In brief

- Venezuela's national currency suffers from hyperinflation.

- One of the ways that Venezuelans have sought to escape the devaluing bolivar is through Bitcoin.

- But now that Venezuela's government has made it much easier to access US dollars, Bitcoin's appeal could be tested.

Venezuela’s complex economic conditions have led to it often being referred to as a “case study” in Bitcoin—a cryptocurrency practically tailor-made for an economy saddled with hyperinflation and a repressive government.

And even though Bitcoin use is hardly mainstream in Venezuela, that narrative has more or less held up: the country ranks third in the world in terms of Bitcoin adoption, according to a September 2020 report from crypto analytics firm Chainalysis.

But recent societal and political changes in the South American nation may soon put that narrative to the test.

Part of the reason why some tech savvy Venezuelans turned to Bitcoin to protect their wealth and escape the devaluing bolivar was because US dollars were difficult to obtain. Buying them was technically illegal, so citizens would resort to the black market to find them.

They no longer have to do that. What’s more, the notoriously “anti-imperialist” government of Nicolas Maduro appears to have now conceded defeat to dollarization—accepting the fact that the dollar is the de facto currency of Venezuela.

Earlier this year, Maduro’s government began allowing Venezuelan banks to open accounts for their customers in dollars. Businesses can now even start paying their workers in foreign currencies—something that would have been unimaginable in Venezuela a decade ago.

So now that Venezuela has opened its doors to dollars, will that diminish the role Bitcoin plays in the country’s informal economy? Regional experts don’t believe there’s much reason to think so yet.

For most people, the dollar will continue to provide “shelter” from inflation for day-to-day transactions, but it “will never be a store of value in the same way that Bitcoin is today,” according to Alberto Zambrano, founder of the AJZ Institute, a regional project that offers training on crypto, blockchain and other technologies.

Saulo Muñoz, an economist who specializes in social development, shares a similar view: "Bitcoin is consolidated as an important aspect of a community that currently rejects fiat money," he told Decrypt. Muñoz not only sees Bitcoin trading within Venezuela maintaining its momentum, it could even “escalate” as new use cases for the cryptocurrency emerge, he said.

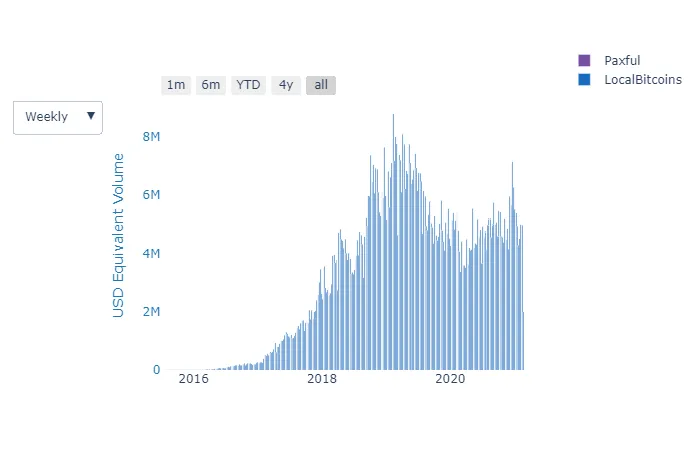

Venezuela currently has a very active peer-to-peer Bitcoin trading market. Trading volume in the country remains the highest among all Latin American nations, according to data from metrics site Useful Tulips. Other than a spike in volume in late December and early January, trading on peer-to-peer Bitcoin exchange LocalBitcoins among Venezuelans remains on par with levels recorded throughout the last two years.

That suggests that Bitcoin trading in the country has remained stable regardless of price fluctuations and, more recently, irrespective of the government’s shifting views on currency controls and limitations on the dollar.

What’s more, cryptocurrencies appear to be becoming an increasingly important consideration for Maduro’s government. In September 2019, Maduro confirmed that Venezuela's central bank holds Bitcoin and Ethereum, the second-largest cryptocurrency by market cap, among its international reserves. The state-run platform for remittances also accepts cryptocurrencies and even expanded that initiative just last week.

According to Muñoz, instead of hampering Bitcoin trading, dollarization in Venezuela may just lead to a “diversification of payment methods” on trading platforms.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.