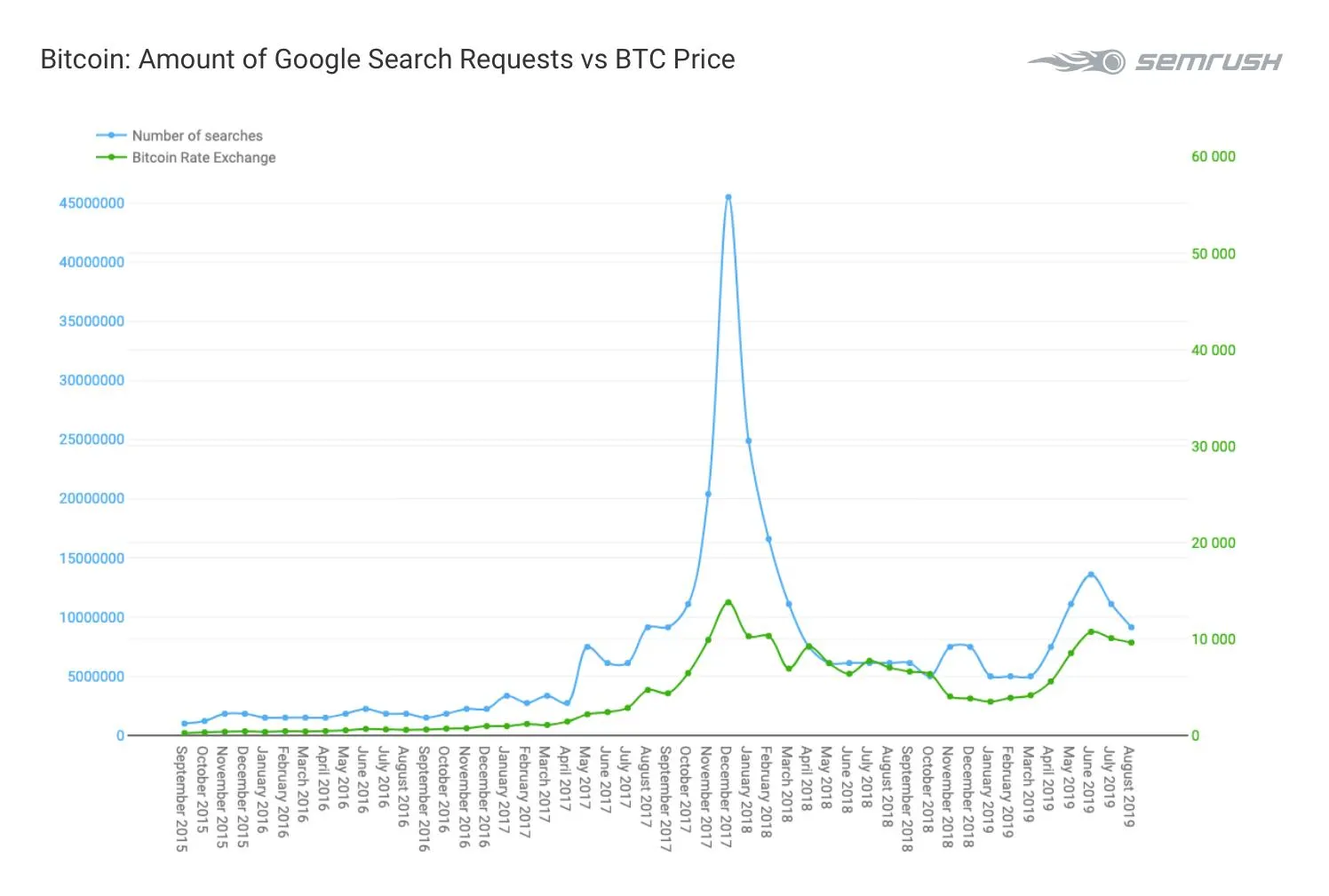

Bitcoin's price is more heavily correlated with Google searches than you might think. According to data provider SEMrush, there's an 80% correlation between the two. That means four out of five times, whenever Bitcoin's price rises, so does search volume.

The correlation compared the average monthly Google search volume for Bitcoin (that peaked at 45.5 million in December 2017) with the average monthly traded price for bitcoin in dollars.

The dataset goes all the way back to Sept 2015, when Bitcoin was trading at just $225, and Google search interest was only 1 million a month.

It's hard to pin down exactly where the causation lies but we can take a stab.

It's fairly clear that a rising Bitcoin price leads to more news articles and general awareness, causing an increase in search volumes. And it's possible this creates a virtuous circle, where more people searching for Bitcoin end up buying some—raising the price even more. But on the other hand, it's possible people are finding out about Bitcoin by other means and then searching for ways to buy it.

The firm found that there was an even higher correlation for XRP, at 86%, with other altcoins seeing similarly positive correlations, such as Ethereum (74%) and Litecoin (71%).

And like most things in crypto, someone's already tried to manipulate the system. In September searches for BTC–Bitcoin's price ticker surged in the first week of September. Some commentators have suggested bots were being used to inflate searches in order to manipulate other bots that use search volume as an indication of how they should trade.

But for now, it remains a mystery.