In brief

- Exchange-traded digital assets have doubled in February.

- The surge reflects a growing institutional interest in the cryptocurrency market.

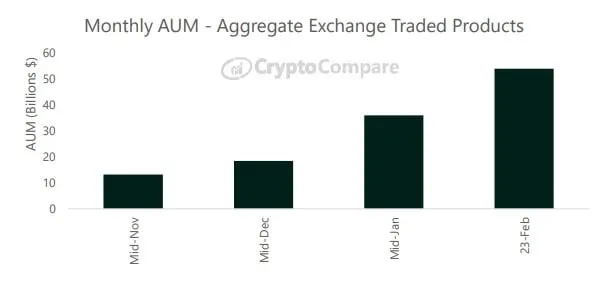

Digital assets under management across exchange-traded products have increased by 50% in the past month, reaching $43.9 billion, according to research from market data provider CryptoCompare.

The figure indicates a growing interest in cryptocurrencies among institutional investors throughout February—which makes sense given the fact the two most popular cryptocurrencies, Bitcoin and Ethereum, have risen by 58% and 100% so far this year.

February has also seen the introduction of Canada's Purpose Bitcoin ETF, the first Bitcoin ETF to be established anywhere in North America. It’s already enjoyed rapid growth; in its first two days of trading, the Bitcoin ETF raised $421 million.

The arrival of a Bitcoin ETF in North America may have been a long time coming, but others could soon be on the way. Earlier this month, Osprey Funds’ CEO Greg King told Decrypt that the Osprey Bitcoin Trust—which only recently started trading—might turn into an ETF in the future. “People always ask about ETFs, if it becomes clear that an ETF is doable, we’ll be certain to take a close look at that,” King said.

Grayscale beyond Bitcoin

The majority of assets under management for exchange-listed products is still in Grayscale’s Bitcoin Trust (GBTC), which has seen a 55% interest in the last month to $35 billion. But Bitcoin is not the only cryptocurrency benefiting from this trend. According to CryptoCompare’s research, Grayscale’s Ethereum Classic Trust saw returns of 105.5% in the last 30 days.

Although digital assets under management are booming this month across exchange-traded products, trading appears to have dried up; CryptoCompare’s research also found that daily trading volumes across exchange-traded products that involved cryptocurrencies fell to $936 million in February, representing a decline of 38% on the month.