, according to CoinMarkeCap.

Amid the depegging, Tether, the company behind the stablecoin, stated that in times of market volatility, it continued to honor all redemptions from verified customers, with about $2 billion processed on May 12 alone.

Centralized stablecoins allege to have enough actual fiat reserves in case users decide to swap their stablecoin holdings for fiat currencies (a process called redemption). These reserves aren't necessarily kept in cash either, with stablecoin providers reporting cash equivalents, crypto, and commercial paper, among other reserve assets.

In a depegging scenario, users can put these reserves to the test due to an enticing arbitrage opportunity. If a stablecoin has fallen below its peg, investors may buy the discounted token and then redeem it for its dollar value, pocketing the difference.

If not redemptions, savvy speculators can also swap the discounted stablecoin for another stablecoin that hasn’t lost its peg for a similar trade.

Tether Continues to Honour All Redemptions from Verified Customers During Market Volatility, On Track To Process 2bn Today https://t.co/p1AugHb9Gn

— Tether (@Tether_to) May 12, 2022

According to Tether CTO Paolo Ardoino, the company has redeemed $7 billion in the past 48 hours, all “without the blink of an eye.”

A recent Glassnode report indicates that indeed “over $7.485 billion worth of USDT has been redeemed.”

Stablecoin competition heats up

As observed by Glassnode, other major stablecoins, such as Circle’s USDC, Binance’s BUSD, and MakerDAO’s DAI, experienced a 1% to 2% premium during Tether’s redemption wave.

And just as USDT’s supply shrank, USDC expanded by $2.639 billion over the same span—something that, per Glassnode, may be “providing insight on market preference during times of stress.”

“Given the dominant growth of USDC over the last [two years], this may be an indicator of changing market preference away from USDT and towards USDC as the preferred stablecoin,” reads the report.

Like USDT, USDC is a stablecoin that claims to have a 1:1 value with the actual U.S. dollar. USDC was developed by financial services company Circle in partnership with America’s largest crypto exchange Coinbase.